name: Bitcoin Development Accelerator goal: Acquire all the foundations to start developing on Bitcoin objectives:

- Understand the core concepts and technology underpinning Bitcoin.

- Gain practical skills in Bitcoin security, software development, and network governance.

- Develop a mastery of the Lightning Network and its associated protocols.

Welcome to the Cubo+ development courses for Bitcoin!

Over the next 20 hours, you will dive deep into the BTC and LN protocols. This course is designed for programmers who want to start working in the BTC ecosystem and are seeking a solid understanding of the different technology stacks of BTC and LN.

The videos were recorded live during the CUBO+ 2023 bootcamp in El Salvador and succeeded in bringing together world-renowned teachers. This course was offered for free thanks to the generosity of Fulgure Venture and the collaborative efforts of the teachers, the Bitcoin office, DecouvreBitcoin, and many other actors.

Enjoy!

Introduction and Preparatory Courses

Introduction to CUBO+ Courses

Filippo and Mario provide an introductory talk on CUBO+ 2023, setting the stage for the comprehensive learning journey that awaits. They discuss the structure of the courses, the learning outcomes, and how these will empower students in the Bitcoin development space.

Objectives

The course aims to equip participants with a deep understanding of Bitcoin's underlying principles, practical development skills, and the ability to navigate and contribute to the Bitcoin ecosystem effectively. Through a blend of theoretical knowledge and practical exercises, students will master the essentials of Bitcoin security, the intricacies of its software stack, and the mechanisms of its governance.

Prerequisite

Participants are expected to bring a strong sense of curiosity, an eagerness to learn at a professional level, and some foundational knowledge in development. While a detailed background in Bitcoin is not required, a basic understanding of coding principles and an openness to engaging with complex technical concepts are essential for making the most of the accelerator.

Tools

Throughout the course, participants will leverage key tools that will aid their understanding and enhance their learning experience. The use of Linux, the command line interface, GitHub, and Docker will be integral in providing a hands-on approach to Bitcoin development. These tools will facilitate working with the Bitcoin software stack, managing development environments, and collaborating on projects in a real-world setting.

Why Bitcoin

Why El Salvador needs Bitcoin

Welcome to the first lecture of the Cubo Plus educational program. Today, we are diving into the world of Bitcoin, led by Ricky, the founder of the Bitcoin Italia Podcast. Ricky is a passionate human rights activist who uses Bitcoin as a tool to protect and promote human rights. With over six years of experience, Ricky has traveled extensively, documenting Bitcoin adoption in emerging markets like El Salvador and Guatemala. His work goes beyond podcasting; he’s also active on YouTube (Bitcoin Explorers) and Twitter (BTC Explorer, Ricky6). Ricky's commitment to Bitcoin stems from his belief that it offers financial freedom and privacy, challenging traditional, centralized banking systems.

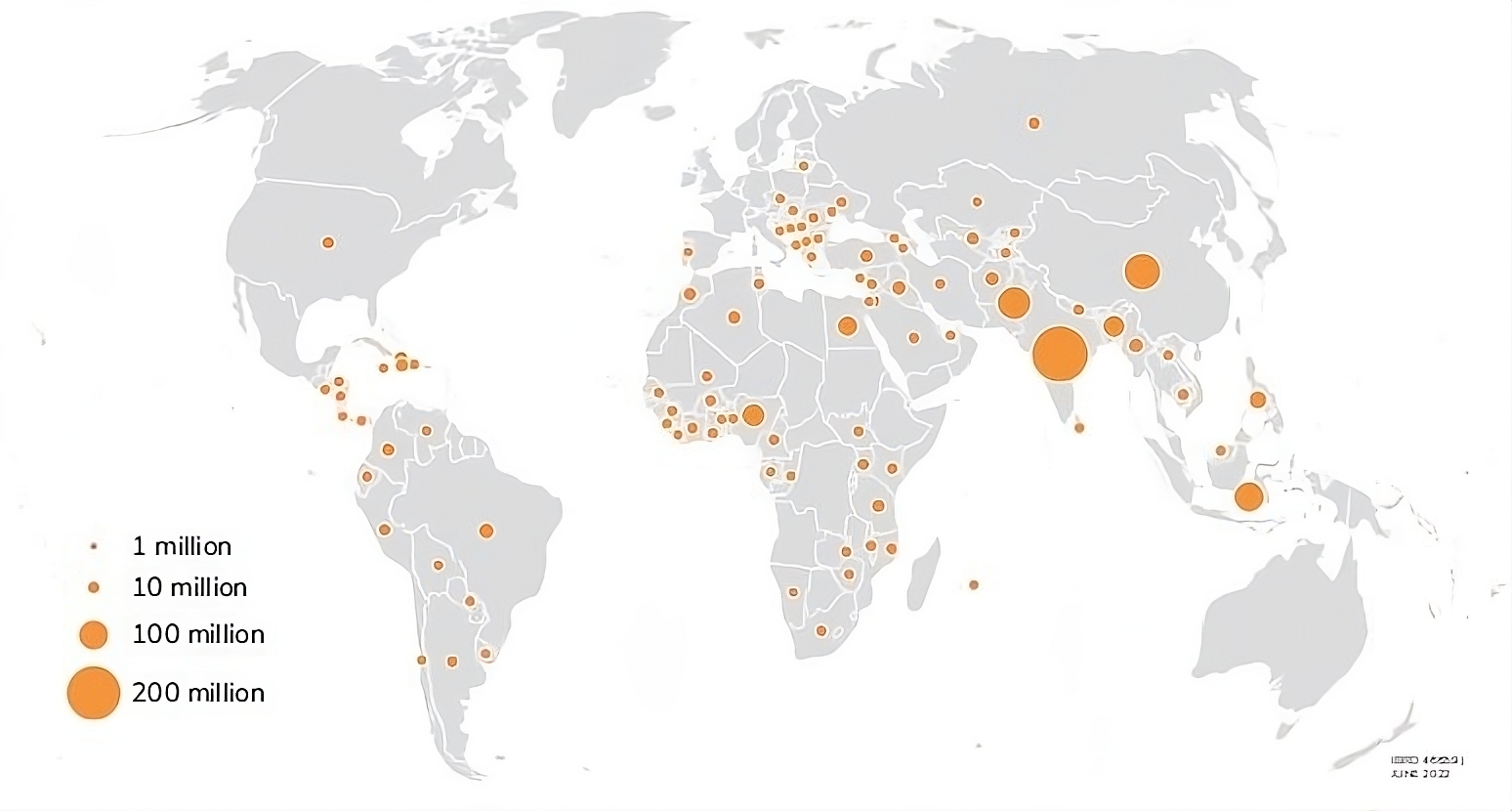

The Global Unbanked Population

The Global Unbanked Population

Bitcoin: financial freedom and its impact on El Salvador

This lecture, "Why El Salvador Needs Bitcoin," provides an overview of the Bitcoin protocol, its roots in the Cypherpunk movement, and its role as a tool for freedom—enabling uncensored money, financial inclusion, and much more.

Definitions:

- Bitcoin protocol: The rules and structure that govern how Bitcoin operates as a decentralized digital currency.

- Cypherpunk movement: A group advocating for the use of cryptography to ensure privacy and freedom in digital spaces.

- Financial inclusion: Providing access to financial services for people who have been excluded from traditional banking systems, often referred to as the "unbanked."

- Uncensored money: Money that cannot be controlled or restricted by governments or financial institutions.

Ricky's background and Bitcoin advocacy

Ricky’s journey into Bitcoin is rooted in his work as a human rights advocate. He believes that Bitcoin can provide individuals with control over their finances, allowing them to protect their privacy and avoid the limitations of centralized banks. His exploration of Bitcoin's adoption in places like El Salvador highlights how this technology can empower people in emerging markets to gain financial independence.

The global significance and challenges of Bitcoin

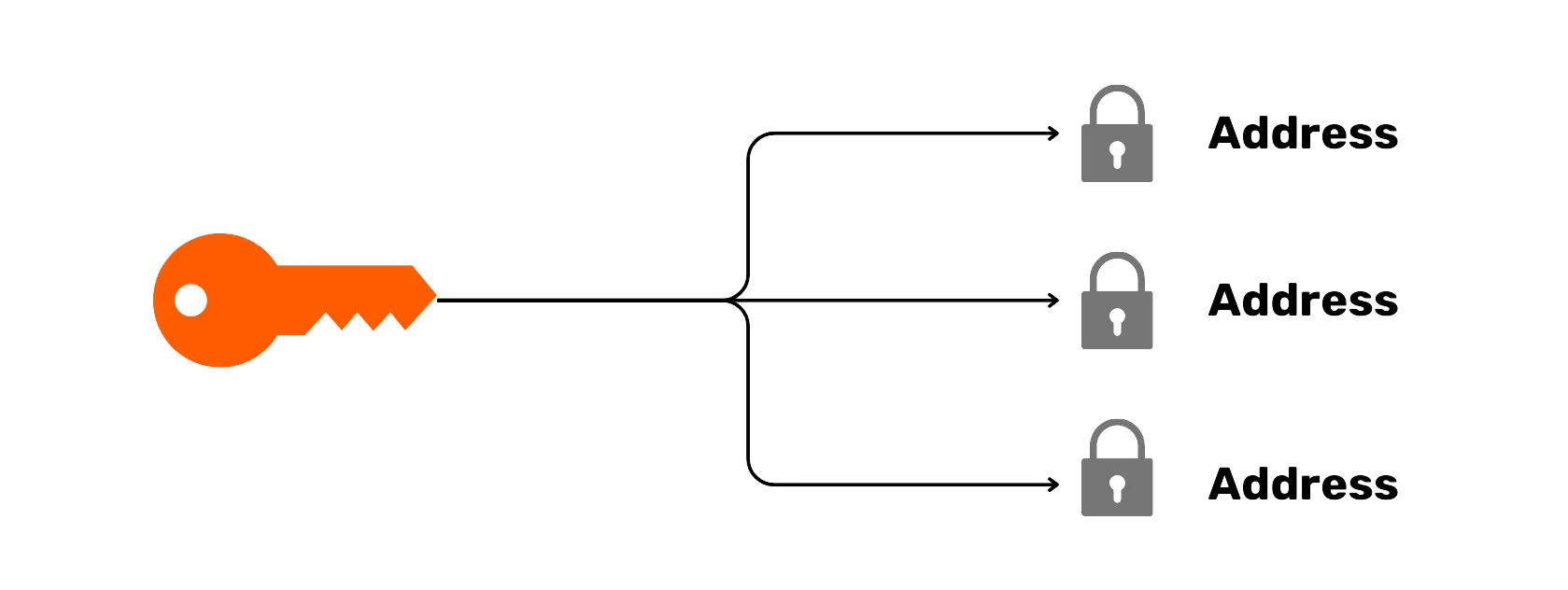

Bitcoin is much more than just a digital currency. It is a tool for protecting privacy and ensuring financial freedom. By using private keys, which act like master passwords, users can securely manage their Bitcoin, with full control over their funds.

In authoritarian regimes, where financial repression is common, Bitcoin’s uncensorable nature allows people to transact without fear of their funds being frozen or confiscated. Its open-source nature encourages global participation, fostering a community that continually improves the network.

Despite its potential, Bitcoin faces significant challenges. In areas such as Africa and India, basic infrastructure like electricity and internet access is often lacking, limiting adoption. Moreover, digital inclusion—ensuring that people of all ages and educational levels can use technology—remains a major hurdle.

Definitions:

- Private keys: Secret codes that give access to a user's Bitcoin.

- Open-source: Software that anyone can inspect, modify, and improve.

The case of El Salvador

El Salvador's decision to adopt Bitcoin as legal tender demonstrates its transformative potential. By using Bitcoin, the country seeks to attract foreign investment and foster financial stability. Projects like Bitcoin Beach show how local economies can grow by adopting Bitcoin as a means of exchange.

However, global Bitcoin adoption faces obstacles such as ignorance, resistance to new technologies, and challenges in infrastructure. The path to a more inclusive financial system—where Bitcoin can help elevate developing nations—is long but promising. The decentralized and open-source nature of Bitcoin offers hope for a future where financial fairness is available to everyone.

Conclusion

In summary, Bitcoin holds immense promise for financial empowerment and inclusion, but significant challenges lie ahead. Staying engaged with the Bitcoin community, learning, and asking questions will be key to realizing a decentralized financial future. Through collaboration and advocacy, the vision of a fairer financial system for all can become a reality.

Cypherpunk movement and Austrian economics

Cypherpunk movement

The Cypherpunk movement emerged in the late 20th century, advocating for privacy and freedom through cryptography. Pioneers like Eric Hughes and Tim May believed that strong encryption was essential to protect personal freedom in a digital world. Their ideas heavily influenced the creation of Bitcoin.

Definition:

- Cypherpunk: A movement promoting privacy and freedom using cryptography.

Austrian economics

At the same time, Austrian Economics provided the foundation for Bitcoin's monetary principles. Economists like Ludwig von Mises and Friedrich Hayek argued that sound money should be scarce, durable, and a good store of value—core principles that shaped Bitcoin’s design.

Definition:

- Scarcity: Limited availability, creating value through the need for careful allocation.

Bitcoin's creation

Satoshi Nakamoto combined these ideas to create Bitcoin in 2008 as a decentralized, censorship-resistant digital currency. By merging Cypherpunk ideals of privacy with Austrian principles of sound money, Bitcoin offers a financial system that challenges traditional banks and government control.

Definition:

- Censorship-resistant: Money that cannot be controlled or blocked by external forces.

Key economic principles

- Scarcity: Bitcoin’s fixed supply ensures its value over time.

- Time preference: Encourages saving for the future rather than spending immediately.

- Saving: Storing value for future needs, which leads to investment and innovation.

Definitions:

- Time preference: Valuing present goods over future ones.

- Saving: Storing value for future use.

Bitcoin in El Salvador

El Salvador's adoption of Bitcoin reflects its potential as a tool for financial freedom, aligning with Austrian Economics by promoting voluntary adoption and decentralization. This move challenges traditional financial systems by addressing key issues: competition, monopoly, and confiscation.

Competition: Bitcoin introduces competition to the financial landscape by offering an alternative to traditional banking, allowing Salvadorans to bypass financial gatekeepers and choose services that better meet their needs.

Monopoly: By decentralizing financial access, Bitcoin breaks the monopoly of banks and government-issued currencies, reducing reliance on centralized institutions and fostering financial inclusion.

Confiscation: Bitcoin’s resistance to confiscation provides Salvadorans with control over their assets, protecting their wealth from external seizure and enhancing financial sovereignty.

El Salvador’s embrace of Bitcoin promotes a more inclusive, competitive, and secure financial system, challenging the limitations of traditional finance.

Conclusion

Bitcoin’s foundations in the Cypherpunk movement and Austrian Economics make it a unique and revolutionary form of money. Understanding these principles helps in grasping why Bitcoin was created and how it operates today. For further reading, consider The Bitcoin Standard by Saifedean Ammous.

Thank you for engaging with this material!

How Bitcoin

Bitcoin's technology stack

In the first lecture of the 'How Bitcoin' course, we began exploring the technology stack that underpins the Bitcoin network. We covered topics such as Hashcash, transactions, the blockchain, the Lightning Network, and other key components of the Bitcoin protocol.

Bitcoin's technological stack part 2

:::video id=752343b8-aa78-4bd3-9320-efe2a7e9d88f::: During the second lecture of 'How Bitcoin', we conducted a more in-depth examination of Bitcoin's technology stack.

Bitcoin structure

The origins of Bitcoin are based on several key innovations, starting with Adam Back's Hashcash, a proof-of-work (PoW) system designed to prevent email spam and denial-of-service attacks by requiring senders to complete computational tasks. This PoW concept became a cornerstone of Bitcoin's security.

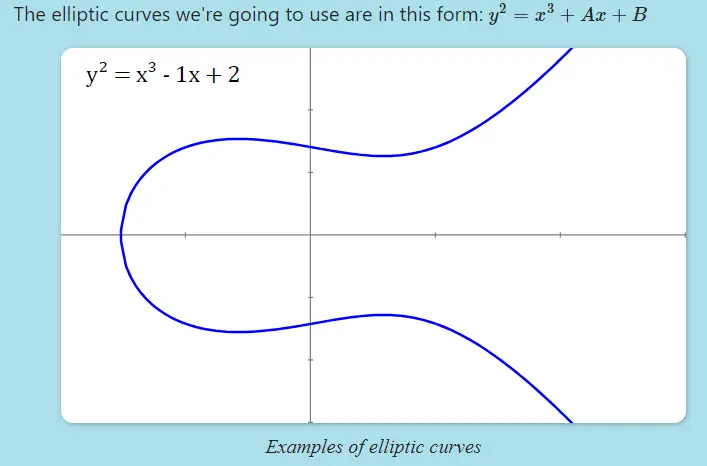

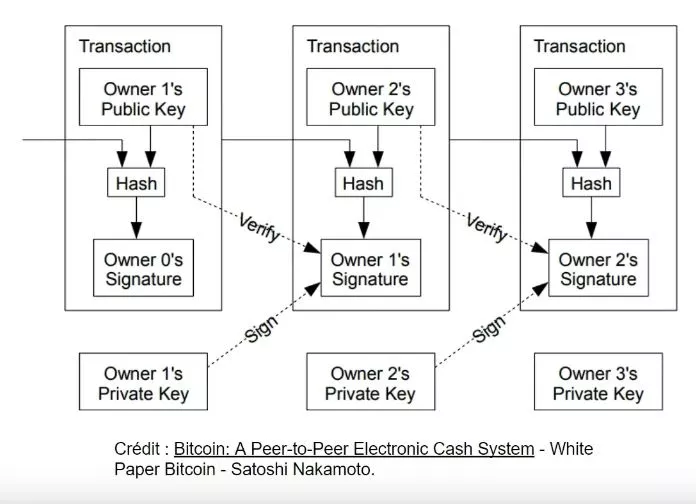

Bitcoin relies on digital signatures using elliptic curve cryptography to secure and verify transactions. The Elliptic Curve Digital Signature Algorithm (ECDSA) ensures that only the rightful owner of Bitcoin can authorize transactions without revealing their private keys.

Satoshi Nakamoto, Bitcoin's pseudonymous creator, expanded on these ideas by transitioning the PoW model to a decentralized blockchain. This allowed for a distributed network of nodes to validate and record transactions without a central authority, marking a significant evolution from previous digital currency attempts.

Definitions:

- Proof-of-Work (PoW): A system where participants must solve computational puzzles to validate transactions and secure the network.

- Elliptic Curve Cryptography: A cryptographic method that enables secure, efficient digital signatures.

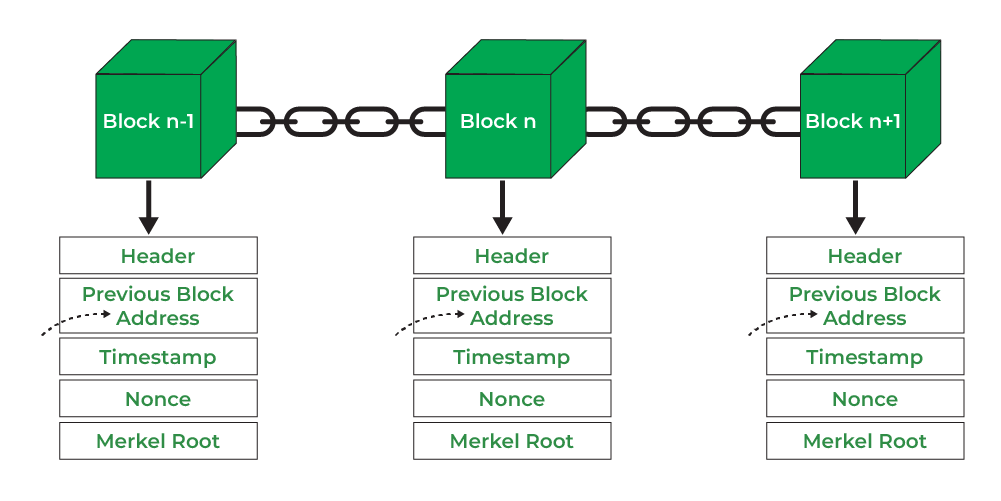

Blockchain mechanics and transaction validation

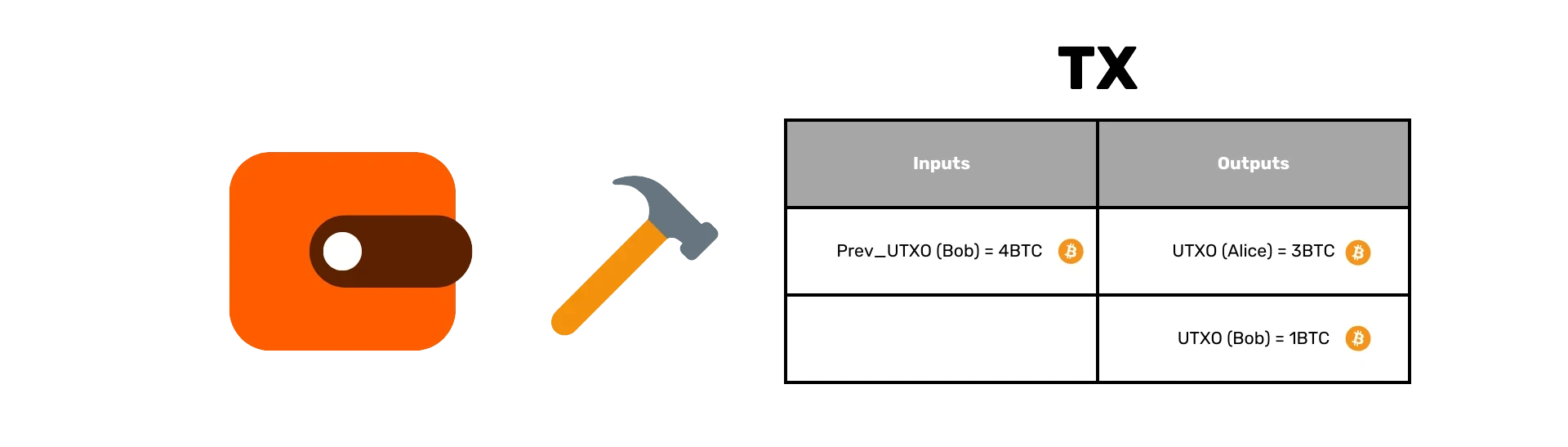

Bitcoin transactions are validated and added to blocks by miners, who compete to solve a cryptographic puzzle using the proof-of-work algorithm. This involves finding a hash with a specific number of leading zeros by adjusting a nonce value until the correct hash is discovered.

Each block in the blockchain consists of a header (with data like the previous block’s hash) and a list of transactions. The first block, known as the Genesis Block, is unique because it has no predecessor.

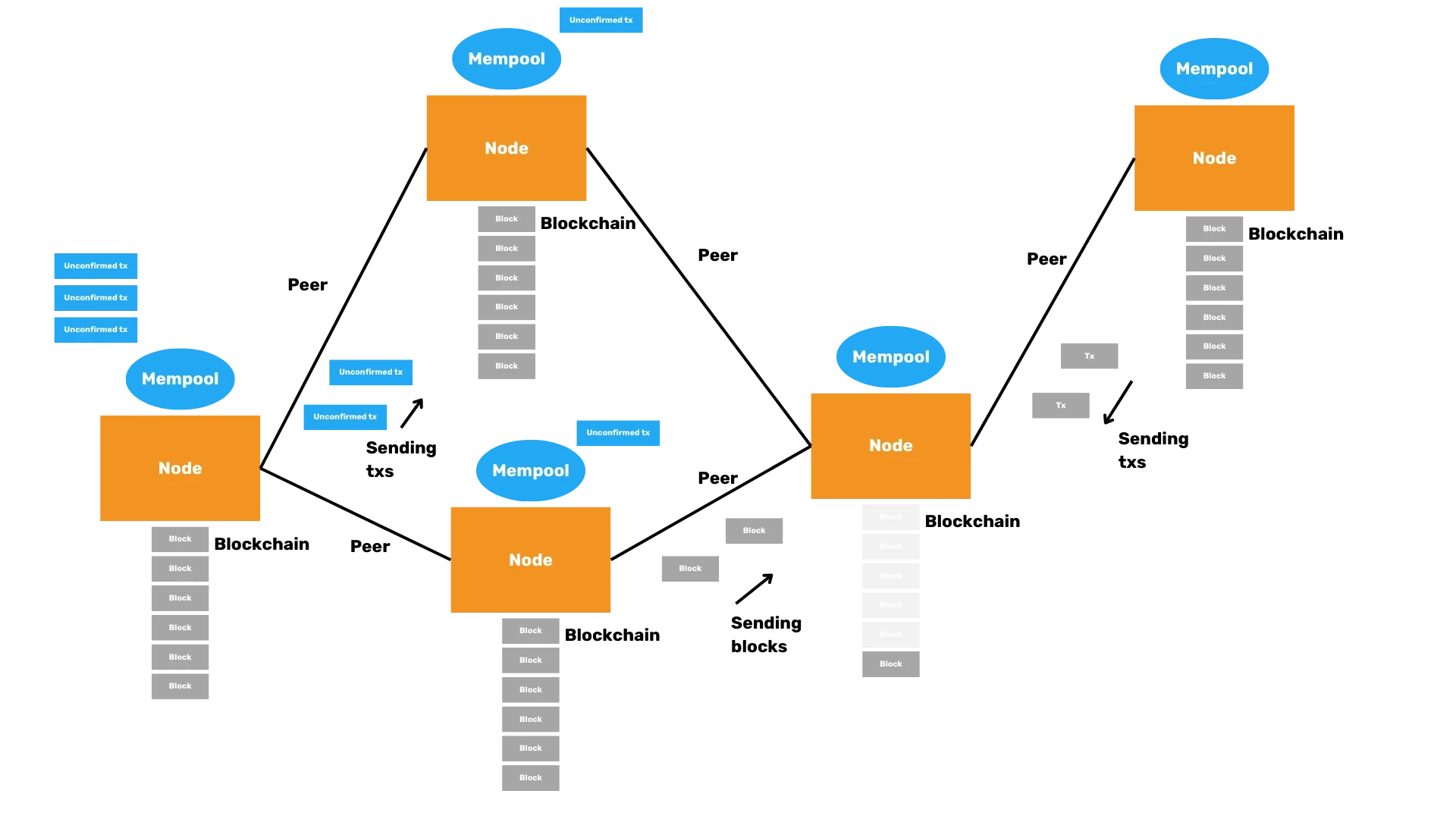

Before transactions are included in a block, they reside in the mempool, where they await validation. Once validated, these transactions are added to the newly mined block and then to the blockchain.

Definitions:

- Mining: The process of solving cryptographic puzzles to add new blocks to the blockchain.

- Nonce: A value used to find the correct hash during mining.

- Mempool: A waiting area for unconfirmed transactions before they are added to a block.

Scalability, privacy, and development in Bitcoin

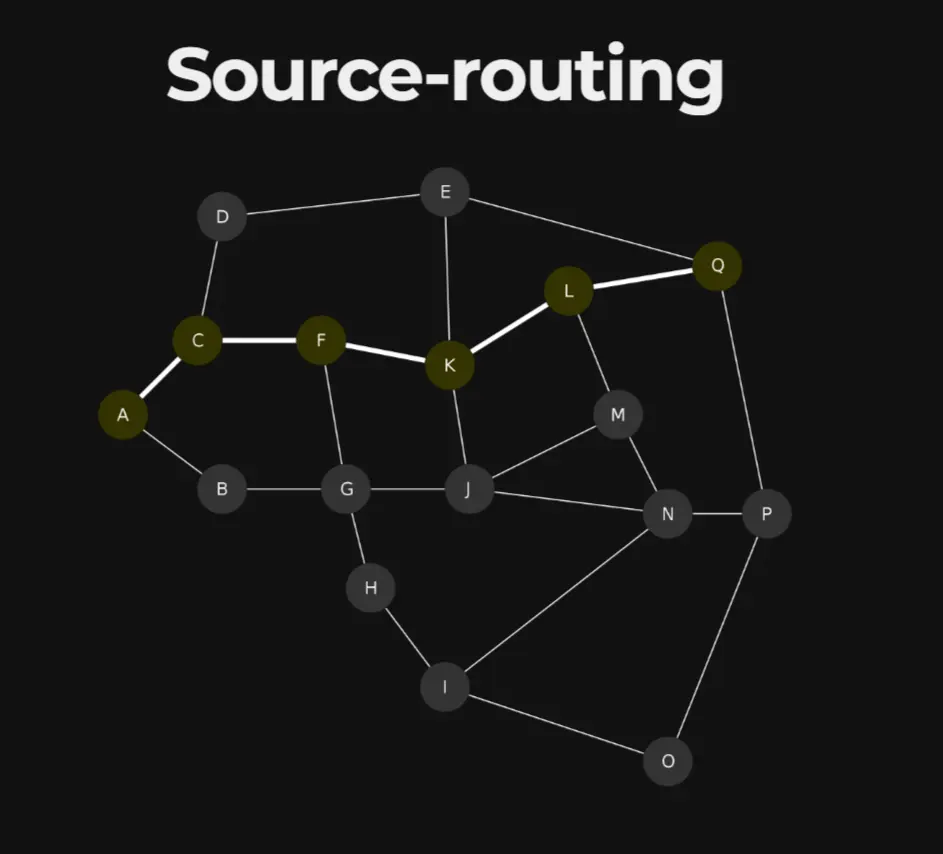

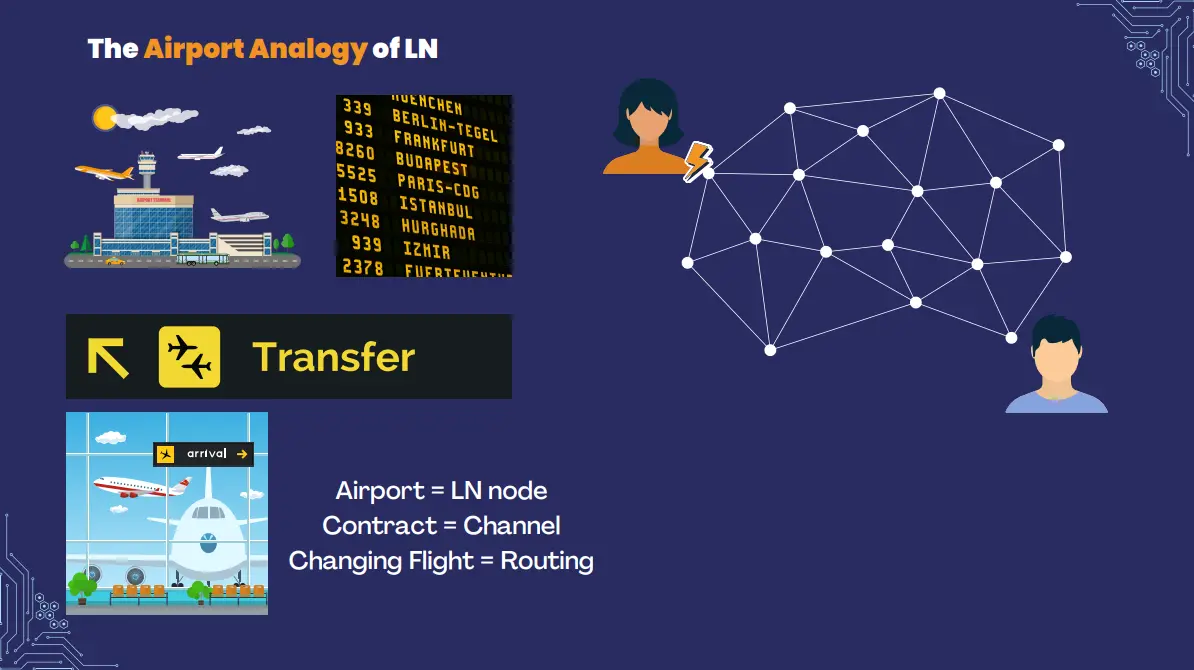

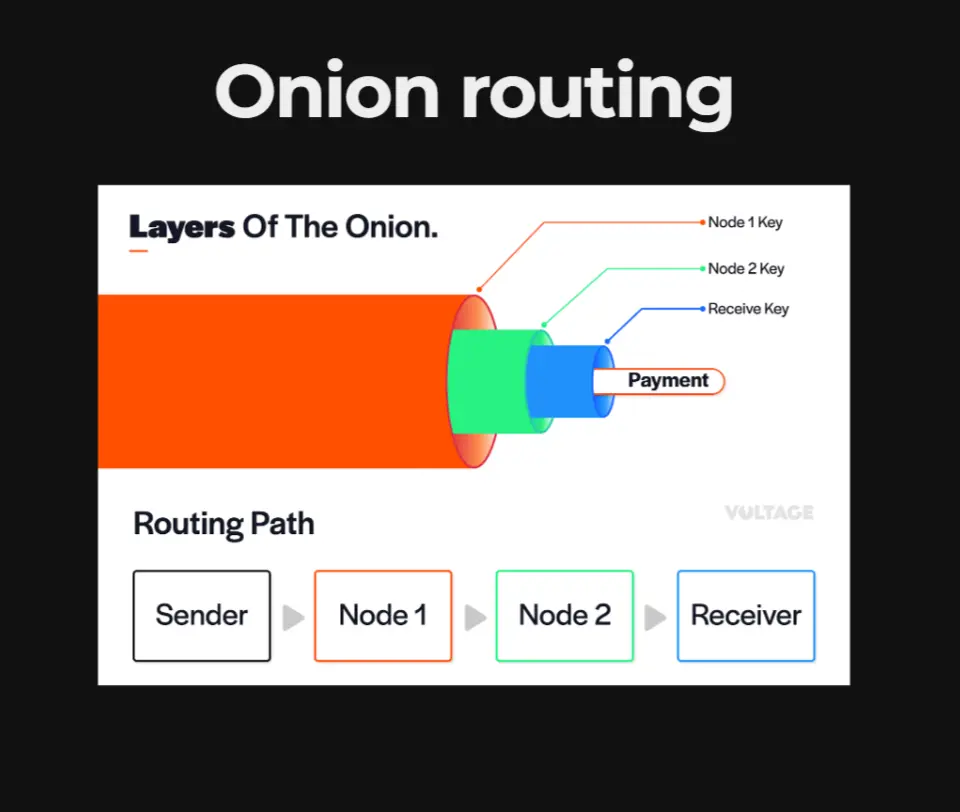

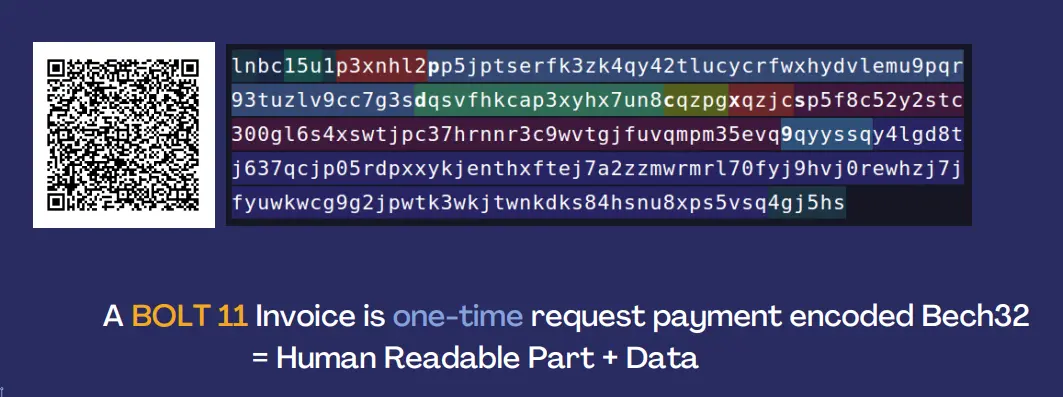

Bitcoin faces challenges related to scalability and privacy. The limited transaction capacity of the blockchain makes it difficult to handle high transaction volumes. Solutions like the Lightning Network address these challenges by enabling off-chain transactions through payment channels, which increase speed and privacy.

Running a full node is essential for ensuring decentralization and security, but Simplified Payment Verification (SPV) nodes allow lighter participation at the cost of some security.

Bitcoin development has evolved to improve performance and security. Major upgrades include Segregated Witness (SegWit), which addresses transaction malleability and increases the effective block size, and Taproot, which improves privacy and allows for more complex contracts using Merkleized Abstract Syntax Trees (MAST).

Definitions:

- SegWit: A Bitcoin upgrade that separates signature data from transaction data, improving efficiency.

- Taproot: An upgrade that enhances Bitcoin’s privacy and scalability by enabling more complex smart contracts.

- Lightning Network: A second-layer solution for faster, cheaper Bitcoin transactions using payment channels.

Conclusion

Bitcoin's structure and ongoing evolution showcase the innovation and adaptability of its technology. From Hashcash to a decentralized blockchain, and from SegWit to Taproot, Bitcoin continues to address challenges related to scalability, privacy, and security. The continuous efforts of the community ensure that Bitcoin remains resilient and decentralized while evolving to meet the demands of the future.

Debunk Bitcoin

Debunking Bitcoin

In this lecture, we debunk common myths surrounding Bitcoin, blockchains, and cryptocurrencies. Let's address misconceptions about Bitcoin's energy consumption, criminal usage, and the broader "FUD" (fear, uncertainty, doubt) spread about this technology.

Bitcoin vs. Blockchain

A frequent misconception is that Bitcoin and blockchain are the same. While Bitcoin is a digital currency, blockchain is the technology that powers it. Blockchains provide a verified record of transactions but come with trade-offs like slower speeds and higher costs, which solutions like the Lightning Network address.

Definitions:

- Blockchain: The underlying technology used to record transactions in a decentralized, immutable ledger.

- Lightning Network: A second-layer solution that improves Bitcoin's transaction efficiency by enabling off-chain transactions.

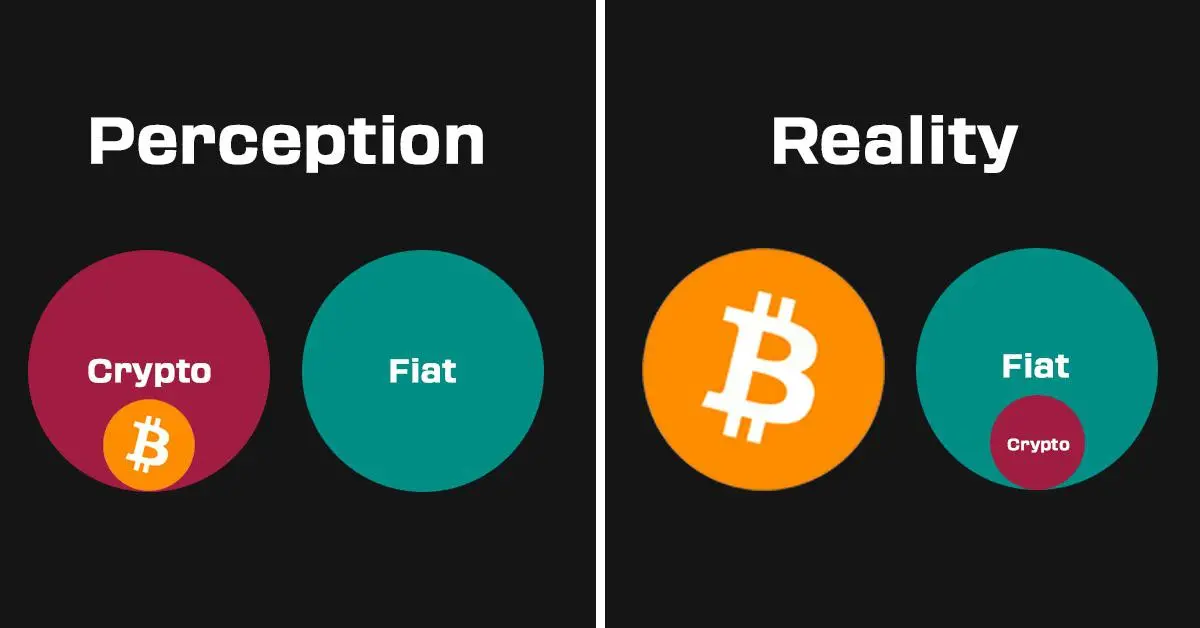

Bitcoin vs. Crypto

Another key distinction is that Bitcoin was created with the sole purpose of providing a decentralized, censorship-resistant form of money, free from control by any company or government. In contrast, cryptocurrencies shitcoins are often designed with centralized control, primarily existing to enrich the companies behind them through predatory practices, pump-and-dump schemes, or outright scams. These tokens typically serve no genuine purpose beyond making a quick profit for their creators at the expense of uninformed investors. Bitcoin, however, stands alone as the only truly decentralized digital currency with a proven track record of security and resilience.

Definitions:

- Shitcoins: Shitcoins are low-value or questionable quality cryptocurrencies that lack real utility. They are often highly speculative and are sometimes created for fraudulent purposes or without a clear purpose, taking advantage of the cryptocurrency market boom.

Energy consumption and environmental impact

One of the most common criticisms of Bitcoin is its energy consumption. While Bitcoin mining does use energy, it accounts for less than 1% of global electricity consumption and less than 3% of wasted energy. Moreover, Bitcoin mining often taps into unused or renewable energy sources, making it greener than often portrayed.

Definitions:

- Bitcoin Mining: The process of validating transactions and securing the network by solving cryptographic puzzles, which requires computational power.

Misconceptions about criminal usage

Bitcoin is often criticized for being used in criminal activities. However, blockchain analysis shows that only a small percentage of Bitcoin transactions are linked to crime. In reality, traditional financial systems see far more criminal use than Bitcoin.

Privacy and fungibility

Privacy and fungibility are essential features of Bitcoin. Privacy protects users in oppressive regimes, and fungibility ensures that every Bitcoin is equal, regardless of its history. This makes Bitcoin a reliable and fair form of money.

Definitions:

- Fungibility: The property of money where each unit is interchangeable with another, ensuring equal value.

Handling FUD and market dynamics

FUD surrounding Bitcoin often exaggerates concerns about its environmental impact, criminal usage, and security. While market fluctuations will occur, Bitcoin’s decentralized and sound technology provides a solid foundation for long-term stability and financial freedom, particularly in restrictive environments like Venezuela.

Conclusion

Understanding the realities of Bitcoin’s energy consumption, privacy features, and role in crime prevention helps dispel the myths surrounding it. By cutting through the FUD, we can appreciate Bitcoin’s potential as a revolutionary form of sound money that promotes privacy, security, and decentralization.

Running Bitcoin

5f638ec9-a6c1-5716-b27f-d837ab896eb1 e7e63d59-ea19-4960-9446-61bd4dcc98f0

Installation of Bitcoin Core

In the first lecture of the 4th module, we explored Bitcoin's architecture and the installation of a Bitcoin Core node.

Running a Bitcoin node

1. Introduction recap Welcome back! In the previous session, we covered the fundamental concepts behind Bitcoin’s architecture, including its cryptographic foundations and the peer-to-peer network structure. Today, we'll move from theory to practice by demonstrating how to install and configure a Bitcoin node.

2. Practical session overview In this session, Alekos will walk us through the process of setting up a Bitcoin node using a virtual machine. This hands-on tutorial is designed to familiarize you with the steps involved in configuring your node to participate in the Bitcoin network.

Running a Bitcoin node involves validating transactions and blocks, enforcing consensus rules, and supporting the network’s decentralization. Setting up a node ensures you have a direct connection to the Bitcoin network, allowing you to contribute to its security and integrity.

In this lecture, you will find a guide to install and run your own Bitcoin Core, learn how to prune the blockchain to save space, and begin experimenting with the software. Alekos will guide you step by step through this exciting process.

What you can do with Bitcoin Core and its benefits

By running Bitcoin Core, you gain the ability to:

- Validate your own transactions and blocks: Ensuring that the Bitcoin network's rules are followed without relying on third parties.

- Strengthen the network: By participating in the network, you help keep it decentralized, making Bitcoin more resilient to attacks.

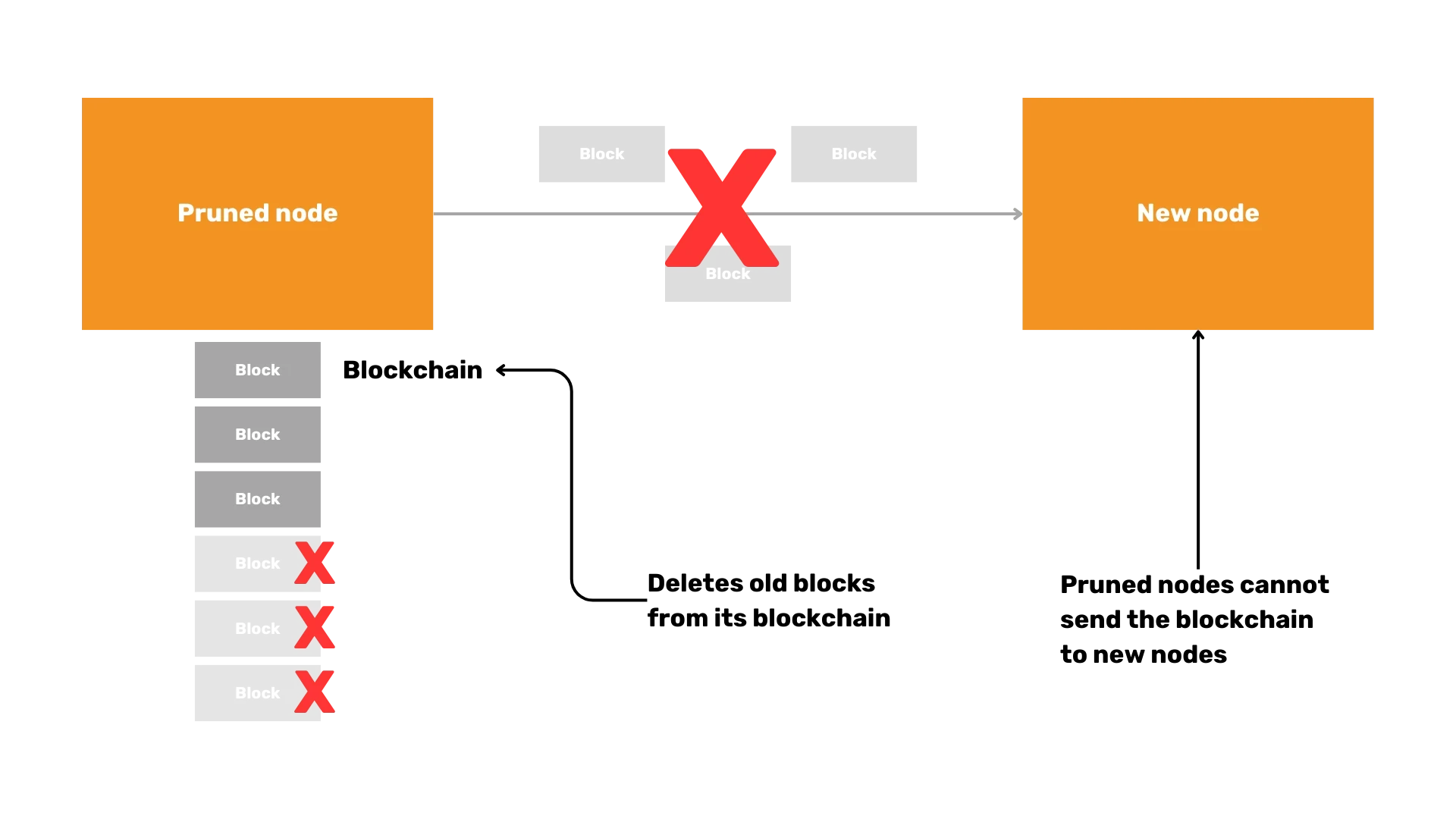

- Prune the blockchain: Reduce the storage requirements by keeping only the most recent transactions, which is ideal if you have limited disk space.

- Use advanced wallet features: Manage your Bitcoin with privacy and security, generate private keys offline, and sign transactions securely.

- Interact with the Bitcoin network directly: By using Bitcoin Core, you can connect directly to the network without intermediaries, ensuring you get the most accurate data.

- Benefit from increased privacy: As a full node operator, you don’t have to trust external services, protecting your transaction privacy from external surveillance.

The benefits of running a Bitcoin node are substantial for any dedicated Bitcoiner. Not only do you help secure the network and reinforce its decentralization, but you also enhance your privacy, ensure the integrity of your own transactions, and take a proactive role in the Bitcoin ecosystem. Running a node is a key step in achieving financial sovereignty and fully embracing the decentralized nature of Bitcoin.

Fundamental commands

These are some of the basic commands when configuring your node:

Check the status of the Bitcoin daemon:

sudo systemctl status bitcoindStart the Bitcoin daemon::

systemctl start bitcoindStop the Bitcoin daemon::

sudo systemctl stop bitcoind- Get detailed information:

bitcoin-cli getblockchaininfoPrune the blockchain to save disk space by keeping only the most recent blocks::

prune=550Enable the Bitcoin Core server and configure RPC settings::

server=1 rpcuser=yourusername rpcpassword=yourpasswordCheck the status of the Bitcoin daemon:

sudo systemctl status bitcoindCheck the balance of your Bitcoin wallet::

sudo systemctl status bitcoind

Installation of C-lightning

1. Bitcoin Core recap

Let's start with a brief recap of the steps involved in installing Bitcoin Core on a cloud VM, as this will be crucial for our subsequent setup of C-Lightning.

Reinstalling Bitcoin Core on a cloud VM To begin, you'll want to reinstall Bitcoin Core on your virtual machine. For this session, we'll skip the verification of binaries to save time, but remember that in a production environment, verifying binaries is a critical step to ensure security.

Download and verify file hashes First, download the latest Bitcoin Core release and verify the file hashes to ensure no tampering has occurred.

wget https://bitcoin.org/bin/bitcoin-core-22.0/bitcoin-22.0-x86_64-linux-gnu.tar.gz

sha256sum bitcoin-22.0-x86_64-linux-gnu.tar.gz

# Compare the output hash with the official hash

Install the binary and configure auto-start with systemd Next, install the binary and set it up to auto-start using systemd.

tar -xzf bitcoin-22.0-x86_64-linux-gnu.tar.gz

sudo install -m 0755 -o root -g root -t /usr/local/bin bitcoin-22.0/bin/*

Create a systemd service file:

sudo nano /etc/systemd/system/bitcoind.service

Add the following configuration:

[Unit]

Description=Bitcoin daemon

After=network.target

[Service]

ExecStart=/usr/local/bin/bitcoind -daemon

User=bitcoin

Group=bitcoin

Type=forking

PIDFile=/var/lib/bitcoind/bitcoind.pid

Restart=on-failure

[Install]

WantedBy=multi-user.target

Create and configure Bitcoin user and directories Create a dedicated user and set up directories for Bitcoin Core.

sudo adduser --disabled-login --gecos "" bitcoin

sudo mkdir -p /var/lib/bitcoind

sudo chown bitcoin:bitcoin /var/lib/bitcoind

Use minimal disk space by pruning the blockchain To save disk space, enable pruning in the configuration file.

sudo nano /var/lib/bitcoind/bitcoin.conf

Add the following lines:

prune=550

With these steps, you should have Bitcoin Core up and running with minimal disk usage, ready to interact with C-Lightning.

2. C-Lightning overview and installation

C-Lightning overview

C-Lightning, also known as Core-Lightning, is a Layer 2 protocol that facilitates faster and cheaper transactions using off-chain channels. It stands out due to its modular and developer-friendly architecture, which allows for extensive customization through plugins.

Importance of modularity and extensibility with plugins The modular design of C-Lightning means you can add or remove features as needed, enabling you to tailor the system to specific use-cases. Example use-cases include:

- Payment processing: Custom plugins can handle specific payment conditions.

- Routing fees: Adjust routing fees dynamically based on network conditions.

- Automation: Automate tasks like channel management and liquidity provisioning.

C-Lightning installation

Let's move on to installing C-Lightning.

Use the latest stable release For this lecture, we'll use the latest stable release, e.g., 22.11.1.

wget https://github.com/ElementsProject/lightning/releases/download/v22.11.1/clightning-v22.11.1.tar.gz

sha256sum clightning-v22.11.1.tar.gz

# Verify the hash against the provided hash

Verify integrity with GPG Keys Always verify the integrity of the downloaded file with GPG keys.

gpg --recv-keys <developer-key-id>

gpg --verify clightning-v22.11.1.tar.gz.asc clightning-v22.11.1.tar.gz

Install dependencies and compile from source code Install the necessary dependencies and compile C-Lightning from the source.

sudo apt-get update

sudo apt-get install -y autoconf automake build-essential git libtool libgmp-dev \

libsqlite3-dev python3 python3-mako net-tools zlib1g-dev

tar -xzf clightning-v22.11.1.tar.gz

cd clightning-v22.11.1

./configure

make

sudo make install

Configure the systemd service for auto-start Create a systemd service file for C-Lightning:

sudo nano /etc/systemd/system/lightningd.service

Add the following configuration:

[Unit]

Description=C-Lightning daemon

After=network.target bitcoind.service

[Service]

ExecStart=/usr/local/bin/lightningd

User=bitcoin

Group=bitcoin

Type=simple

Restart=on-failure

[Install]

WantedBy=multi-user.target

3. Configuration and setup

Create necessary directories and configuration files Create directories and configuration files required for C-Lightning.

sudo mkdir -p /var/lib/lightning

sudo chown bitcoin:bitcoin /var/lib/lightning

sudo -u bitcoin nano /var/lib/lightning/config

Add the following lines to the config file:

network=testnet

log-level=debug

plugin=/usr/local/libexec/c-lightning/plugins

Configure C-Lightning to connect with Bitcoin Core on testnet Ensure that C-Lightning can connect with Bitcoin Core by adding the following lines:

bitcoin-datadir=/var/lib/bitcoind

bitcoin-rpcuser=<rpcusername>

bitcoin-rpcpassword=<rpcpassword>

Ensure compatibility and synchronization Start the services and ensure they are compatible and synchronized.

sudo systemctl start bitcoind

sudo systemctl start lightningd

sudo systemctl enable bitcoind

sudo systemctl enable lightningd

Address file paths and permissions, especially for Tor integration Configure file paths and permissions to ensure smooth operation, especially if using Tor for privacy.

sudo apt-get install tor

sudo -u bitcoin nano /var/lib/lightning/config

Add the following for Tor integration:

proxy=127.0.0.1:9050

Backup HSM secret for fund recovery Backup the HSM secret for fund recovery.

sudo cp /var/lib/lightning/hsm_secret /path/to/secure/location

Test connections and validate node's operational status Finally, validate the operational status of your node by testing connections and ensuring everything works as expected.

lightning-cli getinfo

By following these steps, you will have a fully functional C-Lightning setup connected to your Bitcoin Core node, ready for testnet transactions.

Conclusion & questions

In conclusion, today we covered the essential steps for reinstalling Bitcoin Core, followed by a detailed walkthrough of installing and configuring C-Lightning. If you have any questions, please feel free to ask now or prepare them for further clarification in our next session. Remember, practical hands-on experience is crucial, so use the Testnet setup we discussed to gain more insights.

Security and hardware devices

Specter and Ledger device

Introduction

Welcome to our lecture on security and device setup for Bitcoin. Today's focus is on understanding the utilization of security tools, particularly the Specter desktop wallet and Ledger hardware wallet, and how to configure them effectively for enhanced Bitcoin security.

Tools: Specter desktop wallet and Ledger emulator

Specter is a desktop wallet designed to facilitate the creation and management of Bitcoin wallets, particularly those using hardware devices. For our demonstration, we'll employ a Ledger emulator, which mimics a Ledger hardware wallet's functionality.

Difference between Ledger device and company controversy

The Ledger device, a popular hardware wallet, is celebrated for its robust security. However, the company behind Ledger has faced scrutiny due to various controversies concerning user data privacy. Understanding the distinction between the physical device's security and the company's practices is crucial for informed usage.

Security models: importance of multi-sig wallets and diverse hardware

A key aspect of Bitcoin security is leveraging multi-signature (multi-sig) wallets. Multi-sig wallets require multiple private keys to authorize a transaction, significantly enhancing security. Additionally, using different types of hardware wallets diversifies risk and strengthens the security model.

Setup and configuration

Downloading and setting up Specter

The first step in our setup process involves downloading Specter from its official repository. It's crucial to verify the integrity of the download to avoid compromised software. Once downloaded, install Specter on your desktop and launch the application.

Configuring Specter to connect with Bitcoin Core or Electrum servers

To configure Specter, you need to connect it to a Bitcoin Core or Electrum server. These servers provide the necessary blockchain data for wallet operations. Configuration involves setting the server address in Specter's settings and ensuring a stable connection.

Explaining derivation paths and public key retrieval

Understanding derivation paths is essential for wallet management. Derivation paths define how keys are generated from a master key. In Specter, you can retrieve public keys by connecting your hardware wallet (or emulator) and navigating through the wallet interface. Ensure you document these paths for future reference.

Practical demonstration: Using Ledger Emulator

We'll now use a Ledger emulator to fetch keys. This involves connecting the emulator to Specter, navigating to the key management section, and selecting the appropriate keys for wallet creation.

Creating and managing wallets in Specter

Creating a wallet in Specter is straightforward. Access the wallet creation interface, input the necessary details, and include your retrieved public keys. Once created, you can manage the wallet, monitor transactions, and ensure robust security practices.

Receiving and monitoring transactions

After the wallet setup, receiving transactions is as simple as sharing your wallet address. Specter provides real-time monitoring of incoming transactions, ensuring you're always up-to-date on your wallet's status.

Advanced configurations

Setting up remote Specter daemon

For advanced users, setting up a remote Specter daemon can enhance accessibility and security. This involves configuring a remote server to run Specter's backend, allowing secure access from different devices.

Enabling Tor for privacy

To bolster privacy, configuring Specter to use Tor is highly recommended. Tor anonymizes your network traffic, protecting your IP address from potential surveillance. This is particularly important for users concerned about privacy and security.

Connecting to remote nodes securely

When connecting to remote nodes, ensure the connection is secure. This involves using SSL/TLS certificates and verifying the node's authenticity. Secure connections prevent man-in-the-middle attacks and ensure data integrity.

Debugging issues: practical techniques

Encountering issues is inevitable. Practical debugging involves checking user permissions, verifying data directory access, and consulting logs for errors. For example, ensure Specter has the necessary permissions to access the Bitcoin Core data directory to avoid operational disruptions.

Example issue: data directory access

A common issue is incorrect data directory access. Verify that the path to your Bitcoin Core data directory is correctly set in Specter's configuration. This ensures Specter has access to the necessary blockchain data for wallet operations.

Next steps and integration

As we conclude, the next steps involve integrating Specter with the Lightning network. This enables sending funds from Specter to a Lightning node, facilitating faster and cheaper transactions. Future lessons will cover this integration in detail, enhancing your Bitcoin transaction capabilities.

Block timing variability

Understanding block timing variability is crucial. Bitcoin blocks can be mined at varying intervals, affecting transaction confirmation times. This variability must be accounted for in all configurations and wallet operations.

Learning resources

For additional learning, consider resources like "Mastering the Lightning Network" and Rusty Russell's tutorials. These materials provide in-depth knowledge on Lightning nodes and advanced Bitcoin configurations.

Node installation and Tor security

Installing nodes, whether locally or remotely, benefits from using Tor for enhanced security. Running your own node ensures personal transaction validation, improving security and privacy.

Philosophy: self-sufficiency in learning

Embrace a philosophy of self-sufficiency. Practical skills and self-learning are paramount, often surpassing formal education's benefits. Engage in hands-on practices to deepen your understanding of Bitcoin security.

Privacy considerations

Maintain privacy by avoiding services that track or log transactions. Anonymity is crucial for secure Bitcoin operations, and careful service selection helps protect your identity and transaction history.

This concludes our lecture on security and device setup for Bitcoin using Specter and Ledger. Feel free to ask any questions or seek clarification on any points discussed.

Improving Bitcoin

Open problems in the Bitcoin ecosystem

Over more than a decade, Bitcoin has proven to be a transformative innovation in the financial world, successfully operating on a global scale and opening new possibilities in the digital economy. However, it still faces challenges that require creative and collaborative solutions. The ongoing evolution of Bitcoin presents a unique opportunity for those interested in shaping the future of decentralized finance.

Open problems in the Bitcoin usability

Bitcoin, despite its over-a-decade-long existence, still grapples with significant usability challenges. The tools and interfaces available to users often lack the maturity and user-friendliness found in more traditional financial systems. This is particularly evident in regions such as El Salvador, where Bitcoin adoption has been government-endorsed. The primary issue here is the need for better abstractions that can simplify the user experience, making Bitcoin accessible even to individuals with minimal technical know-how.

Open problems in scalability

Scalability has been a persistent problem in Bitcoin's development. The network's ability to handle a high volume of transactions remains limited, often leading to high on-chain fees that can exclude some users from participating. While solutions like the Lightning Network offer some relief by enabling off-chain transactions, they do not fully address the scalability concerns. The need for more comprehensive solutions that can handle growing transaction volumes without compromising the network's integrity is evident.

Open problems in security

Securing Bitcoin assets is a complex task, fraught with challenges. Hot wallets, which are often used for everyday transactions, pose significant security risks, especially for those who operate Lightning nodes. Additionally, planning for the inheritance of Bitcoin assets remains a convoluted and often insecure process. The complexity of these security measures can deter potential users and complicate widespread adoption.

Open problems in privacy

Privacy is another critical issue within the Bitcoin ecosystem. While privacy is essential for security, Bitcoin's current framework offers limited privacy features. On-chain transactions are easily traceable, posing a risk to user anonymity. Although the Lightning Network has the potential to enhance privacy, it still requires substantial improvements. The balance between transparency and privacy is delicate and demands innovative solutions to ensure user security and privacy.

Open problems in flexibility

Flexibility within the Bitcoin protocol is necessary to foster improvements in privacy, security, and scalability. However, too much flexibility can become a vulnerability, potentially serving as an attack vector and threatening the network's decentralization. Striking the right balance is crucial to maintain the integrity and resilience of the Bitcoin protocol.

Trade-offs in enhancing Bitcoin

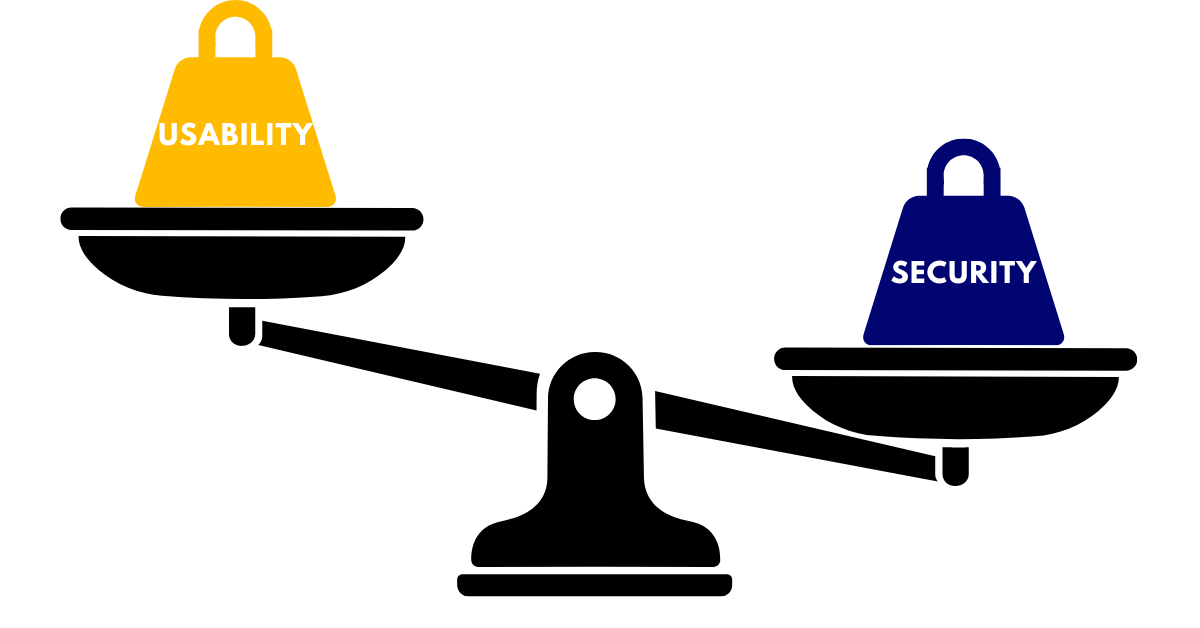

Usability vs. security and privacy

Efforts to enhance Bitcoin's usability often come at the expense of security and privacy. For instance, user-friendly custodial wallets, such as the Wallet of Satoshi, provide an accessible interface but compromise significantly on security and privacy. Simplified systems may increase usability but can lead to issues like address reuse, which undermines privacy. Therefore, any improvements in usability must be carefully weighed against potential security and privacy trade-offs.

Scalability and privacy trade-offs

Scalability and privacy are often at odds in the Bitcoin network. Enhancements that improve scalability, such as larger UTXOs or reduced cryptographic obfuscation, generally diminish privacy. Conversely, privacy-focused techniques like Monero's ring signatures enhance user anonymity but negatively impact scalability. Furthermore, the introduction of stateful contracts, as seen in Ethereum, offers increased flexibility at the cost of reduced security and scalability. Balancing these trade-offs is a complex challenge that requires meticulous consideration.

Privacy techniques

Different approaches to privacy in Bitcoin come with their own sets of trade-offs. Privacy by obfuscation, which involves adding more information to obscure relevant data, can enhance privacy but may complicate the network. Examples include Monero and Zcash. On the other hand, privacy by omission, which aims to reduce on-chain information, as seen in the Lightning Network, can improve both privacy and scalability. Each method has its advantages and drawbacks, necessitating a nuanced approach to privacy enhancements.

Consensus changes and challenges

Altering Bitcoin's consensus mechanism is a rare and challenging endeavor due to the network's decentralized nature. Proposals like ChISA (cross-input signature aggregation) and covenants aim to introduce more complex transaction rules, but their implementation is fraught with difficulties. Consensus changes require broad agreement within the community, and the coordination needed can lead to significant frustration and burnout if proposed changes are not accepted. This highlights the need for careful and collaborative efforts in protocol development.

Innovations and standards in Bitcoin development

Adhering to standardized practices in Bitcoin wallet development is crucial for ensuring ease of use and security. Many wallets currently do not follow established standards, leading to fragmentation and potential vulnerabilities. Standardization can significantly improve user experience and the overall security of Bitcoin transactions.

The traditional 12-word backup phrases, while effective for basic Bitcoin use, fall short in accommodating off-chain protocols like the Lightning Network. Future backup standards need to evolve to provide better security and usability for these advanced features, ensuring that users can safely manage their assets across different layers of the Bitcoin ecosystem.

Simplifying the payment process through unified protocols is essential for enhancing user experience. Existing protocols like BIP70, BIP78, and Payneem offer various solutions, but there is room for further innovation. A more streamlined and user-friendly payment protocol can facilitate broader adoption and ease of use.

The development of better tools and hardware is vital for improving Bitcoin's usability and security. Innovations like hardware wallets (e.g., Ledger and Trezor) offer robust security solutions but must continue to evolve to address emerging threats. Improved tools can make Bitcoin more accessible and secure for a wider audience.

Mitigating risks associated with hardware wallet distribution and ensuring their integrity is crucial. Supply chain attacks pose significant threats to the security of these devices. Implementing rigorous security measures and ensuring transparency in the production and distribution process can help mitigate these risks.

Simplifying user interactions with Bitcoin and the Lightning Network while maintaining security and efficiency is a key goal. Better UX abstractions can make Bitcoin more accessible to non-technical users, fostering broader adoption without compromising on security.

Creating educational materials to improve Bitcoin's usability, security, and privacy is impactful. Educating users on best practices and the underlying principles of Bitcoin can empower them to make informed decisions and enhance their overall experience with the network.

Layer 1 and layer 2 changes

Innovations at the base layer (Layer 1) are challenging but critical for the long-term evolution of Bitcoin. Layer 2 solutions, like the Lightning Network, allow for more experimental changes and can address scalability and privacy issues more flexibly. Both layers play a crucial role in Bitcoin's ongoing development.

Consensus coordination

Changes to Bitcoin's protocol require significant coordination and community consensus. The decentralized nature of Bitcoin makes this process inherently challenging. Effective coordination and clear communication are essential to navigate the complexities of protocol changes and ensure the successful adoption of improvements.

Scalability challenges

Achieving global consensus and managing complex secondary layers, such as the Lightning Network, present scalability challenges. These issues must be addressed to ensure Bitcoin can accommodate increasing transaction volumes while maintaining its core principles of security and decentralization.

In conclusion, continuously addressing these open problems and innovating within the Bitcoin ecosystem is crucial for its evolution. The balance between usability, security, privacy, and scalability requires careful consideration and collaborative efforts. By contributing to these developments, participants can help shape the future of Bitcoin and its role in the global financial landscape.

Bitcoin Fundamentals

Security Thinking in Bitcoin

0b97af0c-015a-54e3-a7f0-0f62ceb96c07 7dfc5865-a0f6-4c3b-9b05-83e0d807ac59

Welcome to today's lecture on Security and Reliability. Our objective is to explore the nuanced relationship between these two fundamental aspects of system design and application in real-world scenarios.

Introduction to security thinking

Security thinking is grounded in principles designed to protect systems from intentional attacks. It involves identifying potential threats and implementing measures to mitigate them. In contrast, reliability focuses on ensuring systems function correctly under specified conditions, accounting for probabilistic failures rather than deliberate attempts to breach security.

Relationship between security and reliability

While both security and reliability aim to maintain system integrity, their approaches differ significantly. Reliability engineering deals with the likelihood of system failures due to random events and often employs statistical methods to predict and mitigate these failures. On the other hand, security must consider the deliberate and intelligent nature of attacks, requiring a multi-layered defense strategy known as "defense in depth."

Security vs. reliability

A quintessential example of reliability engineering can be traced back to the 18th century with the construction of a bridge. The quality of steel used, including its composition and manufacturing process, critically influenced the bridge’s reliability. Engineers had to consider single points of failure and use probability and statistics to assess and ensure the bridge's dependability over time.

Unlike reliability, security deals with intentional threats. For instance, a 256-bit cryptographic key provides a mathematical guarantee of security due to the infeasibility of brute-forcing it. Security measures must account for different threat models, from physical tampering to sophisticated cyber-attacks.

Real-World applications

Consider the process of creating and storing Bitcoin keys using paper wallets. While paper wallets can be secure, they are susceptible to physical damage and tampering. Ensuring the integrity of such wallets requires tamper-evident methods and robust verification protocols.

In another scenario, imagine an airport pickup where a driver uses a secret code to authenticate the passenger. This simple yet effective security measure prevents imposters from deceiving both parties.

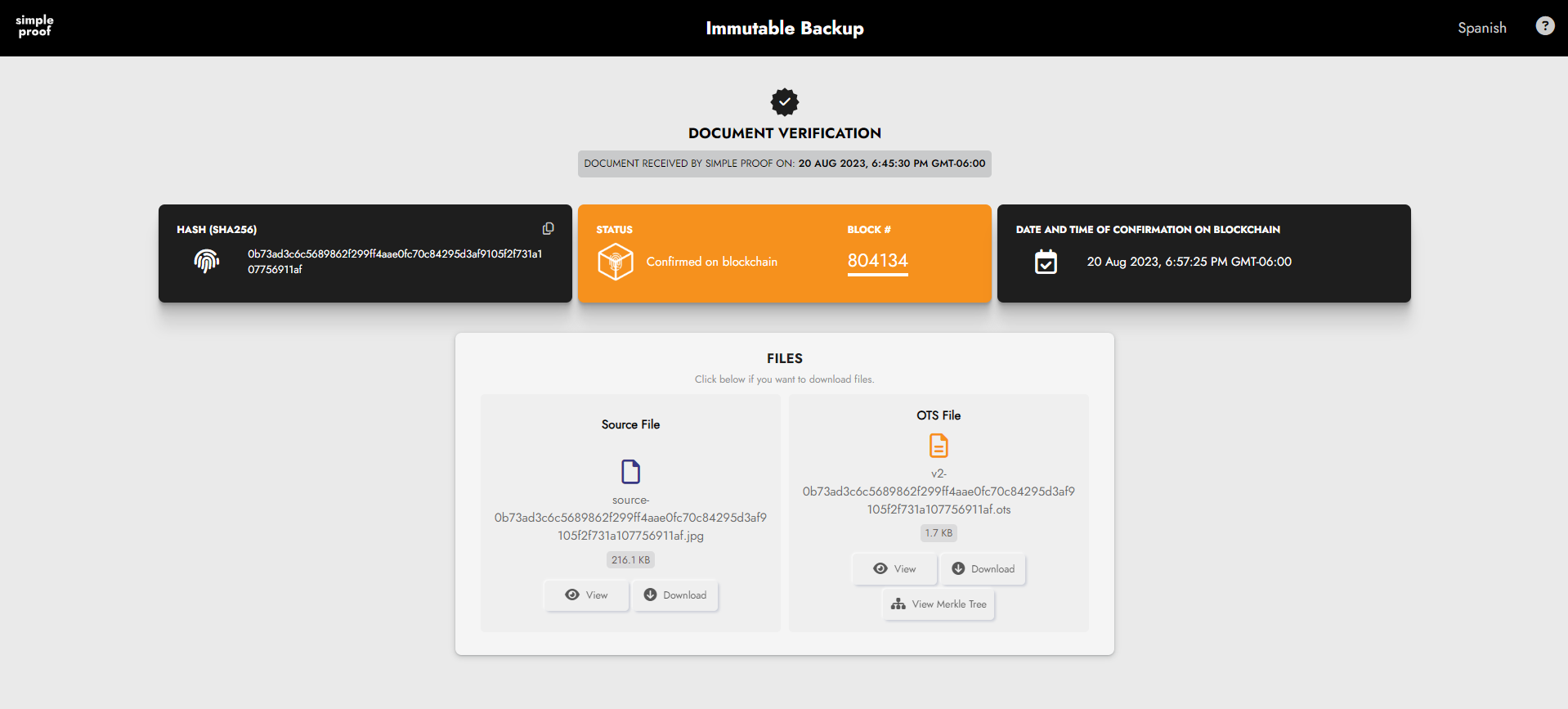

In Guatemala, timestamping election results played a critical role in ensuring the integrity of the electoral process. By using cryptographic methods to timestamp data, election officials could provide tamper-evident proof of the results' authenticity, deterring potential manipulators driven by significant financial incentives.

Identifying and mitigating potential threats

Threat modeling is the process of identifying potential security threats and creating strategies to mitigate them. This involves understanding the system's environment, identifying possible attackers, and developing secure protocols based on assumptions and probabilistic analysis.

Creating secure protocols

To safeguard elections, for instance, impartial oversight or cross-party monitoring can be implemented to ensure transparency and integrity. Cryptographic methods, such as timestamping and cross-verification, help in maintaining data authenticity and preventing tampering.

Trust verification

Trust verification can be illustrated with PGP (Pretty Good Privacy) verification. By verifying the fingerprints and signatures of PGP keys, users can establish the authenticity of digital identities. Similar practices are essential in verifying software integrity through hash matching (e.g., SHA-256).

Establishing trust pathways

Building trust is not instantaneous; it requires linking multiple trust pathways and ensuring redundancy. Using HTTPS and blockchain-backed certificate transparency, for instance, ensures the authenticity of web sources, making it difficult for attackers to breach trust.

Incentives for security

Understanding the role of incentives is crucial in maintaining security. For example, Bitcoin’s security model relies on miners' incentives and network participants' validation, highlighting the importance of economic incentives in safeguarding digital ecosystems.

Securing Bitcoin wallets

Strategies for securing Bitcoin wallets include multi-signature setups and diversified storage. These methods ensure that even if one component is compromised, the overall security remains intact.

Validation importance

Finally, user validation is critical in maintaining a secure network. Each user’s role in validating transactions and verifying software and hardware components helps preserve the network’s integrity and thwart potential threats.

In conclusion, comprehending and integrating security and reliability principles are essential in designing robust systems. By learning from historical examples, applying real-world strategies, and continuously validating trust, we can build systems that are both secure and reliable.

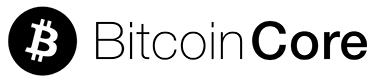

Free and Open Source Software (FLOSS) in Bitcoin

2c59d609-f1ef-53f4-9575-df62e4d066e9 7dfc5865-a0f6-4c3b-9b05-83e0d807ac59

The use of Free and Open Source Software (FLOSS) is critical in Bitcoin's ecosystem. Peter Todd explores the importance of FLOSS for Bitcoin, exploring the history of FLOSS and examining how Github allow us to collaboratively build open-source software like Bitcoin.

Nature and importance of software

Software, at its core, is a collection of code and data that instructs computing devices on how to perform specific tasks. Unlike hardware, which requires physical materials and manufacturing processes to replicate, software can be easily copied and distributed at virtually no cost. This fundamental difference plays a crucial role in the proliferation and development of software.

One of the key distinctions between software and hardware is the concept of open-source. While open-source hardware exists, it is not as prevalent due to the complexities involved in duplicating physical objects. In contrast, open-source software thrives because of the ease of replication and distribution. Open-source software allows anyone to view, modify, and distribute the code, fostering a collaborative environment that accelerates innovation and problem-solving.

The legal framework governing software primarily revolves around copyright laws. These laws grant the creator of the software exclusive rights to use, modify, and distribute their work. However, open-source licenses provide a mechanism to share these rights with the public, under specific conditions. This legal structure is essential in understanding the dynamics of software distribution and modification.

In summary, software's nature as easily replicable code and data, coupled with the legal mechanisms provided by open-source licenses, underscores its critical importance in the modern digital landscape. This framework not only drives innovation but also ensures that software can be freely shared and improved upon by the global community.

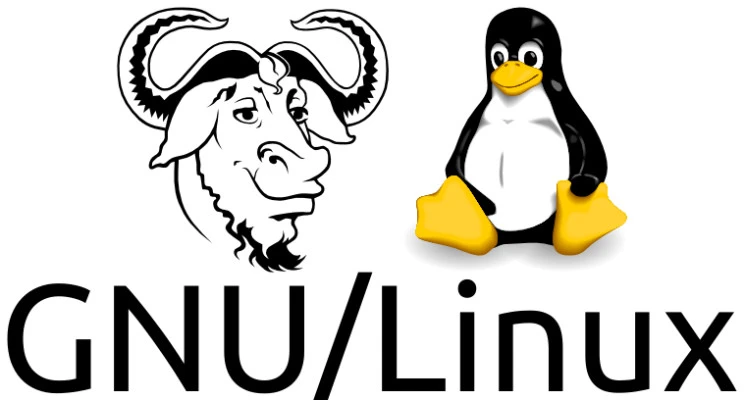

History of Free Software Movement

The Free Software Movement has its roots in the early 1980s, primarily driven by Richard Stallman's vision of software freedom. Frustrated by the restrictive nature of proprietary software, Stallman embarked on a mission to create software that users could freely use, modify, and share. This led to the founding of the Free Software Foundation (FSF) in 1985.

One of Stallman's significant contributions was the development of the GNU Project, aiming to create a free Unix-like operating system. GNU, which stands for "GNU's Not Unix," provided many essential components of a fully free operating system. However, it lacked a kernel, the core part of the operating system.

The gap was filled by Linus Torvalds' creation of the Linux kernel in 1991. Torvalds' kernel, combined with the GNU components, resulted in a fully functional free operating system known as GNU/Linux. This collaboration between Stallman's philosophical commitment to software freedom and Torvalds' practical contribution exemplifies the power of the open-source approach.

The Free Software Movement has profoundly impacted the software industry, promoting the idea that software should be free for all to use, modify, and share. Its principles have laid the foundation for many of the open-source projects and communities that thrive today.

Economics and funding in open source

Funding and sustaining open-source projects present unique challenges and opportunities. Unlike proprietary software, which generates revenue through sales and licensing fees, open-source projects often rely on alternative funding models.

One successful example is Bitcoin Core, a critical part of the Bitcoin infrastructure. Developers working on Bitcoin Core are often funded through grants, donations, and sponsorships from organizations that benefit from the project's success. This model allows developers to focus on improving the software without the constraints of traditional commercial funding.

Another prominent example is the Linux operating system. Many companies, such as IBM, Red Hat, and Intel, contribute to the development of Linux because their products and services depend on a robust and secure operating system. These companies provide financial support, contribute code, and offer resources to maintain and enhance the Linux ecosystem.

Open-source licenses, such as the MIT, GPL, and AGPL, also play a crucial role in the economic dynamics of open-source software. Permissive licenses like MIT allow for more flexible use of the code, including commercialization. In contrast, copyleft licenses like GPL ensure that any derivative work must also be open-source, fostering a collaborative environment.

In conclusion, the economics of open-source software are driven by community contributions, corporate sponsorships, and innovative funding models. These mechanisms ensure the sustainability and continuous improvement of open-source projects, benefiting both developers and users.

Cryptography in Bitcoin

71867dd2-912c-55ad-b59c-9dbca8a39469 6cfd206c-53b8-47a0-bbf4-44fd84e6ee1d

Welcome! Today, we will dive into the crucial aspects of cryptography that every Bitcoin developer should know. We'll focus on foundational concepts and practical applications without overwhelming you with excessive theoretical details. The primary goal is to equip you with the knowledge to understand, implement, and troubleshoot cryptographic mechanisms in Bitcoin effectively.

Core cryptographic concepts for Bitcoin developers

In this section, we’ll delve into the key cryptographic concepts essential for Bitcoin developers, including hash functions, Merkle trees, digital signatures, and elliptic curves.

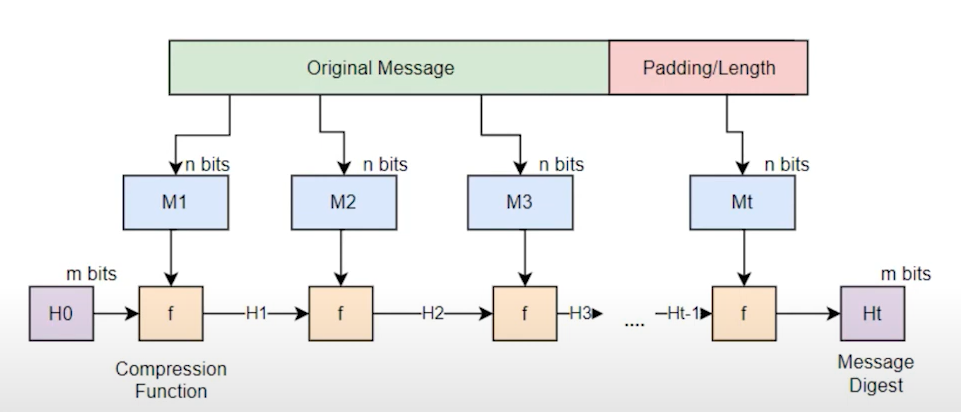

Hash functions: A hash function takes an input and produces a fixed-length string of bytes. In Bitcoin, hash functions are fundamental for data integrity and security. Cryptographic hash functions must be efficient, generate seemingly random outputs, and produce fixed-length outputs regardless of input size. They are used for file integrity checks, ensuring that data has not been altered maliciously.

Security properties: Cryptographic hash functions must adhere to several security properties. Pre-image resistance ensures that it is computationally infeasible to reverse-engineer the original input from the hash output. Second pre-image resistance means it should be difficult to find a different input that produces the same hash output. Collision resistance ensures that it is improbable to find two different inputs that yield the same hash output.

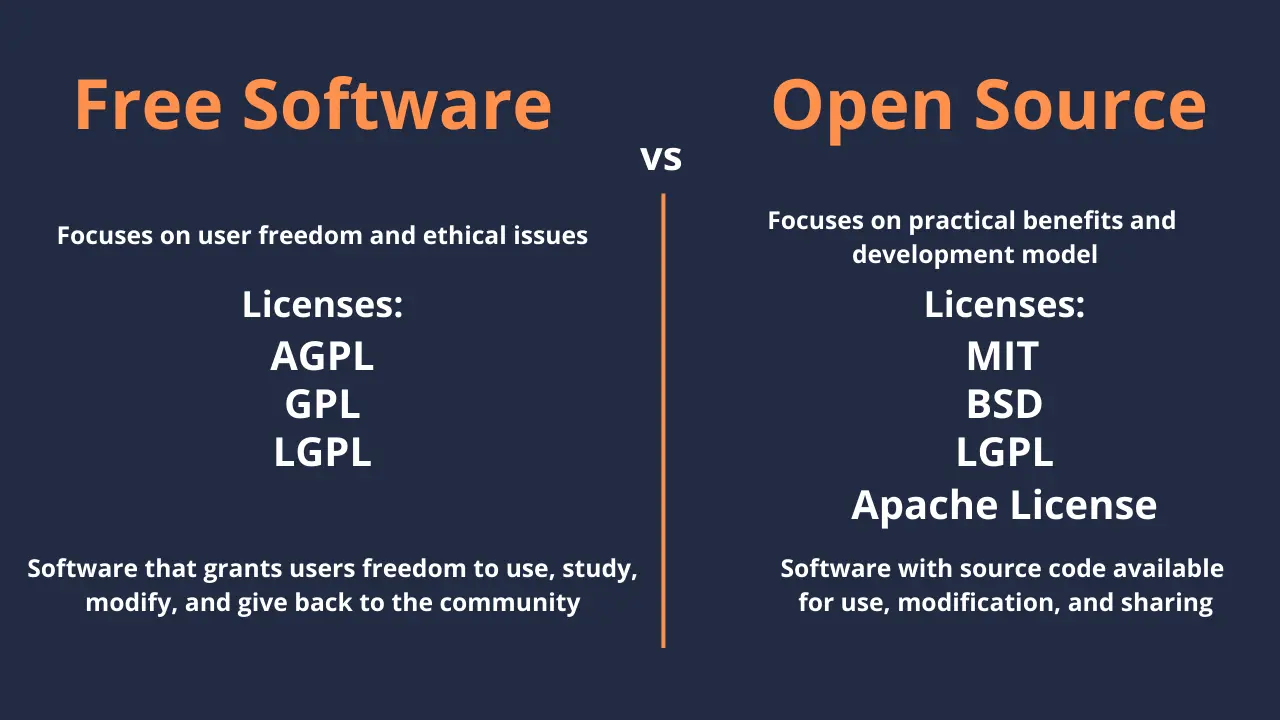

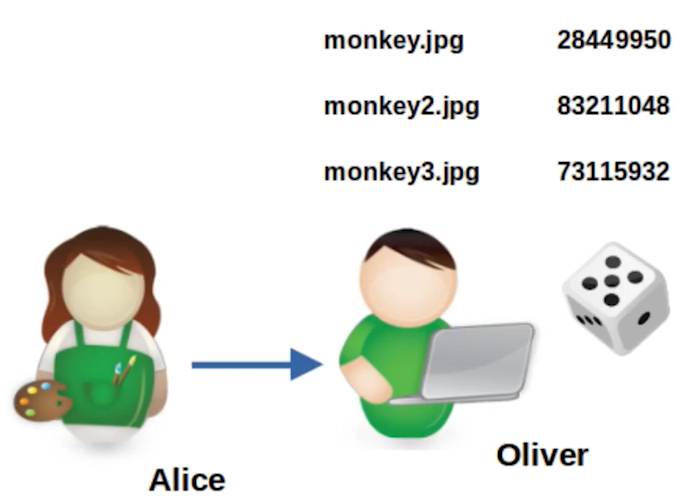

Merkle trees: A Merkle tree is a data structure that enables efficient and secure verification of large data sets. Data items are hashed in pairs, with the resulting hashes combined iteratively to form a single root hash. In Bitcoin, Merkle trees are crucial in block creation and transaction verification, particularly for Simplified Payment Verification (SPV) clients and in Taproot (Mast).

Digital signatures (ECDSA): The Elliptic Curve Digital Signature Algorithm (ECDSA) is used to ensure authenticity and integrity in Bitcoin transactions. It involves generating a signature using a private key that can be verified using the corresponding public key. Key concepts include understanding finite fields, discrete logarithms, and the importance of nonces.

Elliptic curves: Elliptic curves are used in public key cryptography due to their efficiency and security. The security of elliptic curve cryptography relies on the difficulty of solving the discrete logarithm problem.

Practical cryptographic applications and security practices in Bitcoin

In this section, we will explore the application of these concepts in real-world Bitcoin development and the best security practices to follow.

Cryptography = danger: Cryptography is a double-edged sword. While it protects against accidental data damage and malicious actions, incorrect implementation can lead to severe vulnerabilities. Developers must deeply understand cryptographic mechanisms to ensure both secure implementation and the ability to troubleshoot potential issues. For example, SHA-2's 256-bit output ensures preimage attacks require around 2^256 work, with collision resistance around 2^128 work.

Merkle tree applications: Understanding the logarithmic proof size and ensuring careful tree design is essential to avoid flaws, such as hash duplication in transaction verification. Merkle trees are used in block creation, transaction verification, and enhancements like Taproot.

Public key cryptography: Discrete logarithms and finite fields are fundamental in cryptographic calculations in Bitcoin. Challenge-response protocols are used to verify knowledge of a private key without revealing it.

Security implications: Historical examples show significant financial losses due to nonce reuse. Understanding the importance of generating unique nonces is crucial. Using trusted libraries like LibSecP256k1 ensures robust and secure cryptographic operations.

Elliptic Curve Cryptography (ECC): Signature schemes have evolved from identity protocols to schemes like Schnorr signatures, currently used in Bitcoin (BIP 340). Knowledge of elliptic curves and finite field arithmetic ensures secure cryptographic implementations.

General advice for developers: Cryptographic protocols must undergo thorough peer reviews. Developers must be precise and fully understand every step of cryptographic procedures. Awareness of common pitfalls in cryptographic implementations can prevent significant vulnerabilities.

Elliptic curves in cryptography: Key tweaking and security are important topics, such as modifying a public key using an additional private key while ensuring security. Bitcoin's specific elliptic curve, SECP256K1, and its parameters (P and N) are fundamental to its implementation.

Conclusion

In this lecture, we've explored the fundamental cryptographic concepts that underpin the security and functionality of Bitcoin. From the critical roles of hash functions, Merkle trees, and digital signatures to the intricate mathematics of elliptic curve cryptography, these elements form the backbone of Bitcoin's decentralized network. Understanding these concepts isn't just about grasping the theory—it's about recognizing the practical implications and potential pitfalls in real-world development.

As Bitcoin developers, it's essential to approach cryptographic implementations with caution and precision. The security of the Bitcoin network relies heavily on the correct and secure application of these cryptographic principles. Whether you're verifying transactions, designing new features, or ensuring the integrity of the blockchain, a deep knowledge of cryptography will enable you to build more robust, secure, and innovative solutions within the Bitcoin ecosystem.

By mastering these concepts and adhering to best practices, you'll be well-equipped to contribute effectively to the ongoing development of Bitcoin, ensuring its resilience and security for the future.

Bitcoin's Governance Model

a30ec3e7-b290-5145-a9a9-042224ab20d2 7dfc5865-a0f6-4c3b-9b05-83e0d807ac59

Nature of Bitcoin

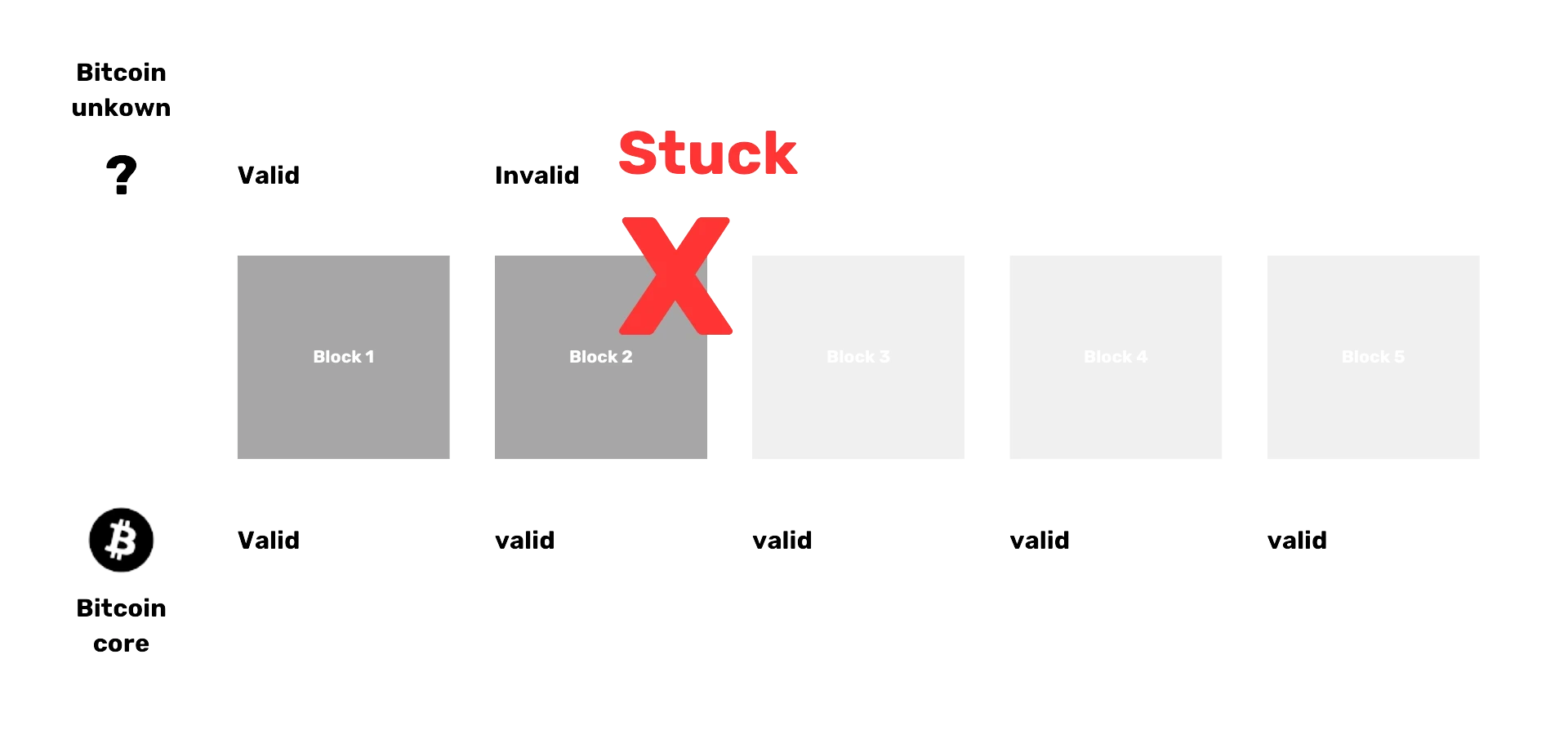

Bitcoin is a digital currency that operates on a consensus protocol, a set of rules agreed upon by the network participants to ensure uniformity and functionality. At its core, Bitcoin is a decentralized ledger known as a blockchain, where transactions are recorded and verified by network nodes. Full nodes, which store the entire history of the Bitcoin blockchain, play a crucial role in maintaining the integrity of this ledger. Other types of nodes, such as archival nodes, pruned nodes, and SPV (Simplified Payment Verification) nodes, also contribute to the network in various ways. The consensus protocol ensures that all these nodes agree on the state of the blockchain, making Bitcoin robust against censorship and fraud.

Preventing changes

Governance in Bitcoin is vital to prevent arbitrary or malicious changes to the protocol. This is achieved through a consensus mechanism that requires broad agreement among the community. Developers with programming knowledge play a significant role in proposing changes, but these changes must be accepted by the wider community to be implemented.

Bitcoin Core and alternate implementations have maintainers who oversee the development and upkeep of the software. These maintainers are responsible for merging code changes, ensuring that they adhere to the consensus rules and do not introduce vulnerabilities.

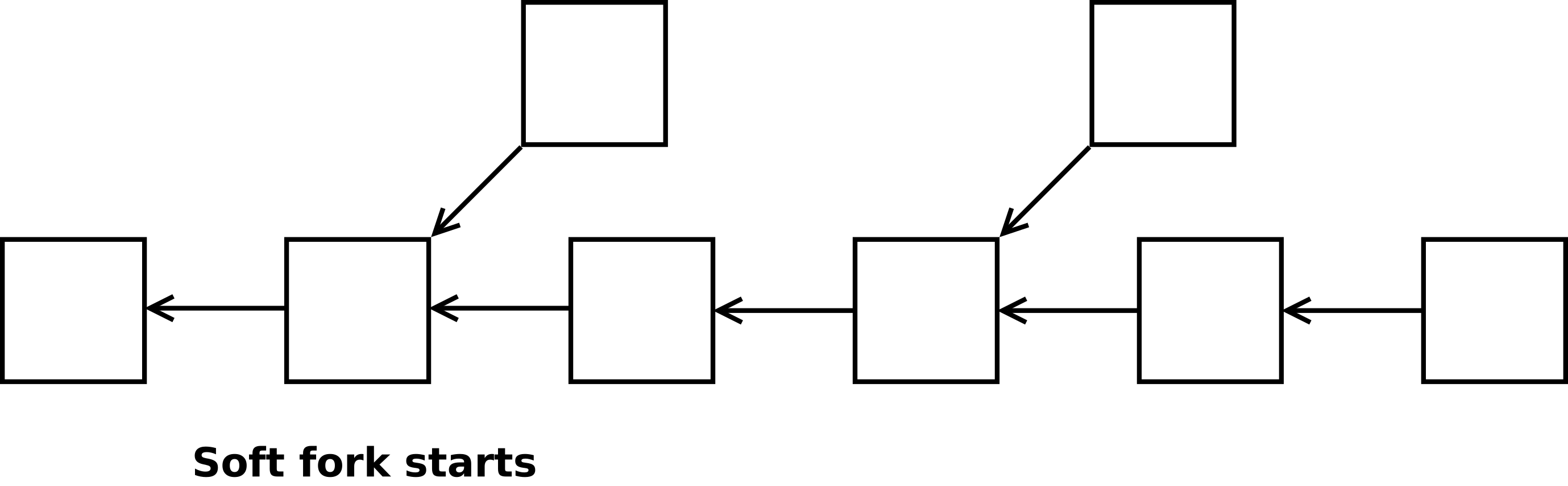

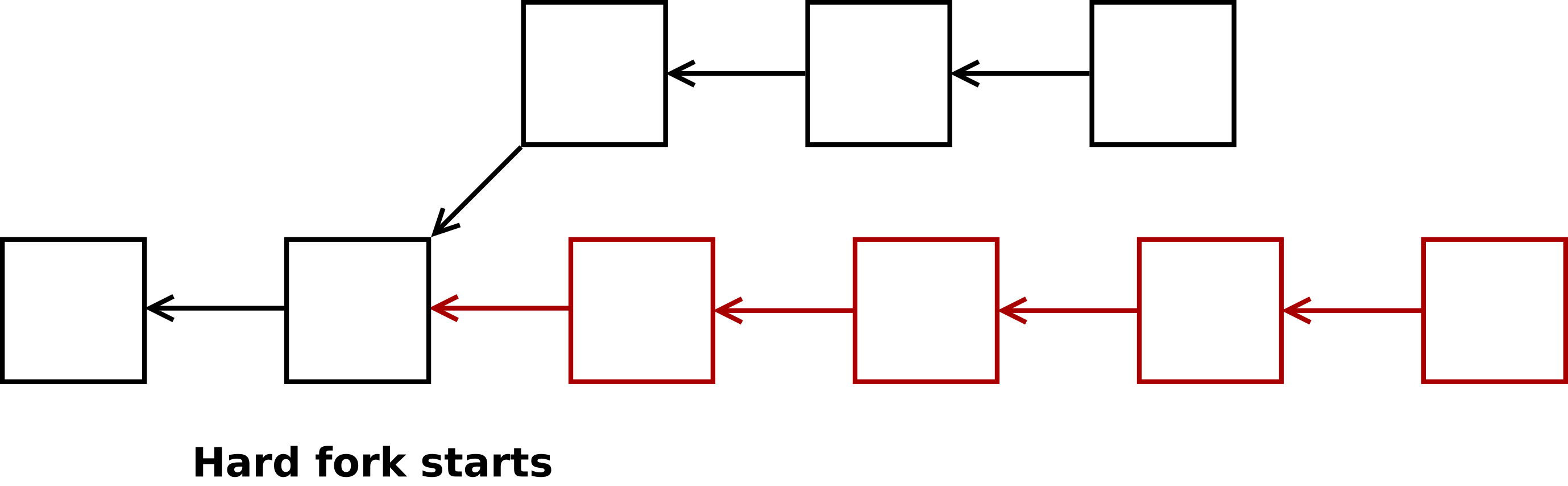

Soft forks vs hard forks

Soft forks are changes that tighten the existing rules of the Bitcoin protocol, making some previously valid transactions invalid. They are backward-compatible, meaning that non-upgraded nodes will still recognize the new rules. An example of a soft fork is the fix for the overflow bug in 2010, which prevented the creation of money out of thin air.

Hard forks are changes that loosen the existing rules, allowing new types of transactions. These are not backward-compatible, meaning that non-upgraded nodes will not recognize the new rules. An example of a hard fork might be needed for the Year 2106 problem to ensure Bitcoin continues functioning beyond this date.

Examples of governance

Several real-world examples illustrate Bitcoin's governance in action. The overflow bug fix in 2010 was a soft fork that addressed a critical flaw. The Year 2106 problem will likely require a hard fork to address its implications. The transition from the longest chain to the most work chain reflects a significant governance decision that affected how consensus is achieved.

Bitcoin's governance also addresses real-world changes in the protocol's usage. For instance, the introduction of ordinals and inscriptions illustrates how protocol changes can fail to censor transactions. Similarly, the implementation of Full RBF (Replace-By-Fee) altered transaction replacement procedures without changing consensus rules.

Motivations for change and consensus

Changes to Bitcoin can be driven by various motivations, such as fixing critical bugs, introducing new features, or limiting changes due to economic or political reasons. These motivations often lead to debates within the community about what constitutes a bug versus a feature and the overall impact on the network.

Bitcoin's consensus mechanism makes it inherently political, requiring broad agreement for changes to be accepted. This political aspect is crucial for maintaining the network's decentralized nature and ensuring that any modifications are in the community's best interest.

Running nodes can validate Bitcoin rules and participate in the network, even with different communication protocols like Blockstream Satellite. This highlights the separation between Bitcoin's consensus mechanism and the data communication methods used by the network. The economic significance of nodes, particularly those run by large entities like Binance, can influence the adoption of changes. These entities have substantial economic interests in the network and can sway decisions by running influential nodes.

Block size debate

The block size debate was a significant governance issue, revolving around whether to increase Bitcoin's block size. This controversy was resolved with the implementation of SegWit, a soft fork that increased the effective block size and enabled the Lightning Network.

Forced changes and majority rule

There have been legal attempts to compel Bitcoin developers to alter the blockchain rules for personal benefit, such as lawsuits by Craig Wright. These attempts highlight the challenges and ethical considerations involved in Bitcoin governance.

In Bitcoin, majority rule plays a vital role. If 60% of miners adopt a new rule, their blocks will be rejected by those running the original Bitcoin Core, leading to a split. An example of a failed hard fork due to lack of community support is Bitcoin Satoshi's Vision (BSV).

Let's briefly review some important concepts.

Forced soft fork: The concept of implementing restrictive rules to change Bitcoin can lead to further splits and governance issues. This approach illustrates the complexities and potential conflicts within the Bitcoin community.

51% attack: A 51% attack describes a scenario where a majority of hashing power could attack Bitcoin by mining empty blocks. This could effectively kill the network unless the community adopts new consensus rules to address the attack.

Check-Lock-Time-Verify (CLTV): Check-Lock-Time-Verify (CLTV) is an example of a governance change implemented as a soft fork. CLTV ensures that transactions are only valid after a certain time, which is useful for payment channels and backup keys. This change tightened the rules using an opcode that previously did nothing.

In conclusion, Bitcoin's future and changes are determined by the collective will of its users. Significant changes require broad consensus, reflecting the decentralized and political nature of Bitcoin's governance.

Layer One Concepts

Node Components in Bitcoin

75ea1d88-ee6f-5f98-af90-e4758c55e606 6cfd206c-53b8-47a0-bbf4-44fd84e6ee1d

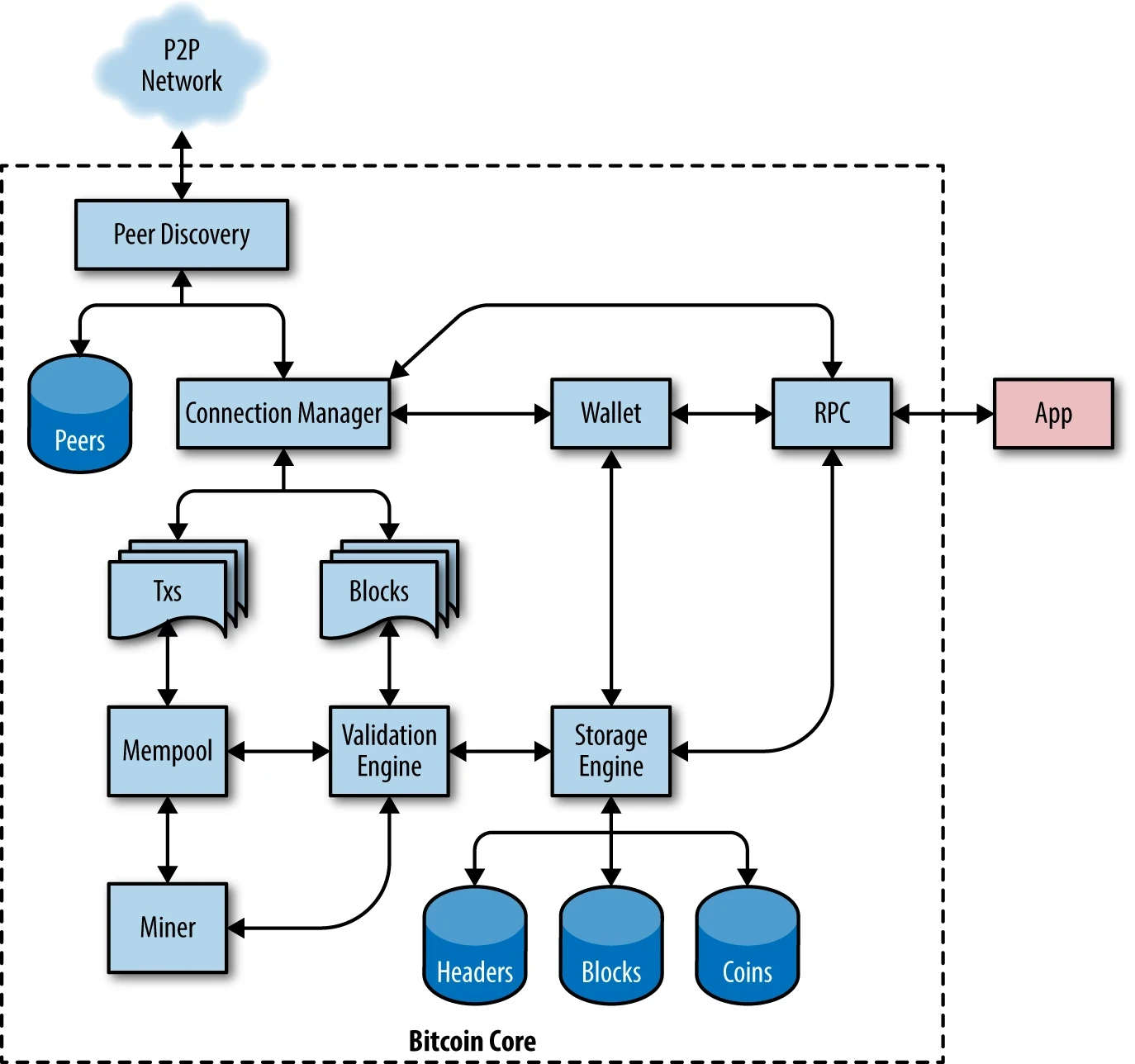

Adam Gibson breaks down the various components of a Bitcoin node. The chapter focuses on the role each component plays in maintaining the network's functionality and integrity. In particularly he focuses on why we should run a bitcoin node, what does a bitcoin node do, and how the different components of a bitcoin node function.

Introduction to Bitcoin nodes

Understanding the role of Bitcoin nodes is critical for anyone involved in the Bitcoin network. Running a Bitcoin node allows users to validate transactions, participate in consensus, and maintain control over their privacy. This lecture delves into why running a Bitcoin node is beneficial and how it contributes to the overall security and decentralization of the Bitcoin network.

Why run a Bitcoin node?

Running a Bitcoin node is essential for several reasons:

- Verification: By running a node, you can verify transactions yourself, ensuring that the Bitcoin you receive is valid without relying on third parties.

- Participation in consensus: Nodes play a crucial role in determining the rules of the Bitcoin network, thus participating in consensus helps maintain the integrity and security of the blockchain.

- Privacy and control: Running your own node ensures that you do not have to rely on external nodes, which could compromise your privacy by tracking your transactions and wallet balance.

What does a Bitcoin node do?

- Keeps a list of peers: Nodes must find and connect to other nodes in the network to exchange information.

- Receives and sends valid transactions and blocks: Bitcoin nodes are responsible for propagating valid transactions and blocks across the network.

- Keeps history of blocks and heaviest chain: Nodes store their own copy of the blockchain, which allows them to validate the authenticity of transactions and blocks.

- Maintains list of valid candidates; mempool: Nodes must keep a list of possible transaction candidates in the mempool to be included in blocks.

NOTE: The mempool is a temporary storage area for transactions that have been validated but not yet included on a block.

Node components

Bitcoin Core modules

- Peer discovery: Peer discovery is the process by which a node finds other nodes to connect to.

- Validation engine: The validation engine is responsible for checking the validity of transactions and blocks according to the network's rules.

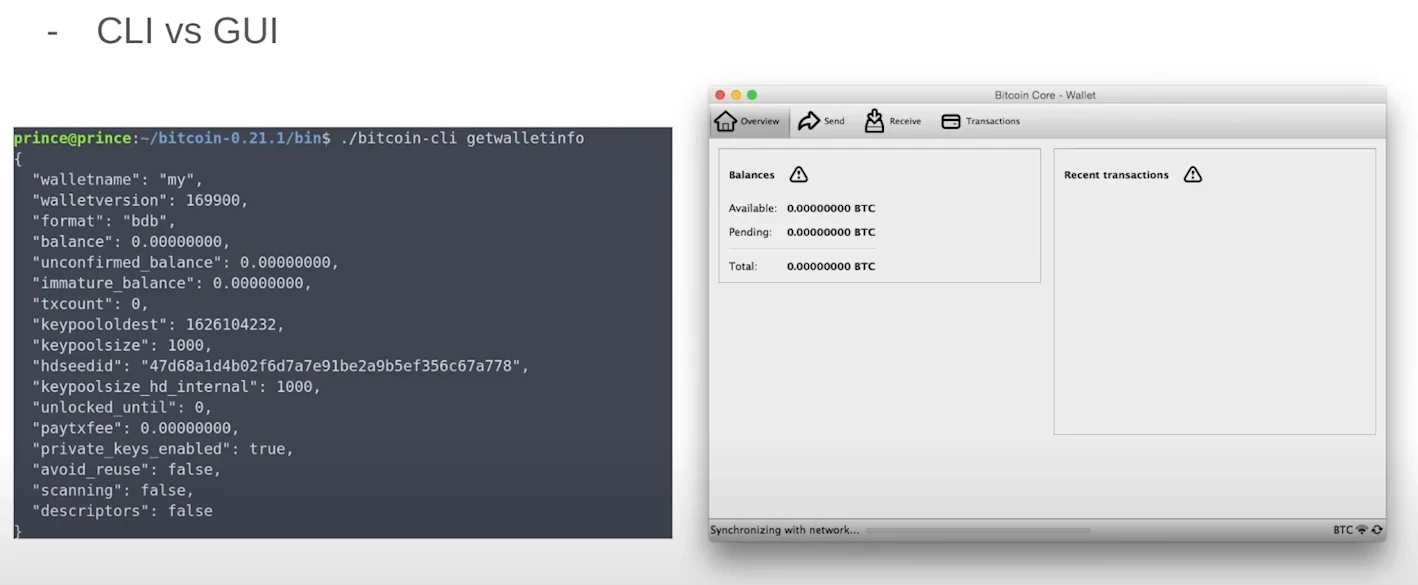

- RPC (Remote Procedure Call): Bitcoin Core includes an RPC interface that allows external applications, such as wallets, to interact with the node.

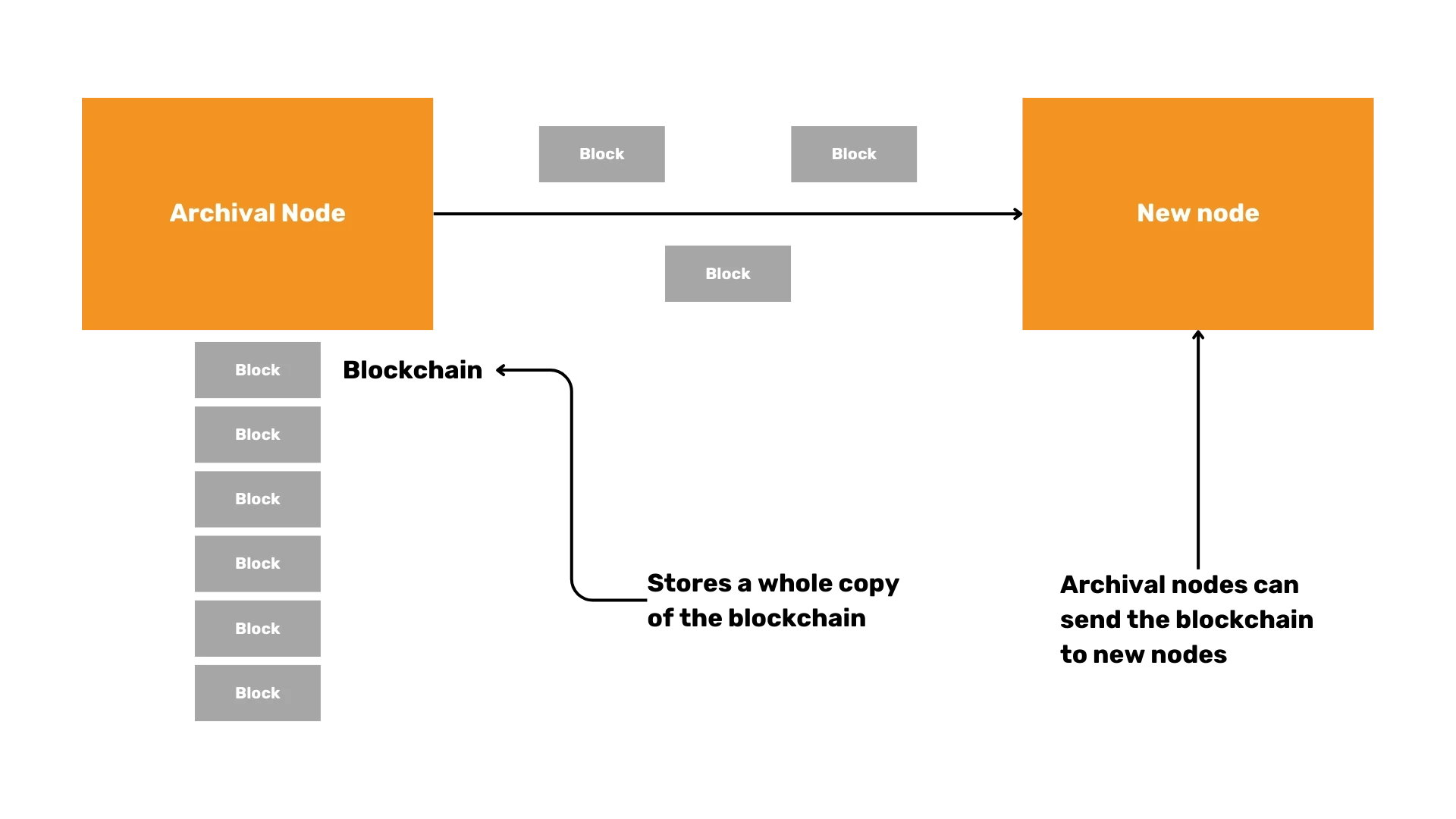

- Storing blocks and chain state: Bitcoin Core can store the whole Blockchain or not, whether it's an archival or pruned node. It also stores the current state of the network (The UTXO set) on disk.

What can we remove?

- Miner: Most Bitcoin nodes do not participate in mining due to the high computational power required.

- RPC (Server): Bitcoin Core implements a JSON-RPC interface that can be accessed using the command-line helper bitcoin-cli.

- Wallet (disablewallet): If you prefer to use an external wallet, you can disable the wallet functionality in Bitcoin Core. This allows you to manage your private keys separately.

- Mempool (blocksonly): For users looking to minimize bandwidth usage, running a "blocksonly" node can be a solution where the node only processes blocks, ignoring transactions.

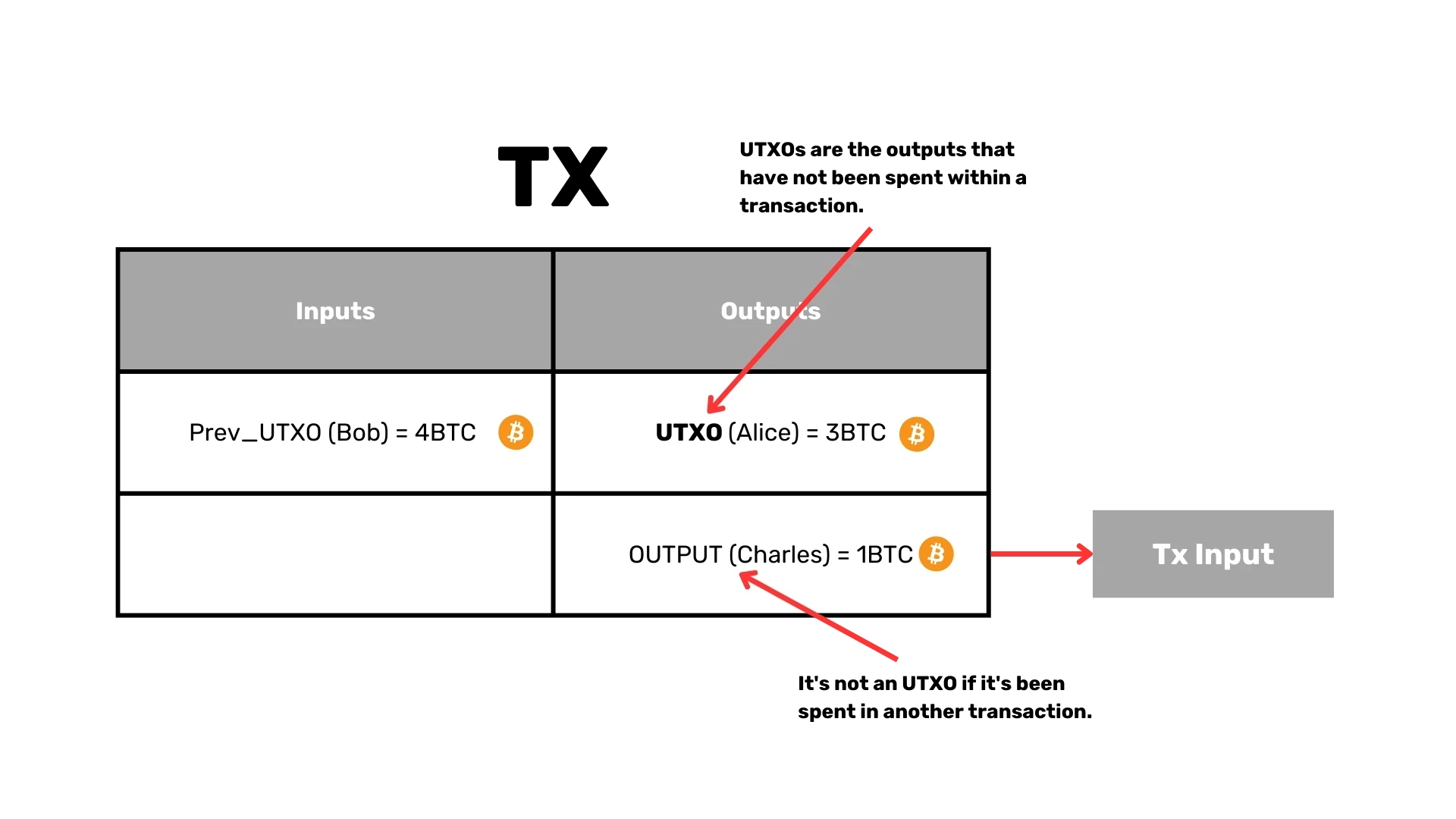

Chain State

Where are the coins?

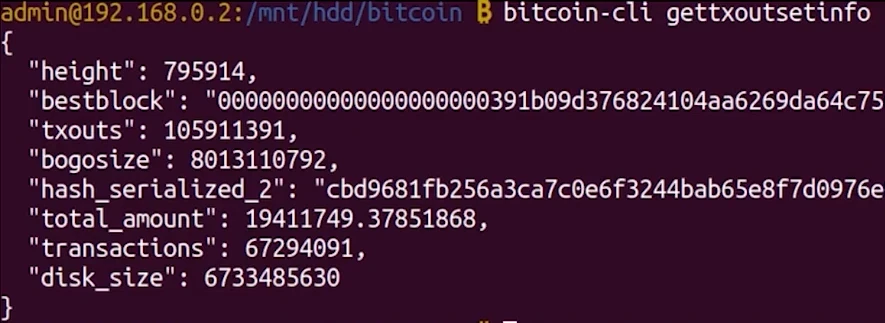

The coins are not stored in addresses; they reside in UTXOs, which represent all outputs of transactions that haven't been spent. You can retrieve this information with the command:

bitcoin-cli gettxoutsetinfo

We can audit that the number of Bitcoins is correct.

For each UTXO, chainstate has:

- Txid.

- Output index.

- Which block the UTXO is in.

- Whether it is a coinbase UTXO.

IMPORTANT: Transactions are not the same as UTXOs.

Mempool

It's a list of unconfirmed transactions in each node, which are called candidate transactions. Stored in RAM for quick access and it's not part of the consensus.

Security considerations for Bitcoin nodes

Security is paramount when running a Bitcoin node. Here are some key considerations to keep in mind:

Avoiding centralization

Relying on a single source for blockchain data, such as downloading all blocks from a central server, poses significant risks. To maintain the decentralized nature of Bitcoin, nodes should connect to multiple peers and validate the data they receive.

Preventing isolation attacks

Isolation attacks occur when a node is tricked into connecting to a limited set of peers, allowing an attacker to feed it incorrect data. By connecting to a diverse set of peers and verifying the data received, nodes can protect themselves against these attacks.

Managing peer connections

Nodes must carefully manage their peer connections to ensure they are not connecting to malicious actors. This includes maintaining a list of banned peers who have exhibited suspicious behavior and regularly updating the peer list to avoid relying on a small group of nodes.

Importance of the UTXO set

The UTXO set represents the current state of Bitcoin, listing all unspent transaction outputs. It is crucial for validating transactions and ensuring that coins are not spent more than once. Keeping this set small and easily accessible is important for maintaining the efficiency of the network.

Conclusion

Running a Bitcoin node is a powerful way to participate in the Bitcoin network, providing you with the ability to verify transactions, maintain privacy, and contribute to the security and decentralization of the blockchain. Whether you choose to run a full node or customize your setup by pruning the blockchain or disabling certain components, understanding the core functions and security considerations of a Bitcoin node will empower you to make informed decisions and contribute to the ongoing evolution of Bitcoin.

Bitcoin's Data Structures

5ed314b1-8293-567d-bf03-730e8c9c774b e7e63d59-ea19-4960-9446-61bd4dcc98f0

The primary goal of this lecture is to guide you through the process of parsing a Bitcoin block by coding a parser in Rust. This involves understanding the structure of Bitcoin blocks and transactions, and implementing the necessary logic to extract and interpret this data.

Parsing Bitcoin blocks and transactions in Rust

Components to parse

To parse a Bitcoin block, you'll need to focus on the following components:

- Block header

- Transactions within the block

- Transaction inputs and outputs

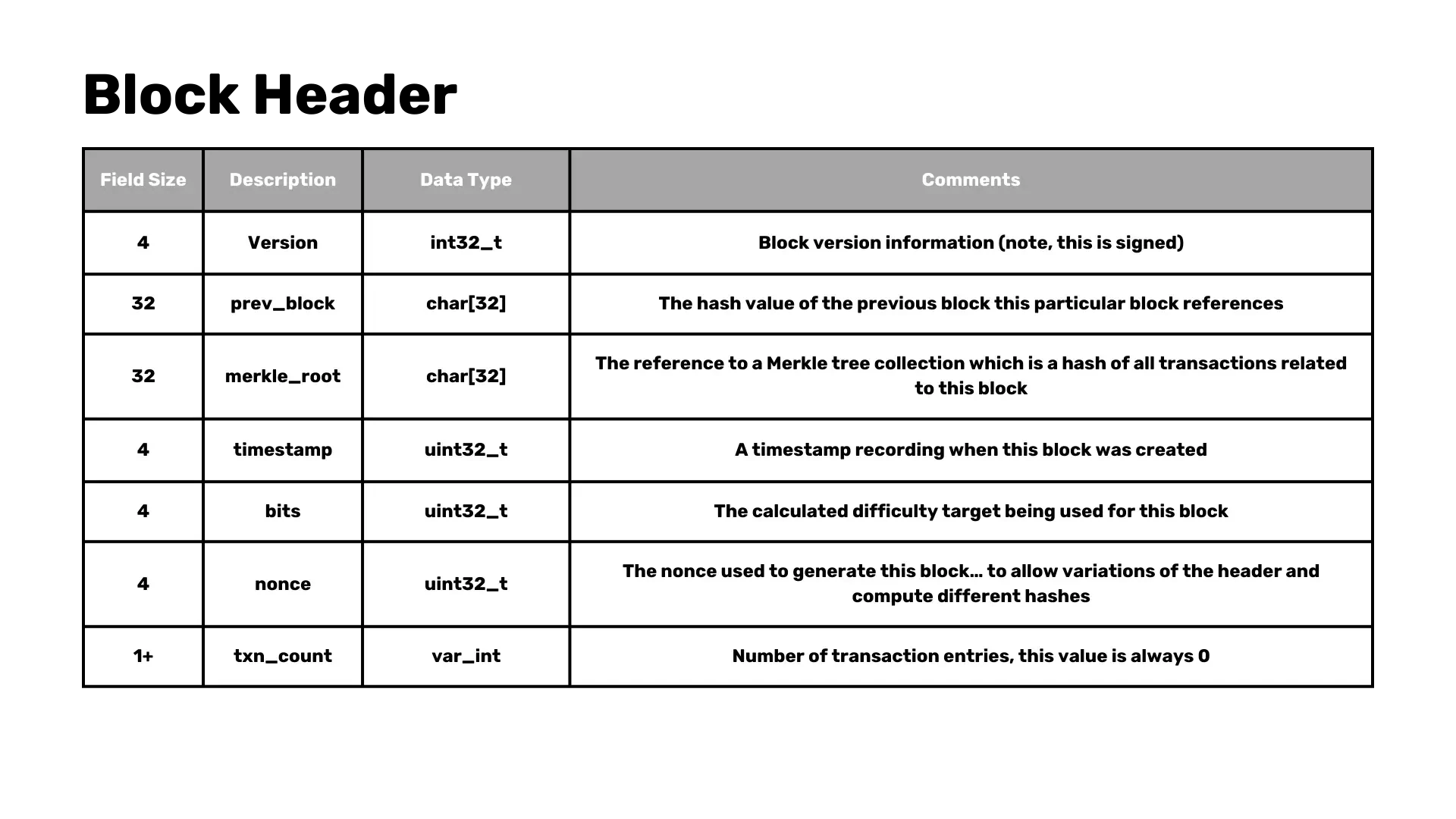

Block header structure

The block header is the cornerstone of a Bitcoin block and contains the following fields:

- Version: Indicates the version of the block.

- Previous block: Reference to the previous block in the blockchain.

- Merkle root: A hash representing the combined hash of all transactions in the block.

- Timestamp: The time at which the block was mined.

- Bits: The target threshold for a valid block hash.

- Nonce: The value that miners adjust to achieve a hash below the target threshold.

- Transaction count: The number of transactions in the block.

Note: Only the first 80 bytes (comprising the block header) are hashed during mining.

Simplifications

To keep our example manageable:

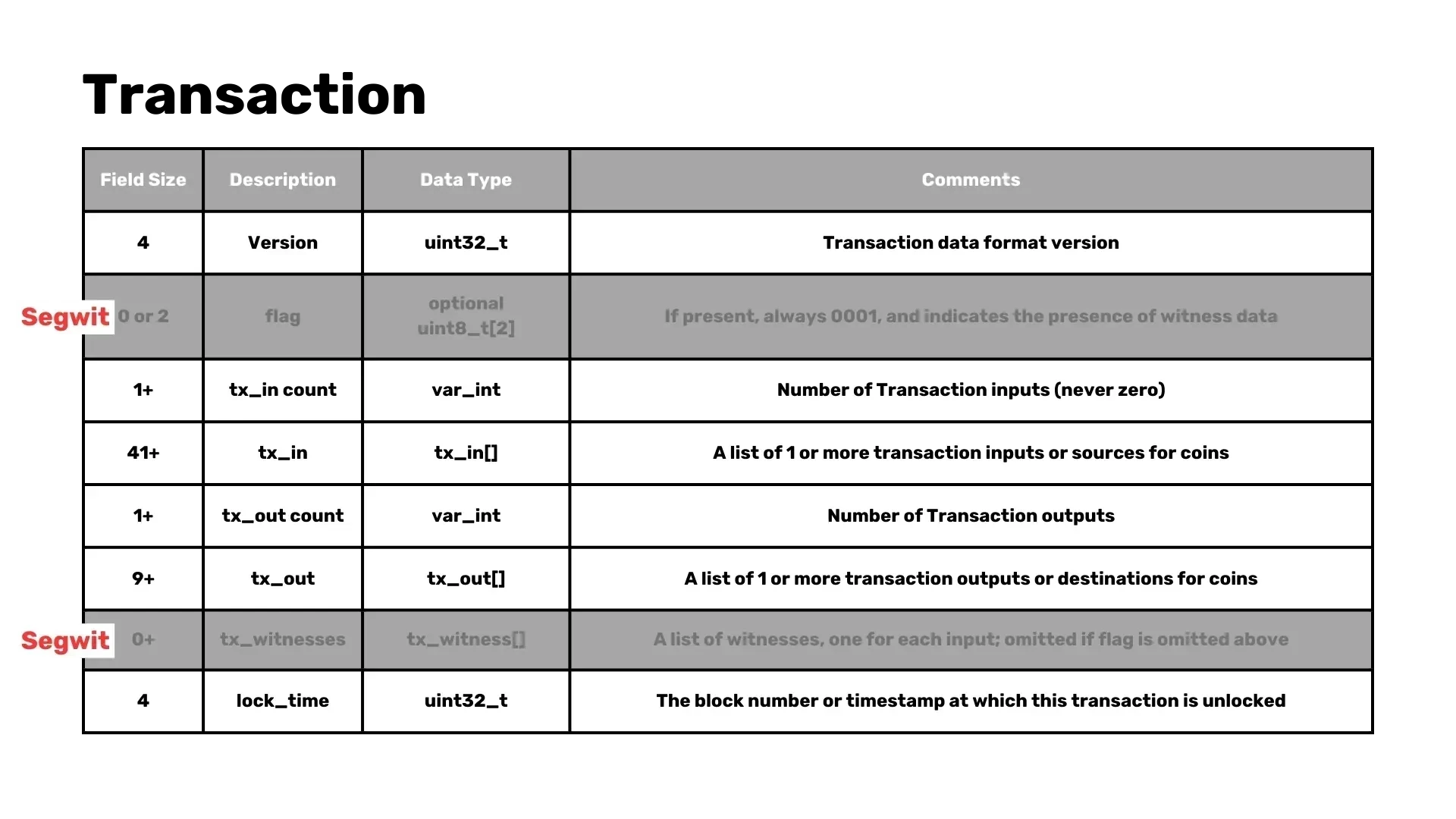

- We will focus on parsing pre-SegWit (legacy) blocks, avoiding the added complexity of Segregated Witness.

- We will skip certain opcodes in the Bitcoin scripting language, focusing on a few that we need to parse a full block.

Transaction structure

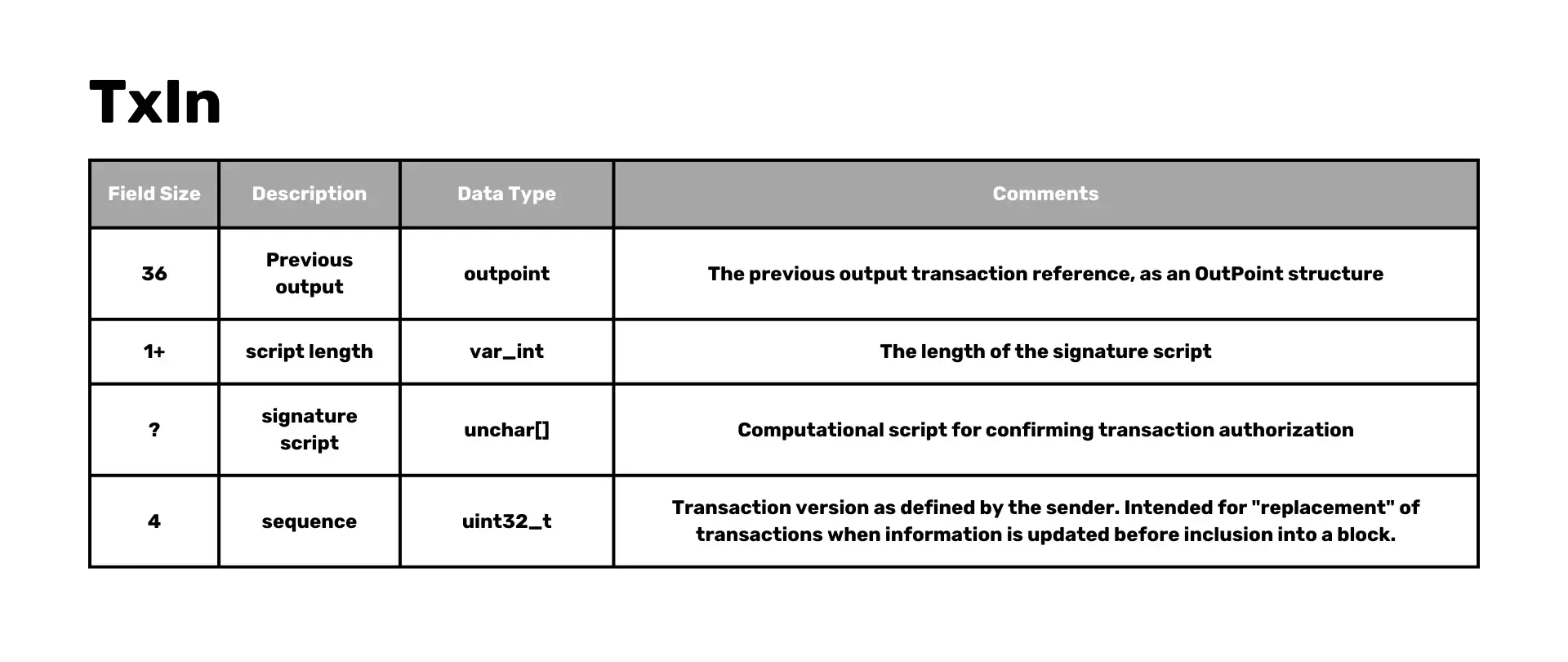

Each transaction in a Bitcoin block contains the following:

- Version: The version of the transaction.

- Number of inputs: Count of transaction inputs.

- Inputs: The list of the inputs.

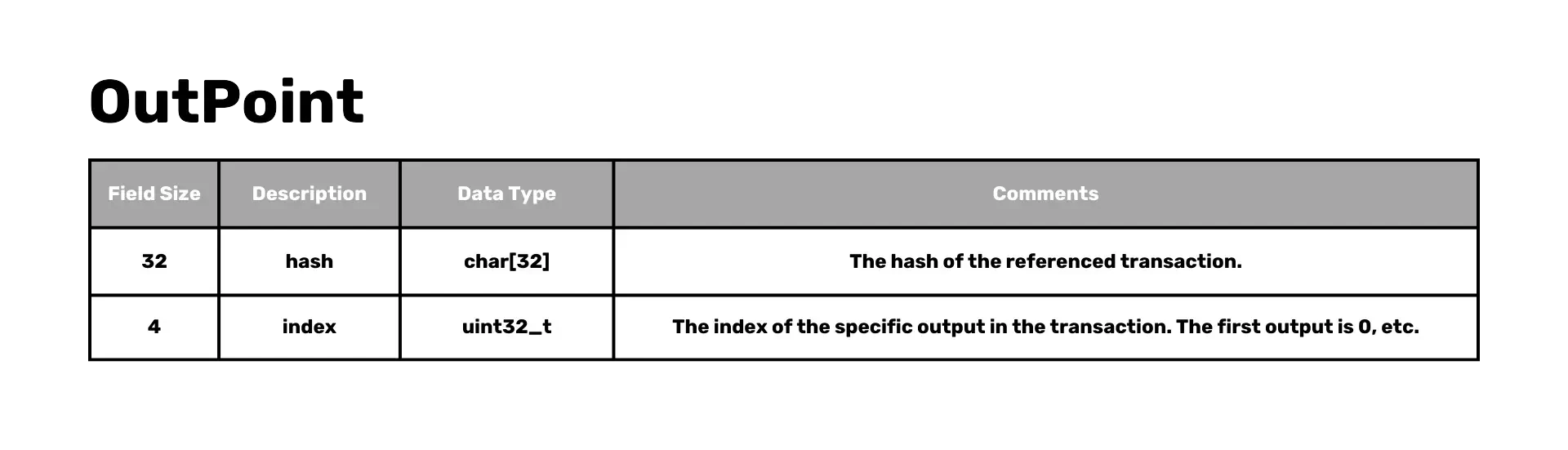

- Previous output (outpoint): The previous output

reference.

- Hash: The hash of the referenced transaction.

- Index: The index of the specific output in the transaction, called "vout".

- Script length: The length of the signature script.

- Signature script: Script for confirming transaction authorization.

- Sequence: Transaction version as defined by the sender.

- Previous output (outpoint): The previous output

reference.

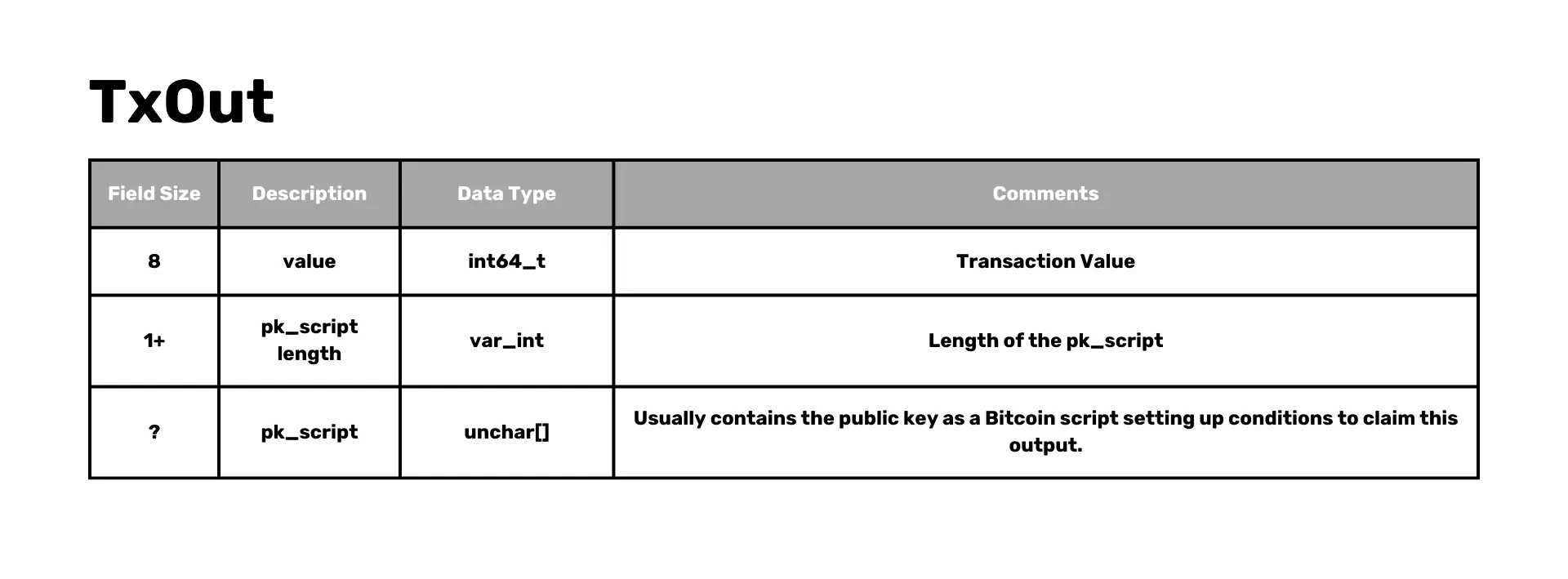

- Number of outputs: Count of transaction outputs.

- Outputs: Contains Value and ScriptPubKey.

- Value: Transaction value.

- PubKey script length: Length of the PubKey script.

- PubKey script: Contains the public key as a setup to claim the output.

- Lock Time: Indicates the block height or timestamp at which this transaction can be included in a block.

Parsing techniques

In Rust, we can use various techniques to parse these structures:

- Utilize

from_le_bytesfor reading Little Endian data. - Implement a custom

parsetrait to handle the parsing logic for different structures.

trait Parse: Sized {

fn parse(bytes: &[u8]) -> Result<(Self, &[u8]), Error>;

}

- Implement parsing generically for lists and specific types such as

VarInt,U32,U64, etc.

impl Parse for i32 {

fn parse(bytes: &[u8]) -> Result<(Self, &[u8]), Error> {

let val = i32::from_le_bytes(bytes[0..4].try_into()?);

Ok((val, &bytes[4..]))

}

}

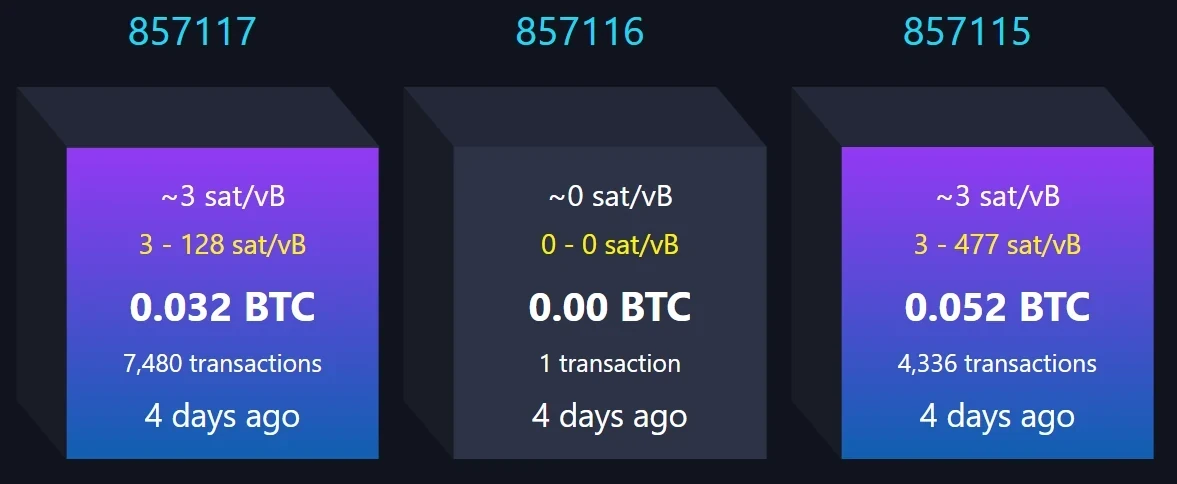

Debugging and testing

To ensure our parser works correctly:

- Compare parsed data against known block details (e.g., from mempool.space).

- Validate that parsed transaction counts and block details match expected values.

Handling special cases and script parsing

Implementation of 'parse' function

We will implement the parse function to handle the full block, including

the block header and transactions. This involves reading the block data and extracting

the relevant fields.

impl Parse for Block {

fn parse(bytes: &[u8]) -> Result<(Self, &[u8]), Error> {

let (header, bytes) = Parse::parse(bytes)?;

let (transactions, bytes) = Parse::parse(bytes)?;

let block = Block {

header, transactions

};

Ok((block, bytes))

}

}

Block header modification

We need to adjust our parsing logic to remove the transaction count from the block header structure, treating it as a separate entity.

impl Parse for BlockHeader {

fn parse(bytes: &[u8]) -> Result<(Self, &[u8]), Error> {

let (version, bytes) = Parse::parse(bytes)?;

let (prev_block, bytes) = Parse::parse(bytes)?;

let (merkle_root, bytes) = Parse::parse(bytes)?;

let (timestamp, bytes) = Parse::parse(bytes)?;

let (bits, bytes) = Parse::parse(bytes)?;

let (nonce, bytes) = Parse::parse(bytes)?;

let header = BlockHeader {

version, prev_block, merkle_root, timestamp, bits, nonce,

};

Ok((header, bytes))

}

}

Structure definition

Define a new structure Block that contains both the block header

and a list of transactions.

struct Block {

header: BlockHeader,

transactions: Vec<Transaction>,

}

Rust syntax elements

Introduce Rust syntax elements such as the question mark (?)

for error handling. This will simplify our code and make it more readable.

Assertions

Add assertions to verify that no bytes are left unparsed after processing a full block. This ensures the integrity of our parsing process.

Special cases like coinbase transactions

Coinbase transactions, which are the first transaction in a block used to claim the block reward, have unique characteristics. We need to handle these special cases appropriately.

struct OutPoint {

txid: [u8; 32],

vout: u32,

}

impl OutPoint {

fn is_coinbase(&self) -> bool {

self.txid == [0; 32] && self.vout == 0xFFFFFFFF

}

}

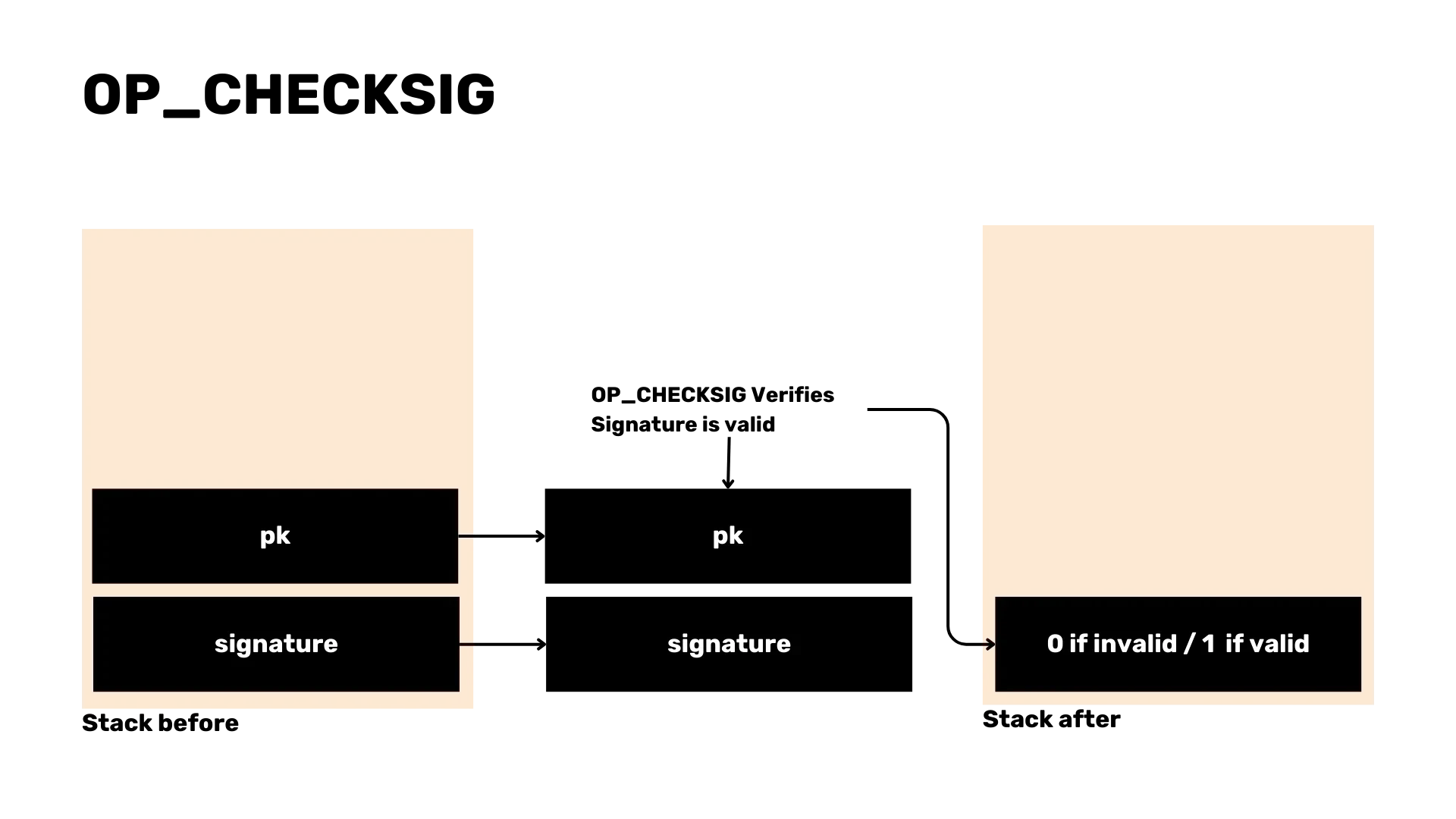

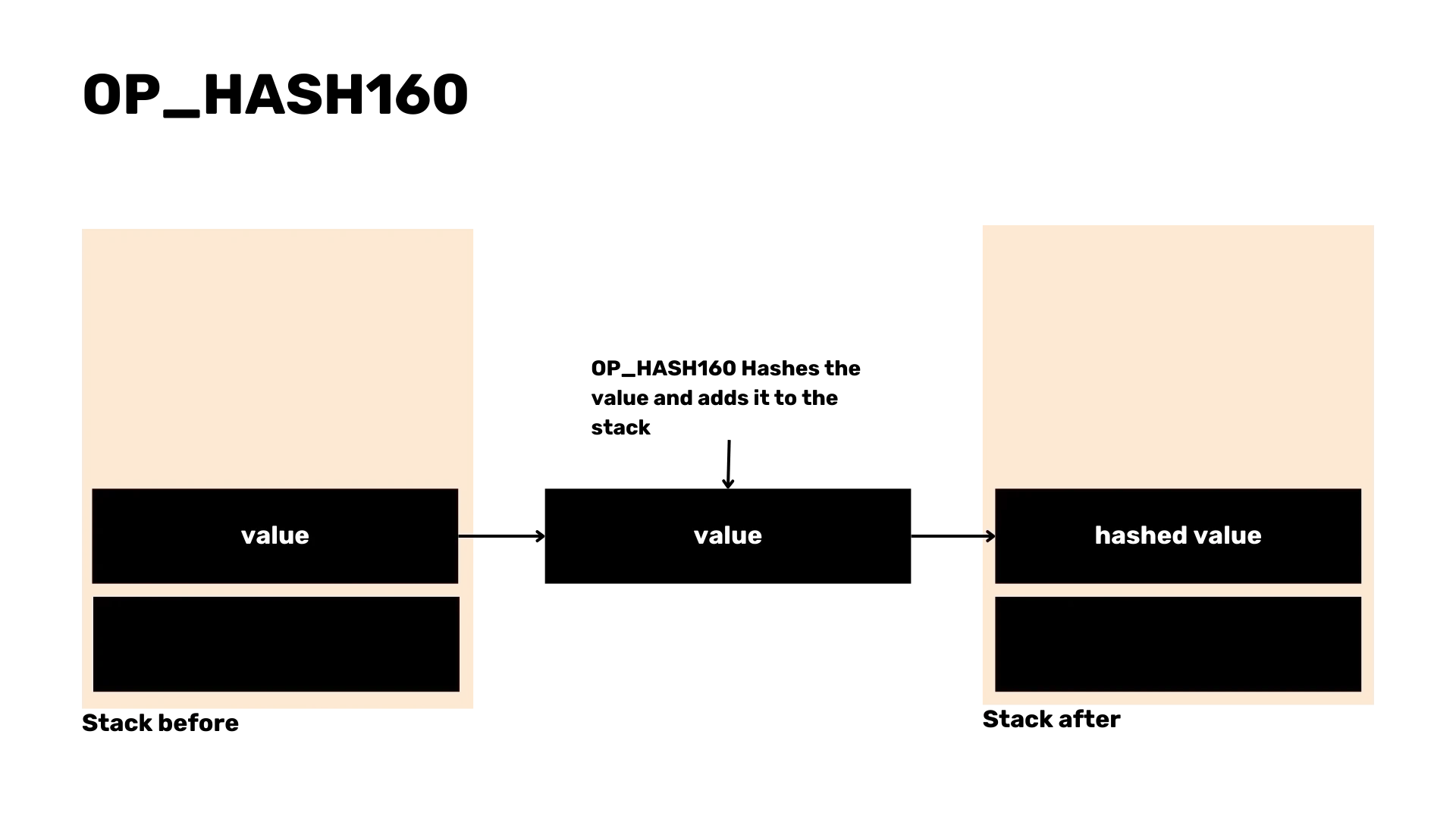

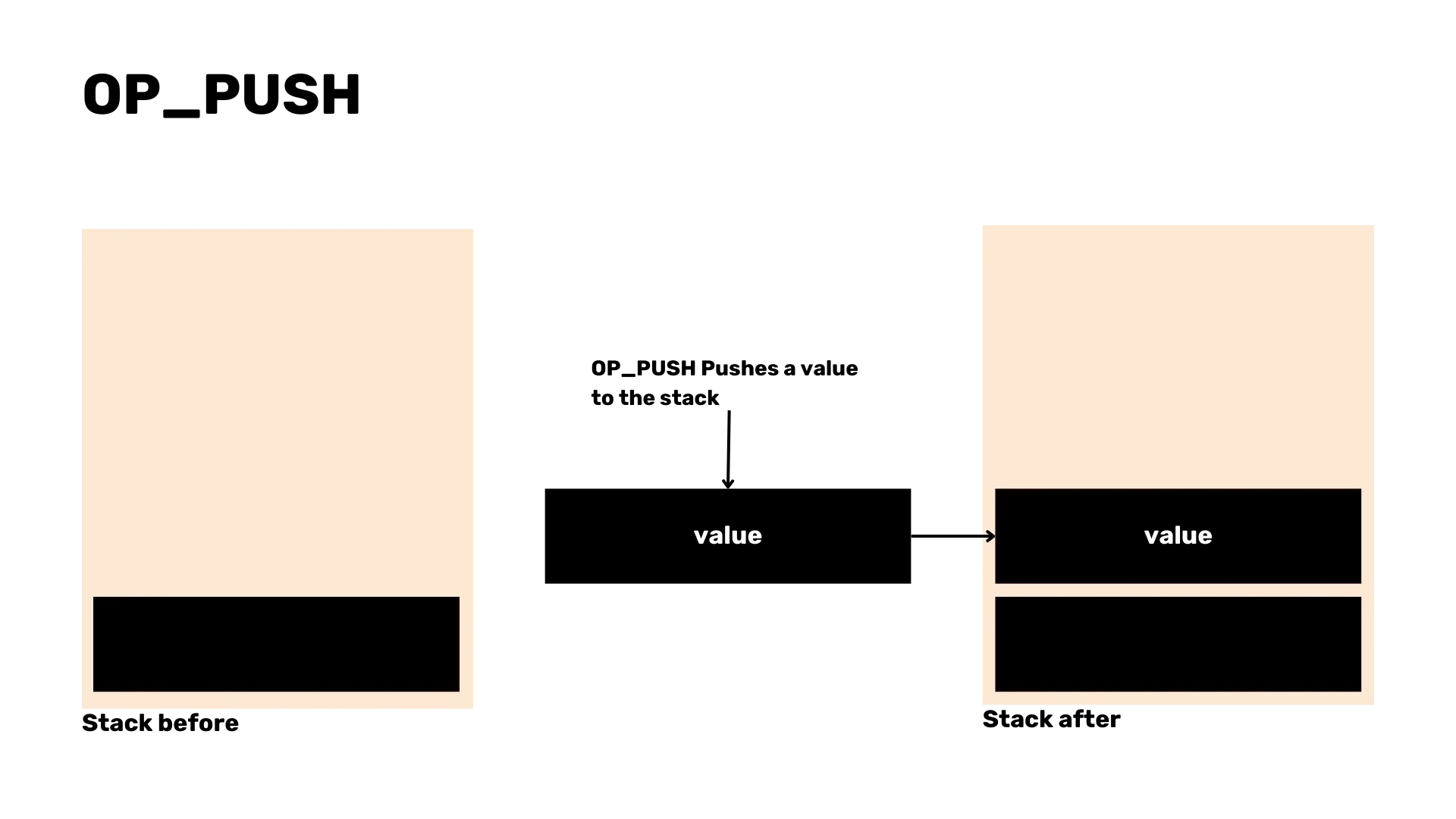

Script parsing strategy

To parse the script in transactions, we will focus on common opcodes such as OP_CHECKSIG, OP_HASH160 and OP_PUSH. Parsing these scripts

is crucial for validating transactions and handling errors.

enum OpCode {

False,

Return,

Dup,

Equal,

CheckSig,

Hash160,

EqualVerify,

Push(Vec<u8>),

}

impl Parse for OpCode {