name: Introduction to Bitcoin & Stablecoin goal: An In-Depth Look at Bitcoin, Stablecoins, & the Sovereignty That Comes With Them objectives:

- Understanding the historical evolution of money and the primary pain points resulting from our current financial system.

- Developing a comprehensive understanding of Bitcoin, differentiating it from traditional fiat currencies.

- Examining the role of stablecoins, specifically Tether, in financial stability and as a bridge between Bitcoin and traditional fiat currencies.

- Identifying and debunking common misconceptions surrounding Bitcoin and stablecoins.

Have you ever wondered:

Why is my cost of living continuing to rise? Is inflation really good for me? What options are available to help me protect against inflation? How does Bitcoin or stablecoins fit into all this?

If you answered yes to any of these questions, you're in the right place.

Welcome to "Opting In To Change," where we delve beneath the surface of our monetary systems while looking at some available tools for creating positive change. As our world grapples with encroaching threats to freedoms and escalating human rights violations, this course attempts to offer a guiding light—an alternative system that restores control back into the hands of the individual.

If what you've just read has piqued your interest, we hope you'll join us on this educational journey.

What To Expect:

Beginner friendly Roughly 3 hours of self-paced content Interactive quizzes to test your knowledge Written by industry professionals Examples from across the globe and from all walks of life

Requirements: A passion for learning

This course has been sponsored by TETHER

Introduction

Course overview

2eaf5947-8180-540e-9418-c40bf04e07ce Welcome to the ECO104 course!

We live in a world where:

● A mere 20% of people reside in societies deemed "democratically free." Yet, even within this privileged fraction, human rights violations are increasingly commonplace— from frozen bank accounts to censorship. The remaining 80% find themselves grappling with the encroachment of authoritarian rule. Just two decades ago, nearly half of the world's population enjoyed the most basic freedoms.

● 1.4 billion adults worldwide remain unbanked, while countless others are restricted to limited banking services.

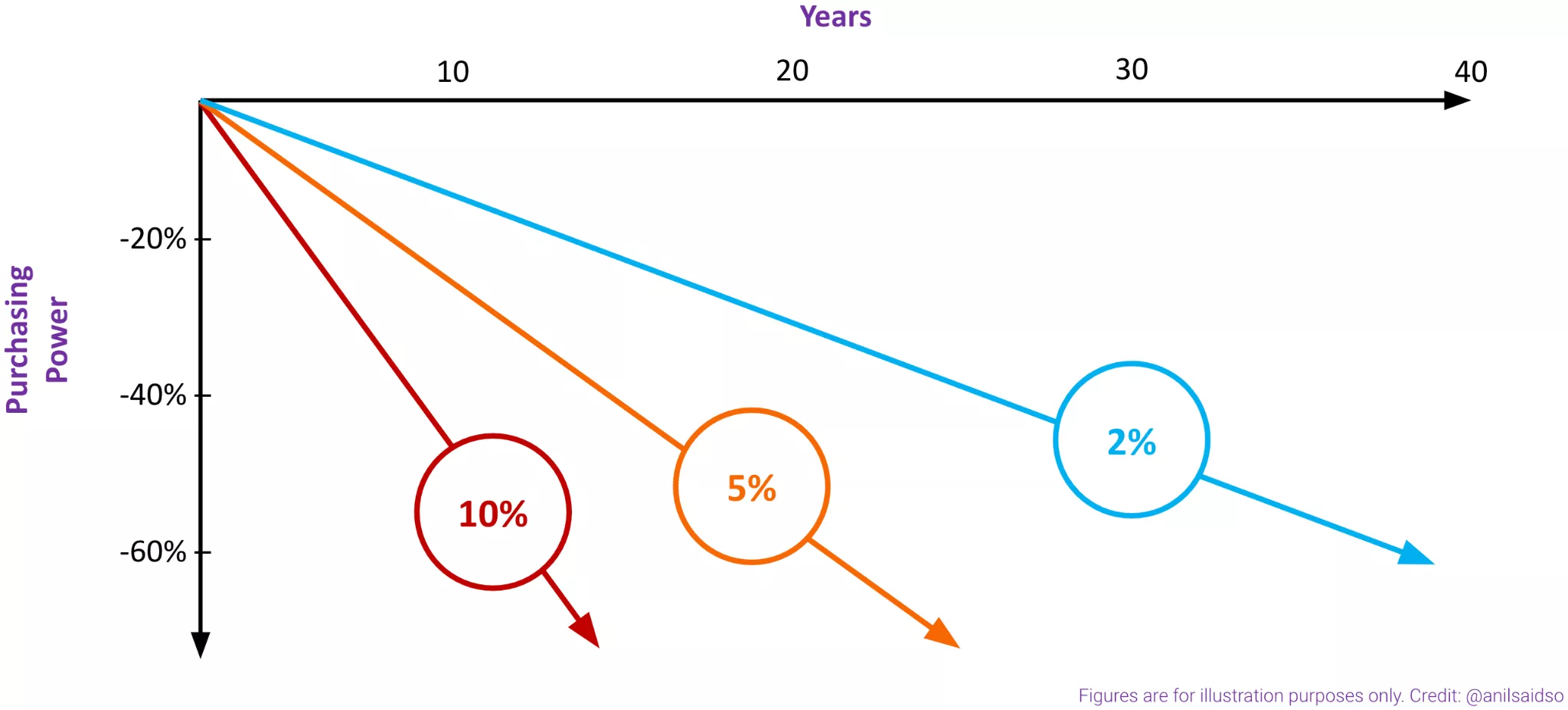

● By the end of 2022, nearly half the world faced double-digit inflation rates, eroding the value of hard-earned money. To put this in perspective, with an inflation rate of 10% over a decade, you would lose a staggering 65% of your purchasing power.

● And even without sustained periods of such inflation, the USD, arguably the strongest global currency, has witnessed a 96% loss of purchasing power over the last century.

These are some of the harsh truths of our global economic environment. Our financial systems fall woefully short of meeting the needs of the majority of the population. These systems perpetuate inequality, exclude many, and disempower billions of people globally.

If you find yourself burdened by the relentless pressures of rising prices or the lack of financial inclusion in our current system, if it's any consolation, know that you are not alone. These are the by-products of our present-day monetary system.

Despite our seemingly gloomy outlook, our focus with this course is not to fixate on the challenges of our present circumstances. Instead, we want to redirect our attention toward achieving liberation and financial empowerment.

That said, this course isn't solely for those facing rampant inflation or limited access to financial infrastructure or banking services. Whether you are already somewhat familiar with these issues or simply eager to expand your knowledge, this course is designed to benefit anyone looking to enhance their understanding and acquire the tools necessary to overcome these barriers and regain financial sovereignty.

With this in mind, our mission is to bring you up to the forefront of change in our current financial landscape, challenge the existing norms and offer alternative solutions. By delving into the history of money, demystifying Bitcoin, and exploring Tether and the world of stablecoins, we aim to inspire individuals to reimagine their financial future.

What to expect:

Module 1: The Price of Progress - A Closer Look at Our Financial System We begin our exploration by peering behind the curtains of our current financial system, where financial censorship, wealth inequality and inflation plague our daily lives. Through a brief history of money, we will look at how we found ourselves where we are, shedding light on some of the primary pain points we're all experiencing.

Module 2: Financial Liberation - An Introduction to Bitcoin This module will demystify Bitcoin, transcending the jargon to help you understand what differentiates Bitcoin from traditional fiat currencies. From how it works to how to use it, we guide you through the functionality and ways of interacting with Bitcoin.

Module 3: Stability Amidst Chaos - An Introduction to Tether & the World of Stablecoins In this module, we take a look under the hood of the leading stablecoin, Tether, exploring how this digital currency maintains its value and has the potential to give freedom to those facing an overbearing government, lack of financial services or rampant inflation.

Module 4: Overcoming Doubts - Debunking Common Misconceptions & Real-World Use Cases To finish, we will challenge the common misconceptions surrounding Bitcoin and stablecoins and offer real-world use cases of individuals who have already embraced and are benefiting from these technologies.

By the end of this course, you will not only have gained powerful knowledge and invaluable tools for navigating our complex financial landscape, but you will also better understand how Bitcoin and stablecoins, such as Tether, empower users by enabling them to opt into an alternative monetary system— one that prioritises the individual, giving anyone greater control of their financial situation. With this understanding, you will be better equipped to pursue financial freedom, personal empowerment, and liberation.

We are excited to have you join us on this journey into the depths of our monetary system.

The Price of Progress - A Closer Look at Our Financial System

An Introduction to Money

Money is a fascinating and essential part of our daily lives. We use it daily to buy groceries, pay bills, and make countless transactions. But what is money, really? At its core, money is simply a medium of exchange, a tool that allows us to trade goods and services with one another. It's an abstract concept we all take for granted, yet it's fundamental to our economic system.

But not all money is created equal. Some forms of money are better than others, depending on their ability to serve as a store of value, a medium of exchange, and a unit of account. Gold, for example, has been highly valued for thousands of years because of its durability and scarcity. On the other hand, paper money is only as valuable as the trust we place in the institutions that issue it.

In this module, we'll explore money's different functions and characteristics and what makes good money. Whether you're an average Joe, a business owner, an investor, or simply curious about the world of finance, our goal is to assist you in gaining a deeper understanding of this abstract yet essential concept that touches all our lives. So let's dive in…

What is money?

In its simplest form, money can be understood as the medium by which two parties agree to settle an exchange of a product, good or service.

Money allows us to swap our resources or services for a store of value, regardless of whether we have an immediate use for this stored value. This has allowed our civilisation to expand and grow much more efficiently than it otherwise would have if we had continued to rely on practices such as barter.

For the average person, money holds its value as there are only two methods to obtain money:

- We must expend time and energy in return for money (i.e. work, labour, services).

- We must trade goods or resources in return for money.

It is important to note that in the second point above, in order to obtain these goods and resources to trade, someone at some stage had to spend the time and energy to create them. We can thus deduce that we must expend time and energy to obtain money. Therefore:

Money = Time + Energy

By viewing money as a store of time and energy, metaphorically speaking, we can better understand that money is essentially a battery– a store of energy that can be used at a later date. With this analogy in mind, the evolution of money, in theory, is this constant search for the most efficient battery to store time and energy.

What makes great money?

As you read the introduction, you may have noticed three important terms: store of value, medium of exchange, and unit of account. Don't worry if you're unfamiliar with this lingo. These three functions are essential for money to provide value to its holder and are commonly referred to as the functions of money.

Let's take a look at each one:

- Store of Value: Money serves as a means of storing value for future use, enabling the holder to preserve their purchasing power over time. By doing so, it provides the holder with the ability to save and plan for the future. Gold serves as a prime example of such a store of value, as it has for centuries been able to purchase a decent suit with just one ounce.

- Medium of Exchange: For money to serve as a viable medium of exchange for goods and services, it must be easily exchanged. While any asset can technically be used as money, larger and immovable assets like houses are not practical for use as a medium of exchange.

- Unit of Account: Finally, money should function as a standard unit of measurement for the prices of goods and services. This means that items are priced and valued in terms of this money, allowing for easy comparison of the relative worth of different products and services.

When these three essential functions of money are met in their entirety, such money has the ability to meet the rigorous demands of trade. Without these functions, money is far less reliable and trustworthy, leading to insecurity and uncertainty in trade, which can have damaging effects on both a personal and national level.

With this in mind, when the money we use offers us a reliable means of storing value, an effective method of facilitating transactions, and a common measure of value, it enables us to save and build wealth, trade confidently and transact with ease. These functions together not only assist us in our capacity to trade and save but also lay the foundation for a stable and efficient economic system, fostering greater economic growth and prosperity for individuals and societies.

You're probably thinking, "Ok, I understand that for money to offer value, it must meet the functions of money laid out above, but how does it do that?"

Great question...

The concept of great money may seem complicated, but at its core, it is defined by certain essential characteristics that enable it to function as a reliable and effective store of value, medium of exchange, and unit of account. These elements are collectively known as the characteristics of money. By understanding the connections between the characteristics of money and its functions, we can develop a deeper understanding as to why certain money is preferable to others.

Characteristics of Money

Store of Value

For money to maintain its purchasing power over time, it must be:

Durable: When we talk about money being durable, we are referring to its ability to withstand the wear and tear of time and use. A durable store of value means that the money will retain its value over time, regardless of any physical or environmental factors that may cause it to deteriorate. For example, if you store your money in gold, it will retain its value and shine even if the coins it represents were to become obsolete. Durable money is important because it allows us to save our wealth over time without fear of losing its value.

Scarce: When money offers scarcity, we mean a limited available supply. This is important for a store of value because if there is too much of a particular currency, it can decrease in value. A scarce currency is more likely to hold its value over time, making it a reliable store of wealth. Think of it like a limited edition item - if there are only a few of them, they are more valuable and sought-after than if there were a limitless supply. Similarly, a scarce currency is more likely to hold its value and maintain its purchasing power, making it a better option for storing wealth.

Immutable: For money to offer immutability, it should be impervious to reversal or alteration once a transaction has been made. This is a crucial characteristic of a reliable store of value because it ensures that the value of the money is not subject to arbitrary changes or manipulations. For example, if you purchase something with cash, you cannot later change your mind and reverse the transaction. Similarly, with cryptocurrencies like Bitcoin, once a transaction has been recorded on the blockchain, it cannot be altered or reversed. This immutability provides a sense of security and reliability for both buyers and sellers in financial transactions.

Medium of Exchange

For money to be an effective intermediary for buying and selling goods and services, it must be:

Portable: When we talk about money being "portable," we mean that it is easy to carry and transport from one place to another. This is an important characteristic of a medium of exchange because it enables us to use money to buy and sell goods and services in different locations. For example, if you wanted to buy a coffee from a café, you could use your portable money (such as cash or a credit card) to pay, no matter where you are. In contrast, if you had to carry around large, heavy objects as a means of exchange, it would be much more difficult to use them in transactions.

Divisible: This is a critical characteristic of a good medium of exchange, which refers to the ability of money to be divided into smaller units to facilitate transactions of varying sizes. For example, making small purchases would be challenging if we only had large denominations of money. Divisibility allows us to make exact payments, regardless of the transaction size, making money more useful and practical in everyday life. Essentially, the more divisible a currency is, the more convenient it is for individuals to use and transact with.

Accepted: When we discuss acceptability, we are referring to whether there is widespread acceptance of a particular form of money. This means that people are willing to accept and use this form of money as a means of exchange for goods and services. If a currency is widely accepted, it becomes easier for people to engage in trade, as there is a common currency to buy and sell goods and services. The more widely accepted a currency is, the more valuable it becomes, as more people are willing to use it. Conversely, if a currency is not widely accepted, it loses its value, as people will hesitate to accept it as a means of exchange.

Unit of Account

For money to be used as a common measure of the value of goods and services, it must be:

Fungible: When money is said to be fungible, every unit of currency is interchangeable with any other unit. In simpler terms, it means that money is uniform and identical, regardless of where it came from or who owns it. For example, if you owe someone $10 and you give them a $10 bill, it doesn't matter if the bill came from your wallet or someone else's wallet. As long as it's a genuine $10 bill, it's considered to be of equal value. The concept of fungibility is important because it allows money to function effectively as a common unit of measurement, making transactions simpler and more efficient.

Conclusion

Money is a crucial and fascinating part of our daily lives. It serves as an intermediary, allowing us to trade goods and services with one another. However, not all money is created equal. Some forms of money are superior as a store of value, like gold coinage, while others may be more effective as a medium of exchange, the US dollar. However, when these functions are met in their entirety, it enables us to transact confidently and with ease, which not only assists us as individuals but fosters greater economic growth and prosperity for our economy.

In the upcoming modules, we'll explore two popular forms of money: Bitcoin and stablecoins. By examining them through the content discussed in this section, we'll explore how they fulfil the various functions of currency and how they can greatly benefit society.

From bartering to the invention of coins and paper currency, money has undergone a series of transformations to adapt to the ever-changing needs of society. As we move on to the next chapter, let's alter course, directing our attention toward the evolution of money.

An Examination of How We Got Here

From the days of bartering goods to the modern era of digital currencies, money has undergone a fascinating evolution. Our forefathers used shells, beads, and even livestock as a medium of exchange. Today, we have virtual wallets and contactless payments. It's a remarkable journey that has seen countless iterations, trade-offs, and adaptations to meet the ever-changing needs of society.

But how has the money we use evolved to become the indispensable part of our lives that it is today? In this section, we will explore the evolution of money, from its earliest forms to the modern digital currencies we use today. We will delve into each major iteration of money, looking at how they have helped shape our modern society.

A quick note: It’s important to highlight that this section is not necessarily a chronological account of the evolution of money. Instead, it is more of an educational journey on the rise and fall of different forms of money. Many of these mediums of exchange have existed simultaneously, and some still exist today in some way, shape or form.

After reading this introduction, you might wonder: Why does money need to evolve and change over time?

The answer is simple: our needs and wants change as society and technology advance. And as our needs and wants change, how we use and value money changes, too. For example, in ancient times, people relied on bartering to exchange goods and services, but as societies became more complex, it became clear that a standardised and portable form of currency was needed. This led to the development of coins, which were eventually replaced by paper money and, more recently, digital currencies. Each iteration of money has its pros and cons, and as technology and society continue to evolve, we will most likely see even more changes in how we use and value money.

Understanding this concept of monetary evolution is important because it helps us see how money has changed over time and how it might continue to change in the future.

With this in mind, let's take a look at the primary forms of exchange that are either in use today or have been used at some point in the past.

- Bartering: The exchange of goods or services directly without the use of money.

- Commodity Money: The exchange of an agreed-upon commodity that is deemed to be of value, such as salt or sea shells.

- Coined Money: The use of precious metals, such as gold or silver, in the form of coins as a medium of exchange.

- Metal-Backed Paper Money: Paper money backed by a physical commodity, such as gold or silver.

- Fiat Money: Currency that is not backed by a physical commodity but rather has value because a government declares it to be legal tender.

- Cryptocurrencies: Digital or virtual tokens that use cryptography to secure transactions and control the creation of new units.

With these in mind, let's examine each one to gain a more holistic understanding of how we ended up where we are today.

Barter

Bartering! It's a simple concept: you trade something you have for something you want or need.

But is it practical?

The problem with bartering is that finding someone who wants what you have and has what you want can be challenging. For example, imagine you're a wheat farmer in need of a new shirt. You might have to search far and wide to find a shirtmaker willing to trade a shirt for your wheat. But what if the shirtmaker doesn't want your wheat? This problem is known as the double coincidence of wants. A successful transaction requires a double coincidence of wants, meaning that both parties must have something the other wants to trade.

Another problem with bartering is that it can be impractical for certain items. How would you split a live cow to trade for a pair of shoes? And without a standardised unit of account, comparing the value of goods and services is tough. Is a cow worth more or less than ten sacks of wheat or two rolls of cloth?

On top of all that, many goods and services are perishable and lose value over time. So if you're relying on bartering as a means of exchange, you must continuously trade and consume your goods and services to avoid a loss of value.

Despite these challenges, bartering is still used in certain situations. You'll often see barter used during online marketplace transactions, or in countries where the currency has failed to offer a store of value, people seek to store value in goods. That said, it is not widely accepted.

All in all, barter may have been an effective and widely used method to trade goods in ancient times, but it had one major flaw: the "coincidence of wants." In other words, for a successful barter exchange to occur, two parties must have something the other wants. This can be a real headache and lead to many fruitless negotiations. Thankfully, we have moved beyond barter and have developed better ways to exchange goods and services.

Commodities

As barter started to show its weakness in trade, individuals and economies alike desperately needed an alternative. Fortunately, with the emergence of commodities as a medium of exchange, our needs were satiated... temporarily. By pre-defining a commodity everyone recognised as valuable, we had our first form of money that acted as an intermediary to reduce trade friction.

The great thing about selecting a pre-defined medium of exchange was that communities could select something that offered scarcity and didn't spoil, making it a more durable store of value. Things like glass beads, salt, and seashells quickly became sought after as they were counted, fairly durable, and portable in sacks. Salt, in particular, was popular because it had utility - curing meats, among other things.

However, as travel became easier, the world started to open up, and people recognised that scarce resources in one area were abundant in others. This led to exploitation, dilution of supply, and triggered events like the slave trade. For example, European settlers exploring Africa saw that the local communities were using glass beads as a form of money. Baffled, due to the ease of glass production in Europe, settlers would bring large amounts of these beads to Africa, diluting their value. Some would even argue that this dilution was one of the triggers that ignited the slave trade, which contributed to the collapse of the African economy.

Overall, commodity money played an essential role in the development of trade and commerce, as it provided a standardised means of exchange that was widely accepted. However, as societies became more advanced, other forms of money that were more convenient and divisible began to emerge.

To solve these problems, people began searching for commodities that had globally recognised scarcity, which gave rise to the use of precious metals as a medium of exchange.

Coined Money

While still technically commodity money, as humans continued their quest for superior money, they stumbled upon an unexpected hero: precious metals. Not only were these metals beautiful and coveted for their use in jewellery, but they also ticked many of the boxes for what makes an excellent monetary asset. Their globalised scarcity in nature and the significant investment required to mine, refine, and store these metals gave them a premium above other previous forms of money.

Moreover, metals such as gold were one of the most inert elements in the periodic table, making them extremely durable and corrosion-resistant.

As technology progressed, gold and silver underwent a transformative process, being melted, shaped, and stamped into coins, increasing the ease of exchange. The standardised value and markings on these coins notably decreased the costs associated with verifying the weight and purity of precious metals. But, as with most good things, someone always finds a way to take advantage. Coin clipping became rampant, with both individuals and governments clipping portions of the coins to reduce their weight of precious metal while attempting to retain their original face value. This led to the first form of currency devaluation, leading to inflation.

To make matters worse, as the world became more global, gold and silver became increasingly cumbersome to transport and transact with, especially for seafarers.

Metal-Backed Paper Currency

Enter metal-backed paper, a solution to the considerable costs of transportation and risks of loss associated with precious metals. But, as we will see, this solution had its own challenges to overcome.

We've come a long way from the days of bartering and trading goods. With the advent of monetary metals, we finally had a stable store of value that could be used universally. But it was the introduction of metal-backed paper currency that really revolutionised the way we transact.

Think about it: no more lugging around heavy bags of gold or worrying about theft. Instead, individuals could deposit their gold at a warehouse and receive a receipt they could trade just like physical gold. This enhanced the fungibility, divisibility and portability of money, making global trade significantly easier. These receipts could then be easily transported over long distances, making it possible to conduct international trade without incurring significant transportation costs. Although it took a little while for metal-backed paper as a form of money to take off, with the expansion of the British Empire, it quickly became the norm.

But as with any new technology, issues began to emerge.

First, gold warehouses, recognising that their customers rarely came back to withdraw the gold that the receipts laid claim to, started issuing paper receipts with no gold backing, leading to the covert creation of the first fractional reserve banking system (issuers only hold a fraction of customers' deposits as reserves and lend out the rest). And even when countries tried to back their currencies with gold, they often abused the system, leading to economic turmoil.

Second, metal-backed paper money was not immune to counterfeiting. Even with security features, counterfeiters could still create fake notes that could be difficult to detect.

Although metal-backed paper currency had its fair share of problems, its enhanced fungibility, divisibility, and portability paved the way for the convenience of fiat currencies we use today, where practicality often trumps scarcity.

Fiat Currency

Fiat currencies have been the foundation of our monetary system for decades. The term "fiat" is Latin for "let it be done" and refers to the state's authority to declare a currency as legal tender. Unlike currencies once backed by gold or other valuables, fiat value comes from the government's promise that someone will accept it in exchange for goods and services.

Fiat currencies emerged as countries faced frustration around metal-backed paper currency– governments would have to obtain more gold to print more paper money. This was a hindrance, so whenever a country needed capital, it would temporarily abandon this peg and expand its monetary supply. This new currency was backed by nothing but faith in the government owing to the fact that it was legal tender. Not only that, this new currency devalued the remaining currency in circulation by inflating the supply of money, and with more dollars chasing the same amount of goods, prices rose.

The demise of metal-backed paper currency started at the tail end of World War II. With much faith in the US, global leaders met in Bretton Woods, New Hampshire, and determined that the US would peg their dollar to gold and the rest of the world would peg their currency to the dollar. This meant that most of the world's gold poured into the US for safekeeping, depleting many countries of their domestic gold reserves.

Fast forward to the late '60s and early '70s, the US, feeling restricted by its backing to gold, started to expand their money supply to fund the war in Vietnam. France was not happy about this and demanded their gold back. This caused a rush for gold, and as the US had printed significantly more dollars than the gold it had available, it quickly dropped this peg altogether. This event, known as the Nixon Shock, meant that individuals and countries could no longer redeem their dollars for gold. From this day on, we saw the proliferation of fiat currencies– a currency that is backed by nothing but debt and our faith in the government.

However, monetary evolution didn't stop there. With advancements in technology, fiat currency has continued to evolve. Today, digital transactions have become increasingly common, with internet banking and digital payment systems like Visa, Mastercard, Paypal, Square, and Venmo becoming the norm.

And in more recent years, we have witnessed increased discussion around central bank digital currencies (CBDCs), the newest iteration of fiat currency, offering a wholly centralised and programmable version of our traditional fiat currencies.

CBDCs differ from the fiat currencies we are used to because they give the issuer total visibility into all transactions and the ability to decide who can and can't use the currency. Governments and central banks have been vocal about their ambitions of introducing CBDCs, citing benefits such as centralised control, improved transaction efficiency, and the ability to deposit stimulus checks quickly.

While CBDCs offer many advantages, they also come with some serious potential drawbacks. For example, governments may be able to freeze bank accounts arbitrarily, put time limits on our cash to promote consumption and restrict who we can and can't transact with.

Moreover, the potential for a transition towards digital identities is becoming more prevalent, as seen in China with their CBDC and the introduction of social credit scores, which have impacted freedom throughout the country by preventing access to housing, financial institutions, and basic mobility rights.

As CBDCs are largely untested, we cannot say for sure what the pros and cons will be. However, we can be sure that CBDCs give governments and banks immense control over our monetary system.

Fiat currencies have certainly undergone significant changes in recent times, largely driven by the rise of the digital economy. To meet the evolving needs of consumers, fiat currencies have adapted accordingly. However, with the emergence of CBDCs, we must remain cautious of their potential drawbacks despite their benefits in terms of speed and efficiency.

With this in mind, individuals who have witnessed the erosion of purchasing power and rising government control alongside the proliferation of fiat currencies have started exploring alternative options.

Cryptocurrencies

Imagine a world where your money could be stored and exchanged digitally without any need for intermediaries or trusted third parties. A world where the supply of money was tamperproof, scarce and in the hands of the community rather than governments or banks. This is the world that the leading cryptocurrency, Bitcoin, has created since its inception in 2009.

Bitcoin was born out of a cryptographer's quest to create a new and improved version of our beloved monetary metals. They were looking for digital gold, a monetary asset that could store value, offer durability, and be used for digital transactions. And thus, Bitcoin emerged as the first successful, digitally native, and scarce monetary asset.

What makes Bitcoin truly unique is that it is a digital bearer instrument, meaning there is no need for intermediaries or trusted third parties. The monetary policy is controlled by those participating in the ecosystem, making it impossible to dilute or tamper with in the same ways that were endemic in previous forms of money. And as Bitcoin exists outside the control of governments and central banks, it is quickly becoming widely adopted as an alternative monetary system because it cannot be manipulated.

Since its inception, Bitcoin has continued to grow in its acceptance and adoption as a monetary good. In fact, it is currently growing at a rate of 137% per year, compared to 76% for the growth of the internet at the same age. And while other cryptocurrencies have been introduced in recent years, none have challenged Bitcoin's status as a superior monetary good.

Some naysayers claim that Bitcoin is slow, expensive to transact with, and wastes energy, but let's not be so quick to judge. What if we told you that Bitcoin represents a paradigm shift in the way we think about money and value?

In the coming modules, we will explore Bitcoin through an alternate lens, one of objectivity and intrigue. So bear with us.

In the meantime, while central bank digital currencies may be viewed as Bitcoin's direct competition, many argue that they are no different from any other digital fiat currency except for frightening political and social implications.

As we continue to move towards a world of programmable money, Bitcoin remains in a league of its own. Its supply cannot be diluted or expanded, it has the largest network effects and user base, and its value proposition and security will continue to strengthen as the network grows. And while it may not be the newest digital currency, it offers something far more valuable: true sovereignty over one's own money.

That said, although digital currencies represent a new frontier in the evolution of money, offering a high degree of security, privacy, and convenience, they also come with their own risks and challenges, which must be carefully considered before adopting them as a form of money.

After examining the different forms of money throughout history, this brings up a pertinent question:

Are we headed in the right direction?

Throughout this journey, we have explored the fascinating evolution of money, tracing its evolution from bartering to our current digital age. We have seen various currencies rise and fall, from shells and beads to precious metals and fiat money.

However, as we have seen, the path of monetary evolution has not been without its challenges. The rise of coin clipping and currency manipulation, the move towards centralisation and away from a generally accepted medium of exchange are just a few examples of the obstacles we have faced along the way.

As we move forward into the future, we must ask ourselves, how will currency manipulation continue to affect our financial well-being?

And, although it is clear we have prioritised ease of use as we have transitioned from barter to commodities to digitalised currencies, should we rethink what characteristics we value most in the perfect form of money?

These are complex questions that require careful consideration and reflection. However, one thing is clear - the future of money is in our hands. We have the power to shape our money, ensuring that it serves the needs of society rather than simply the issuer or our governments.

As we continue our exploration of the world of money, it's important to acknowledge the significant changes that have taken place since the rise of fiat currencies. While these currencies have brought a level of convenience and stability, they have also presented new challenges, such as inflation, rising debt levels, and wealth inequality. In the next section, we will delve deeper into these issues, and in the following modules, we'll explore potential solutions to these tricky problems.

A Look at Where We Are and What We Can Expect Moving Forward

As we discussed in the previous chapter, historically, money has often been backed by a commodity like gold. The benefits of this cannot be overstated. Not only did this connection mean that such money’s value was directly tied to the value of the commodity, but it also meant that the currency issuer, typically the government, was limited in how much money it could print as it would have to obtain more gold.

However, as we moved away from the gold standard, over the last 100 years, money has increasingly become more centralised, with central banks like the Federal Reserve and the US central bank gaining more control over the direction of money.

Today, central banks, alongside the treasury, basically have free reign over the direction of money and the monetary system. They possess the ability to increase the supply of money whenever they deem it necessary, as well as adjust interest rates to promote economic growth, and even provide bailouts to failing banks and businesses.

…but as with any form of intervention, there is no free lunch.

When central banks decide to intervene, although they may be able to print money out of thin air, they can’t create value. For this newly printed money to be worth something, its value must come from the previous currency holders.

What do we mean? Think of the money supply as a pizza, and imagine it cut into four slices. Doubling the money supply would not be equivalent to doubling the amount of pizza. Instead, it would be equivalent to cutting those four slices in half to create eight slices. We have not gained any additional pizza. We just have more slices, each smaller in size.

When we print more money, we devalue the money that is already in existence.

For central banks to bail out one area of the economy, they must take from another. Hence, there is no free lunch.

And with money no longer being tied to a commodity such as gold, there are fewer checks and balances that the government has to follow, giving them greater power to intervene whenever they feel it is necessary. For example, during economic downturns like the ones we faced in 2000, 2008, and 2020, central banks were able to intervene to levels never before seen. Injecting trillions of fresh dollars into the economy in an attempt to stabilise the financial markets.

This intervention has come at a significant cost to small businesses, the wage earner and the long-term stability of the economy, as this increased intervention has led to a ballooning of the national debt and rising inflation. This, as I am sure you can guess, has led to a rise in the cost of living, making it more difficult for individuals and families to afford basic necessities.

Overall, the centralised nature of money today has given central banks an unparalleled degree of power to intervene in the economy. While this may appear beneficial during times of economic hardship, it can also result in significant drawbacks like increased debt and inflation. With this in mind, let's take a look under the hood at these seemingly innocuous terms, debt and inflation and examine some of their byproducts.

Before diving in, you may notice that we reference the US as you read the following text. Considering the US dollar is the global reserve currency, what happens to the dollar will have downstream effects on all global economies and currencies. Therefore, we highlight some of the problems within the US system to illustrate the global challenges we face. Often, if you examine your own local jurisdiction, you may find that the state of affairs in your home country is potentially more dire.

Inflation

Inflation is an increase in consumer prices or a decline in the purchasing power of money due to monetary expansion. And it can be better understood as too many dollars chasing not enough goods, causing prices to rise.

As mentioned earlier, a useful analogy for the money supply is a pizza. When central banks inject newly printed money into the economy, they are not creating more pizza. Instead, they are slicing the pizza into smaller pieces. This leads to the devaluation of our currency, meaning that the value of each slice—or dollar—decreases over time. As more money is pumped into the economy, inflation rises, and the purchasing power of the dollar decreases, leading to higher prices for goods and services.

To give you an idea of the scale of money printing we are talking about, in the past decade alone, the amount of US dollars printed surpasses the total amount of US dollars printed throughout the entire history of the currency. That's right - more money was printed in the last ten years than in the previous two centuries combined! It's no wonder that the value of our money seems to be evaporating faster than a drop of water in the desert.

This can be hard to visualise, so let’s take a look at a hypothetical example.

Let's say we earn a salary of $30,000 per year, and we're planning to buy a new car that costs $15,000. After doing some math, we figure you can save $5,000 per year. That means, given zero inflation, it would take us three years to save up for the car. Sounds reasonable…

However, in such a scenario, we are failing to account for inflation. When we include inflation in the above scenario, we face a very different story.

Assuming our income and savings potential stay the same, after three years of 10% inflation, the car would now cost $19,965. We’re now $4,965 short, and by the time we save for another year and finally have the $19,965, it now costs $21,961. The car is quickly getting further and further out of reach.

All in all, given zero inflation, it would take three years to save for a $15,000 car if we’re able to save $5,000 per year. However, with inflation at 10%, we now have to save for 4.5 years. That is 50% more time! 1.5 years of our life we won’t get back.

If our salary does not increase with inflation, we are earning less money as time passes. This is because the cost of living is increasing, but our salary is staying the same. This leads to a decrease in our purchasing power, making it more difficult to afford the same standard of living as before.

Debt

Historically, governments were constrained in their abilities to fuel economic growth since they had to acquire more gold to obtain capital for stimulation. This limited their ability to grow and expand indefinitely, as they had to abide by the laws of physics.

However, after the Nixon Shock, when the US abandoned the gold standard, governments and central banks worldwide gained the ability to expand the money supply at will, as a physical asset no longer backed currency. This shift initially enabled the US central bank to stimulate the economy more easily during periods of economic stress. However, what started as a measure to spur economic growth quickly became the norm and was instead used to stimulate artificial growth.

Over time, the US and other governments developed an unhealthy appetite for debt, leading to our current situation. The US has spent more than it has earned through taxation and other sources of income in 20 of the last 21 years. If we were to apply this spending pattern to our personal finances, we know how quickly it would lead to financial challenges.

Central banks now find themselves in a difficult position. Given the debt burden, they have few options other than to artificially suppress interest rates in an attempt to reduce the burden of debt– If interest rates are lower, then debt service payments are, too. If rates were to rise, many sectors of the economy would likely be unable to service their interest payments, quickly leading to default.

However, this suppression of interest rates comes at a cost: It makes capital more easily available. As a result, individuals, businesses, and governments are more inclined to take on additional debt, thereby exacerbating the overall debt burden. This creates a challenging balancing act for central banks, which must keep interest rates low enough to manage existing debt while also preventing the accumulation of new debt that could harm the economy in the long run.

This balancing act isn’t going quite as planned…

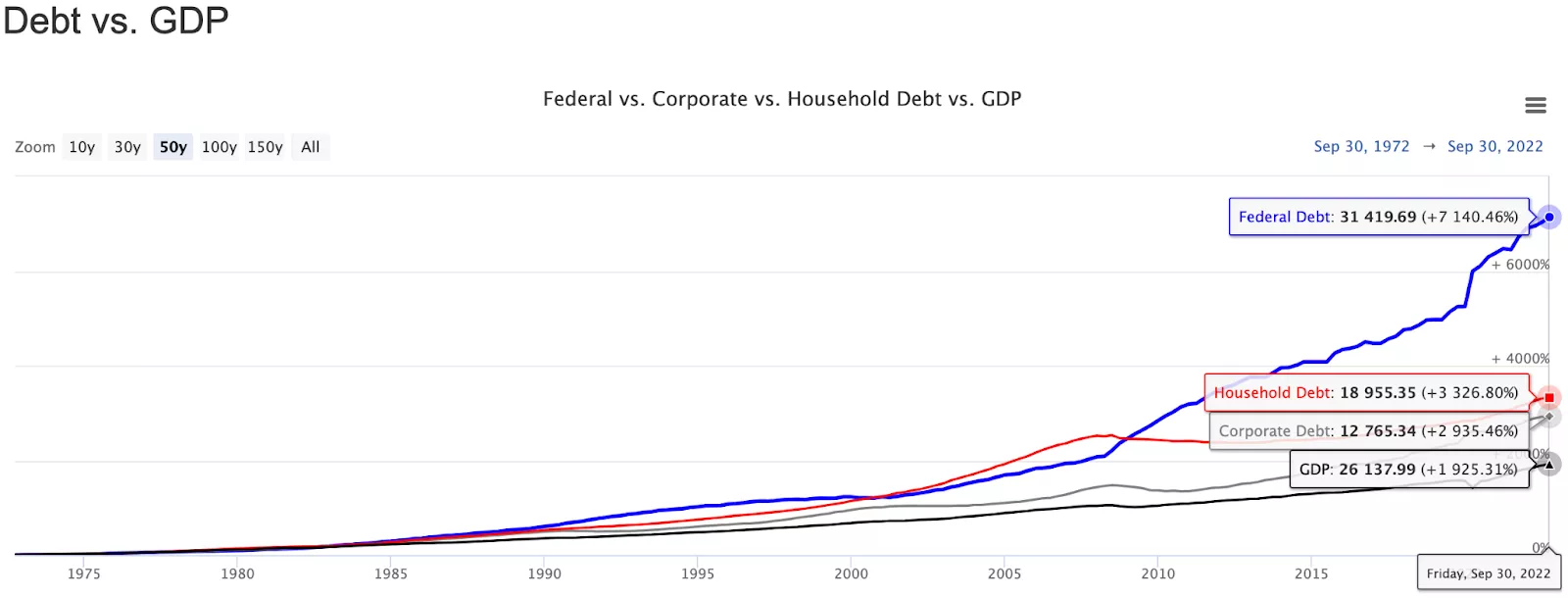

Figure Debt vs GDP

When we add together Federal, corporate, and household debt, the resulting figure is a staggering $63.14 trillion, in contrast to the United States Gross Domestic Product (GDP) of $26.13 trillion. This means that the US has a total debt-to-GDP ratio of 241%. In other words, for every $1 of GDP generated, there is a whopping $2.41 in debt.

$63.14t / $26.13t = 241%

Let’s assume conservatively that the average interest on this debt is 3%.

3% * 241% = 7.23%

The scale of the US's debt burden is such that even servicing the interest payments on the debt would require an annual growth rate of 7.23% - a rate significantly higher than the average GDP growth rate of 3.13% over the last 70 years.

7.23% - 3.13% = 4.1%

Even in the best-case scenario where the US stops running deficits and manages to balance its books, the debt would still increase by 4.1% per year. This is because the country's GDP growth does not fully cover the interest on the debt.

You can probably see where this is going. To address the burden of debt, those in positions of power are compelled to intervene by injecting more money into the economy, devaluing the currency, and leading to higher inflation. We are in a debt spiral with no clear way out.

While this approach provides temporary relief, ultimately, we’re only exacerbating the underlying problem of excessive debt. Finding a long-term solution to reduce debt is going to require difficult choices and a willingness to make tough decisions in the short term. But that's for a whole other course. In the meantime, let’s take a look at why debt and inflation don’t impact everyone evenly. It disproportionately impacts the wage earner.

Wealth Inequality

When money enters the economy, it tends to pool in certain areas: Assets!

Why? You might ask. When central banks increase the money supply by printing new currency, the value of each individual unit of currency decreases. This means that prices for goods and services tend to increase over time, leading to higher costs for basic necessities like food, housing, and healthcare. This inflationary pressure on prices erodes the purchasing power of those who rely on wages and salaries for their income.

With this in mind, are you incentivised to store your hard-earned savings in the currency? Of course not. If you have the capacity, you go out and purchase assets. Given the artificial demand for assets, their value rises. Therefore, those who hold assets such as stocks, bonds, and real estate benefit, to a certain extent, from inflation as the value of these assets tends to increase with inflation. As a result, inflation exacerbates wealth inequality by creating a divide between those who hold assets and those who rely on wages and salaries, leading to a concentration of wealth in the hands of the upper class.

Let's use our newfound understanding to analyse real estate.

With the constant barrage of social media and news coverage, you’ve probably noticed the issue of rising social unrest and wealth inequality on a global scale. One of the underlying causes of this growing unrest is the increasing difficulty for the average person to afford a house, as evidenced by the fact that the ratio of house prices to wages has increased from just above four in the 1980s to above seven today. In other words, the average person must now spend seven times their annual wage to afford an average-priced house.

Why is it so much harder to purchase a house? It is becoming significantly harder to purchase property for two reasons.

Inflation is devaluing our currency’s purchasing power. With a deteriorating currency, people are no longer incentivised to save. This forces Individuals with wealth to direct their resources toward financial assets while individuals without wealth towards consumption. As consumption directs money toward corporations held by the wealthy, and smart money directs their cash toward assets, we see the knock-on effect of rising asset prices due to increased demand. This is all while inflation is wreaking havoc on the purchasing power of the currency.

Due to our excessive debt burden, governments are incentivised to suppress interest rates. In doing so, debt consumption becomes more enticing, especially to those with wealth. When the cost-of-capital is so cheap, people borrow beyond their means, funnelling more capital into assets and driving up prices. This is great for asset holders; however, prices are becoming ever more unobtainable for those trying to get on the property ladder or dip their toes into the financial markets. A simple rule of thumb is that as interest rates decline, asset prices increase as capital is more freely available.

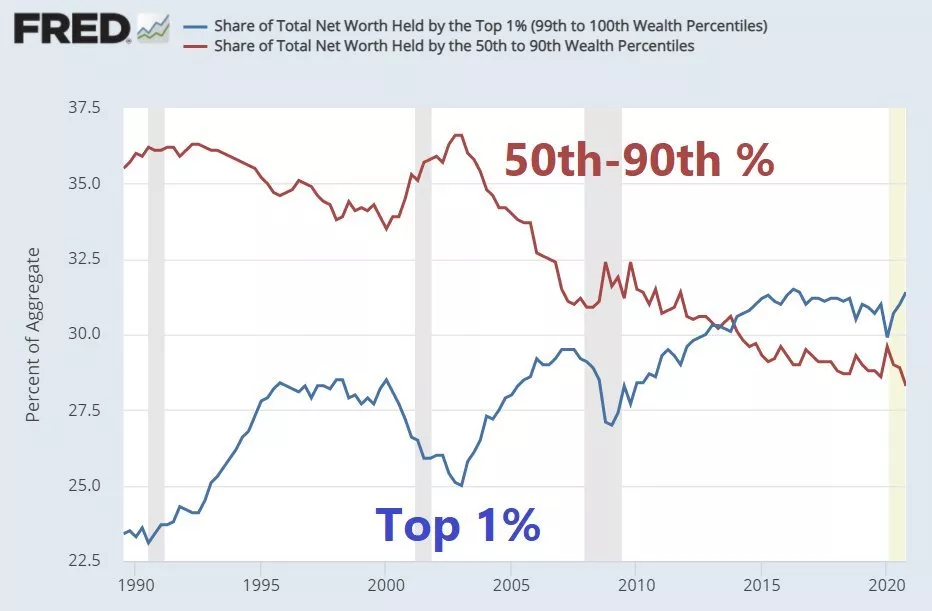

How does this inflation amplify wealth inequality? Considering the upper class holds assets and the lower class tends to hold currency, what ensues is greater and greater wealth inequality as the purchasing power of the currency diminishes and the cost of assets steadily rises, becoming more and more unobtainable. This can be seen in “Figure X” below. You’ll notice a significant difference in the appreciation of assets compared to wages.

Performance By Asset Class

| Asset Class | Total Growth (Jan 2010 - Jan 2021) | Annualized Growth (Jan 2010 - Jan 2021) |

|---|---|---|

| Stock Market | 236.84% | 11.67% |

| Real Estate | 66.38% | 4.74% |

| Gold | 73.10% | 5.11% |

| Average Hourly Wage | 33.37% | 2.65% |

Figure: Performance by Asset Class (Stocks, Real Estate, Gold, Wages)

With this lagging of wages to asset prices, we have seen one of the greatest transfers of wealth from the lower class to the upper class in recent history

Figure: Share of Total Net Worth

Boom & Bust

In a natural, free-market business cycle, expansion and contraction refers to the recurring patterns of growth and decline in an economy driven by market forces. During the expansion phase, businesses experience growth, consumer spending increases, and overall economic activity expands. This phase is typically characterised by increased investment, rising employment rates, and higher profits.

However, economic expansions also contain the seeds of their own contraction. Factors such as excesses in investment, rising debt levels, or changes in market sentiment can lead to a slowdown in economic activity. This contraction phase, often referred to as a recession or economic downturn, is marked by reduced consumer spending, lower business profits, and potential job losses.

Economic contractions, though challenging, serve as a necessary cleansing process, holding irresponsible behaviour and those burdened by debt accountable for their actions. They create financial pressures incentivising individuals and businesses to rectify their behaviour or face consequences. This natural ebb and flow of market expansion and contraction promotes innovation and growth during expansion and purges fiscal irresponsibility during contractions.

However, this process can only occur effectively when interest rates are allowed to freely adjust based on supply and demand. Why, you might wonder? Interest rates serve as a measure of economic risk, rising when demand for debt exceeds available capital and falling when capital is abundant but demand is low.

Regrettably, our current system deviates from this ideal. Central bank interventions intended to stabilise the economy often have unintended consequences. Manipulating interest rates disrupts the natural market signals, distorting the functioning of these cycles. Artificially suppressed interest rates encourage excessive borrowing and speculative bubbles, while abrupt rate increases for inflation control lead to financial instability and economic slowdown.

As a result of interest rate manipulation, economic expansions tend to be prolonged, leading to increased debt levels and fiscal irresponsibility. Conversely, economic contractions become more severe, exacerbating instability and hardship for those at the bottom of the social ladder.

Conclusion

Our current path of monetary intervention is not sustainable. The ever-increasing debt burden, coupled with uncomfortable inflation and rising costs of living, is leading to greater wealth inequality and social unrest. We can only expect these problems to worsen if we continue down this path.

Fortunately, there are options available to us. With the emergence of Bitcoin, we now have the ability to opt out of the traditional fiat monetary system and into an alternative system that places control back into the hands of the community. The decentralised and transparent nature of Bitcoin offers a more equitable and secure financial system free from the control of central banks and governments. This allows individuals and communities to transact with greater freedom and confidence without being subject to the inflationary pressures and wealth inequality created by traditional monetary policy. And with stablecoins, those living under far greater monetary pressures can easily exit their local currency and move into something more stable, i.e. the USD.

As we move forward, we encourage you to approach this new technology with an open mind and a critical eye, exploring how it can offer an alternative to our present-day financial systems. By doing so, we have the potential to address the problems of rising inequality and social unrest while building a more sustainable and equitable economic future.

Exam

Now that you went through the Module "The Price of Progress" you will have to test your newly acquirred knowledge to make sure that you have understood the last sections. We'll start with several Open-Ended Questions and then a small quizz.

- Consider the emergence of Bitcoin and stablecoins as alternative systems to traditional fiat currency. What do you feel are some of the potential advantages and disadvantages, and how might they contribute to a more equitable economic future?

- What information can you gather from the debt-to-GDP ratio of the United States? What is the debt to GDP of your own country?

- How does suppressing interest rates impact the overall debt burden?

- How does the current monetary system exacerbate wealth inequality?

- In light of the information provided about debt and inflation, what is your opinion on the sustainability of the current monetary system? Do you think our current system is beneficial or detrimental in the long run?

Financial Liberation - An Introduction to Bitcoin

Pioneers, Innovators, & the Foundations of Bitcoin

Welcome to Module Two, where we'll explore the fascinating world of Bitcoin. Building on our understanding of the history of money, this module will cover the following topics:

- Bitcoin's backstory and creator

- The benefits of Bitcoin as a digital currency

- The distinction between bitcoin the asset and Bitcoin the network

- How to interact with Bitcoin and its various layers

By the end of this module, you will have a solid understanding of Bitcoin's origins, features, and potential uses. But before we dive into the intricacies of Bitcoin, let's first explore the history of digital currencies that paved the way for this technology that is changing how we think about money.

What is this thing called Bitcoin

Bitcoin is a trustless and permissionless decentralised digital currency. That may sound confusing, so let us explain. Since no government or institution controls Bitcoin, you do not have to trust any third parties or require permission to use it. Instead, it's maintained by a network of users around the world who validate and process transactions on something called the blockchain.

Think of the blockchain as a giant ledger or a digital spreadsheet that maintains a record of every transaction made via Bitcoin. As anyone globally with an internet connection can monitor, validate or process transactions, this ensures that the currency is secure and can't be counterfeited.

Bitcoin is also unique in that it has a limited supply. Only 21 million bitcoin will ever be created, which gives it scarcity, like gold and other precious metals. This scarcity is part of what gives bitcoin its value.

Lastly, and arguably most importantly, given that it operates independently from governments or banks. bitcoin enables people to exchange value with one another directly, just like cash transactions. However, unlike cash, bitcoin can be used to purchase goods and services online, without relying on traditional payment methods. This means that given its decentralised digital nature, Bitcoin eliminates the need for intermediaries, physical banknotes and coins, making transactions easier, faster, and more secure.

For the first time in a long time, Bitcoin represents a new way of thinking about money and value. This is why we're excited to take you down the rabbit hole with us.

Pioneers of Digital Currency

Before Bitcoin's creation, a handful of visionaries laid the groundwork for Bitcoin as they envisioned a world where money could be transferred electronically without intermediaries. These individuals unknowingly played a pivotal role in the development of Bitcoin, as without their contributions to cryptography, it would not exist today. Among the most prominent of these pioneers are:

The Cypherpunks

The Cypherpunks are a group of tech-savvy rebels who came together in the 70s to fight for individual freedom and civil liberties using one powerful tool: cryptography. They believed that the ability to encrypt information would give people the power to take back control from centralised authorities. Imagine being able to keep your online communication private and secure from prying eyes - that's what they were fighting for!

One of the most notable outcomes of the Cypherpunks was the Cypherpunks mailing list, established in 1992. Through the list, individuals could share ideas and discuss cryptographic technologies, digital currency concepts, and privacy-focused initiatives. This led to the formation of a community of like-minded individuals, including developers, activists, and researchers.

Today, the cypherpunks' visionary ideas continue to shape the evolution of our digital landscape, empowering individuals with greater control over their data and communications. One of their most significant legacies is Bitcoin, as it draws heavily from Hashcash— a technology developed by cypherpunk Adam Back in 1997 to combat email spam.

Other notable Cypherpunks include:

- Timothy May: Founding member of the Cypherpunks mailing list and wrote extensively on cryptography and privacy throughout the 90s and early 2000s. His writing laid the groundwork for discussions on digital privacy and electronic cash systems.

- Eric Huges: Another founding member of the Cypherpunks and co-author of "A Cypherpunk's Manifesto," which emphasised the importance of privacy and anonymity in the digital age.

- Whitfield Diffie and Martin Hellman: Developed the concept of public-key cryptography, revolutionising secure internet communication.

- Julian Assange: Founder of WikiLeaks, which publishes classified and sensitive information to promote transparency and accountability.

- Bram Cohen: Created BitTorrent, a peer-to-peer file-sharing protocol that decentralised content distribution and enabled faster downloads.

- John Gilmore: An entrepreneur and libertarian who co-founded the Electronic Frontier Foundation (EFF) and advocated for digital rights and online privacy.

...and the list goes on.

David Chaum (The Father of Digital Currency)

In the early 1980s, David Chaum revolutionised the world of digital currencies with his groundbreaking work on "blinded signatures." This enabled cryptographically signing a message without knowing its content, ensuring privacy and security in digital transactions. In 1982, David Chaum conceptualised Ecash, an anonymous electronic cash system that used cryptography, which was later implemented through his corporation Digicash.

Although Digicash was used as a micropayment system at one US bank from 1995 to 1998, Chaum eventually filed for bankruptcy. That said, his innovative ideas inspired others to explore digital currencies, paving the way for the development of modern cryptocurrencies, such as Bitcoin.

E-gold

Following Chaum's footsteps, in 1996, two innovators, Douglas Jackson and Barry Downey, introduced E-gold, the first widely used digital currency, allowing users to transfer gold ownership electronically. The concept quickly gained traction and attracted millions of users who saw the potential of this unique form of money. With E-gold, people could easily and quickly transfer funds across borders without dealing with the slow and cumbersome traditional banking systems.

However, as with any new technology, E-gold faced regulatory challenges and issues with illegal activities such as money laundering and fraud. As a result, the company was forced to shut down its operations, marking a significant blow to the early development of digital currencies.

Despite its ultimate failure, E-gold was a crucial step in the evolution of digital currencies. The lessons learned from E-gold's experiences provided a roadmap for future innovators to address regulatory challenges and security concerns.

Given Bitcoin's meteoric rise, many people mistakenly believe it was the first digital currency ever to exist. However, as hopefully is now evident, this assumption is far from the truth. Bitcoin's emergence resulted from decades of research and experimentation by pioneers in the cryptography field. Without the contributions of the individuals above and many others, Bitcoin may have never been created. Although these early digital currencies eventually failed, Bitcoin learnt from their mistakes, ultimately becoming the digital currency we know today.

That said, if it weren't for one individual... or group (we don't know for sure), Bitcoin would not exist. And that is Satoshi Nakamoto. The enigmatic creator.

Satoshi Nakamoto

Although Bitcoin has captivated the minds of millions with its disruptive potential and unique technology, despite its popularity, its mysterious origins continue to fascinate and puzzle people. Satoshi Nakamoto, the creator of Bitcoin, remains unknown to this day, despite numerous attempts to uncover his true identity. Even though it has been over a decade since the emergence of Bitcoin, we are still no closer to solving the question of: Who is Satoshi Nakamoto? However, given Bitcoin's decentralised nature, does it really matter?

Either way, let's take a look at the myth and legend.

Satoshi Nakamoto emerged on the internet in 2008 with a revolutionary idea: peer-to-peer electronic cash. He shared his vision in a nine-page paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" with the cypherpunk mailing list. Despite initial disinterest from most mailing list members, the idea sparked enough curiosity in one member, Hal Finney, who eventually reached out to Satoshi. Hal's involvement in Bitcoin development proved to be a turning point, leading to more people offering their support.

However, after two years of working on the project, Satoshi vanished without a trace, with his last credible communication on April 23, 2011, where he stated that he had "moved on to other things."

The mysterious disappearance of Satoshi Nakamoto has led to various theories about where he went. Some speculate that he felt he had accomplished what he set out to do, while others believe he became uncomfortable with the attention that Bitcoin was attracting. In December 2010, when WikiLeaks was banned from using traditional payment methods, it turned to Bitcoin for funding. Satoshi's concerns about the increased attention on Bitcoin and the potential legal ramifications of creating a currency used to interfere with US geopolitical interests may have prompted him to step back. Alternatively, he may have shifted his focus to other projects, may still be contributing to Bitcoin under other names, or even passed away.

Although we may not know who Satoshi is, we have a clearer picture of his intentions behind Bitcoin. He created Bitcoin as a response to the 2008 Global Financial Crisis and the resulting distrust around traditional banking systems and government-controlled currencies.

In his online communications, he expressed cynicism towards the centralised nature of money and banking, highlighting the dangers of trusting central banks not to devalue their currency. Case in point, written into the first Bitcoin block, is:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

This is a reference to a Times newspaper article, reflecting his concerns that banks were engaging in risky behaviour, with little consequence to them, and that losses would be shared amongst currency holders. Furthermore, we know from his more recent messages that Satoshi disagreed with how our current monetary system functioned:

"The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust."

While the enigma of Satoshi adds intrigue to Bitcoin's history, there is one thing we cannot argue about. Satoshi's decision to remain anonymous underscores the core principles of decentralisation and individual freedom that underpin Bitcoin's design. Satoshi's anonymity ensures that the focus stays on the technology and its potential impact rather than on the cult of personality.

Conclusion

To summarise, Bitcoin has revolutionised the way we think about money and value. For the first time in history, we have a digital currency that is:

- Peer-to-Peer: Bitcoin allows individuals to send and receive payments directly without the need for intermediaries, such as banks or payment processors.

- Decentralised: Bitcoin operates on a decentralised network, meaning there is no central authority or control over the currency.

- Secure: Bitcoin transactions are secured using cryptography, making counterfeiting or double-spending coins difficult.

- Limited in Supply & Divisible: The supply of bitcoin is finite—with only 21 million coins in existence—while at the same time, it is divisible to eight decimal places, enabling transactions for a fraction of a cent. This scarcity is designed to give the currency value and prevent inflation.

- Psuedoanonymous: While Bitcoin transactions are not completely anonymous, they offer a level of privacy and pseudonymity that traditional payment methods do not.

These points combined mean that Bitcoin offers anybody financial privacy, security and the ability to transact globally with minimal fees and friction. Ultimately, Bitcoin is a powerful tool for those seeking greater economic freedom and autonomy. This is a game-changer for those looking for a secure savings vehicle, let alone living under authoritarian regimes, experiencing hyperinflation, fleeing war-torn countries, or remitting money back to loved ones overseas. As Bitcoin offers an affordable alternative to traditional money transfer methods, this leaves more money in the hands of those who need it most. With Bitcoin, anyone can become their own bank and take control of their own financial future.

To end, regardless of who Satoshi Nakamoto is, it is undeniable that the invention of Bitcoin has sparked a new way of thinking about the transfer of value.

How Does Bitcoin Work? The Inner Workings of This Magical Internet Money

Bitcoin is often referred to as magical internet money… and for a good reason. Think about it – with Bitcoin, you can send value to anyone, anywhere in the world, without the need for a middleman like a bank or government. It's like having control of your own personal bank, the power to transfer funds across borders with just a few clicks of a button.

Given the numerous benefits that Bitcoin has to offer, from providing a fast, secure, and low-cost way to transact to allowing individuals to take control of their own financial futures without the need for a centralised authority, in addition to the complex cryptographic hurdles it has had to solve to make peer-to-peer digital currency a reality, it's natural to feel as though its functionality is something only a handful of individuals must understand. You may even feel a little intimidated by the idea of a decentralised digital currency. But the truth is that Bitcoin is actually quite simple once you understand its inner workings.

In this section, we're going to take a closer look at the key players in the Bitcoin ecosystem and how they work together to make this magical internet money function.

Let's get started!

As discussed in the introduction to this module, Bitcoin is unique in that we have a fully functional, widely used peer-to-peer decentralised digital currency for the first time in history. This means that instead of relying on a central authority like a bank or government to manage transactions, it is managed by a network of participants that work together. This innovative approach allows us to transact with one another without the need for intermediaries.

When compared to traditional banking systems, while Bitcoin functionally operates differently, the roles it must perform are no different. For instance, both banks and Bitcoin have to:

- validate and process transactions,

- monitor transactions to ensure there is no cheating or bad behaviour,

- ensure everything is up-to-date, functioning smoothly and securely.

While banks perform these roles in-house, giving them complete control over the process, Bitcoin requires collaboration by the community to perform these roles. In other words, for Bitcoin to replicate these processes in a decentralised system, Bitcoin must outsource each of these tasks to ensure that no one individual or centralised entity has outsized control over the system.

To achieve this revolutionary feat, Bitcoin has divided these tasks into three key roles: nodes, miners and developers. Where nodes verify transactions and set and enforce rules, miners order and confirm transactions, and developers keep the network up-to-date and propose upgrades. By distributing these tasks amongst these key players, Bitcoin has created a system that is secure, transparent, and accountable to all users.

Let's, therefore, take a look at each of these roles…

The Roles of Bitcoin

Nodes

Nodes are essential to the integrity and security of the Bitcoin network. They serve as the system's gatekeepers, ensuring that transactions are processed accurately and according to the rules. Every node downloads and locally verifies a complete copy of the blockchain, which is essentially a digital ledger that records every transaction ever made on the Bitcoin network. Through consensus, nodes agree on the validity of each transaction and ensure that the rules are being followed. This means that the nodes will reject the transaction if someone tries to cheat the system, e.g. by sending more bitcoin than they actually have or attempting to spend the same bitcoin twice.

To further elaborate on this idea of consensus, when developers propose changes or upgrades to Bitcoin, nodes play a role in adopting or rejecting these changes. They do this by either upgrading their software to the new version or continuing to run the old version. This process often involves discussions and debates within the Bitcoin community to achieve consensus. That said, Bitcoin's consensus is not as black and white as a voting machine. The majority does not necessarily rule. If some individuals disagree with the change, they can launch a new Bitcoin-derived token. Now, the original Bitcoin exists without the change and a new one with the change. Through buying and selling, it is up to the community to highlight which version they deem more valuable. This consensus mechanism ensures that any changes made to the Bitcoin protocol are agreed upon by the whole community, making it difficult for any individual or group to manipulate the system for their own benefit.

It's also important to note that a node is simply a piece of software anyone can run on their home computer. The only requirement is an internet connection and, depending on how much of the blockchain you wish to store, anywhere from 5 to 500gb of free space.

Miners

Bitcoin miners, on the other hand, play a critical role in record-keeping, as they are responsible for ordering and confirming transactions. To do this, miners use specialised computers to perform a function called hashing. Without diving into the nitty gritty of hashing, think of it as miners competing with one another to add new transactions to the blockchain, the public ledger of transactions. In exchange for their work, miners are rewarded with newly created bitcoin and the transaction fees for any transactions processed. The mining process is designed to be difficult, competitive, and randomised, with only a limited number of new bitcoin released each year, ensuring that the supply of bitcoin is limited and their value is maintained. Without miners, transactions would not be processed.

Given that miners have to compete with one another to process transactions and are rewarded for doing so, this competition minimises the chance that any single miner or entity can control the network and incentivizes miners to act honestly and follow the rules. If a miner tries to cheat or break the rules, they risk losing their reward, so there is a strong incentive to play by the rules.

Developers

Developers are highly skilled and respected members of the Bitcoin community who work together to ensure the network remains secure, reliable, and up-to-date. They play a critical role in the Bitcoin ecosystem by maintaining and improving the software that powers the network. They are responsible for proposing and implementing changes to the Bitcoin codebase, fixing bugs, and improving performance and security.

Without developers, the Bitcoin network would not be able to evolve and adapt to changing circumstances. They are responsible for ensuring the network's long-term viability and ensuring it remains a trusted and decentralised payment system for years to come. In short, developers are the backbone of the Bitcoin ecosystem, constantly working to improve the network's underlying technology and ensure its continued success.

Finally, there is one more role that we want to highlight: the community, which is what gives bitcoin its value. The community consists of everyone who uses the network, transacts back and forth, and incentivises the nodes, miners, and developers to continue working on Bitcoin. As the community grows, so does the value of the Bitcoin network.

Side Note: It's important to emphasise that Bitcoin's decentralised nature allows anyone, regardless of their background or status, to participate in the network and take on any of the roles necessary for its functioning. This distinguishes Bitcoin from traditional currencies, which are often subject to control by central banks or governments. In other words, Bitcoin gives power back to the people by enabling them to be active participants in the network rather than passive consumers of a centralised system.

A Transaction From Start to Finish

To understand how all these players work together, let's imagine a simple Bitcoin transaction between two people, Alice and Bob. Alice wants to send Bob one-thousandth of a bitcoin, around $29 at the time of writing.

Transaction Initiation

Every Bitcoin transaction begins with its initiation when the sender, in this case, Alice, creates a transaction specifying the recipient, Bob, and the amount, 0.00100000 bitcoin. The node associated with Alice's wallet then broadcasts the transaction to the network, where the nodes confirm its validity, and it is sent to the miners for confirmation.

At this point, the transaction enters what is known as the mempool, essentially a waiting room for transactions ready to be added to the blockchain. Think of it as a list of pending transactions, much like the ones you see on your credit card statement, that have been initiated but are waiting to be processed. Once the transaction has been initiated and is sitting in the mempool, it is now in the hands of the miners.

Transaction Confirmation

Miners now take these pending transactions, bundle them up into a new block, and compete against one another to perform a certain task laid out by the software underpinning Bitcoin. The competition winner then appends their block and the enclosed transactions to the blockchain, finalising these transactions. The winner is also rewarded with newly issued bitcoin and the fees associated with the transactions processed, incentivising them to continue processing transactions.

Transaction Validation

Once the transaction is confirmed, Bob should now be able to see the 0.00100000 bitcoin in his wallet. But it doesn't stop there. The nodes then verify that the miner has done their job correctly and that the transactions included in this new block meet the rules agreed upon by the nodes. If the block fails to do so, then the new block will be rejected, and the miner will lose their mining reward.