name: Getting your first bitcoins goal: Learn how to buy, secure, and manage your first bitcoins independently. objectives:

- Identify and avoid common pitfalls associated with Bitcoin

- Understand the fundamentals of Bitcoin

- Choose the right security strategy that best fits your needs

- Learn how and where to get your first bitcoins

- Prepare a inherinheritance plan to transfer your bitcoins

A journey to your first bitcoins

The Bitcoin ecosystem is experiencing spectacular and unprecedented growth. The technological, economic and social transformations driven by Satoshi Nakamoto's invention are intensifying day by day, and are gradually opening the doors to a new world, that you can now take full advantage of.

Diving into the Bitcoin Rabbit Hole is an exciting intellectual adventure that will stimulate your critical thinking and challenge many of your convictions. This exploration will not only give you a deep understanding of how Bitcoin works, but also a real opportunity to reclaim your personal freedom, protect your privacy, and achieve true financial sovereignty.

To guide you effectively through this journey, I've created this entirely free course. Here, the focus is exclusively on Bitcoin. No irrelevant discussions, no mention of other cryptocurrencies, just clear, precise, and straightforward content.

This course is designed to give you full control over how you learn, allowing you to explore Bitcoin at your own pace, following the path that best fits your interests and goals.

Introduction

Course overview

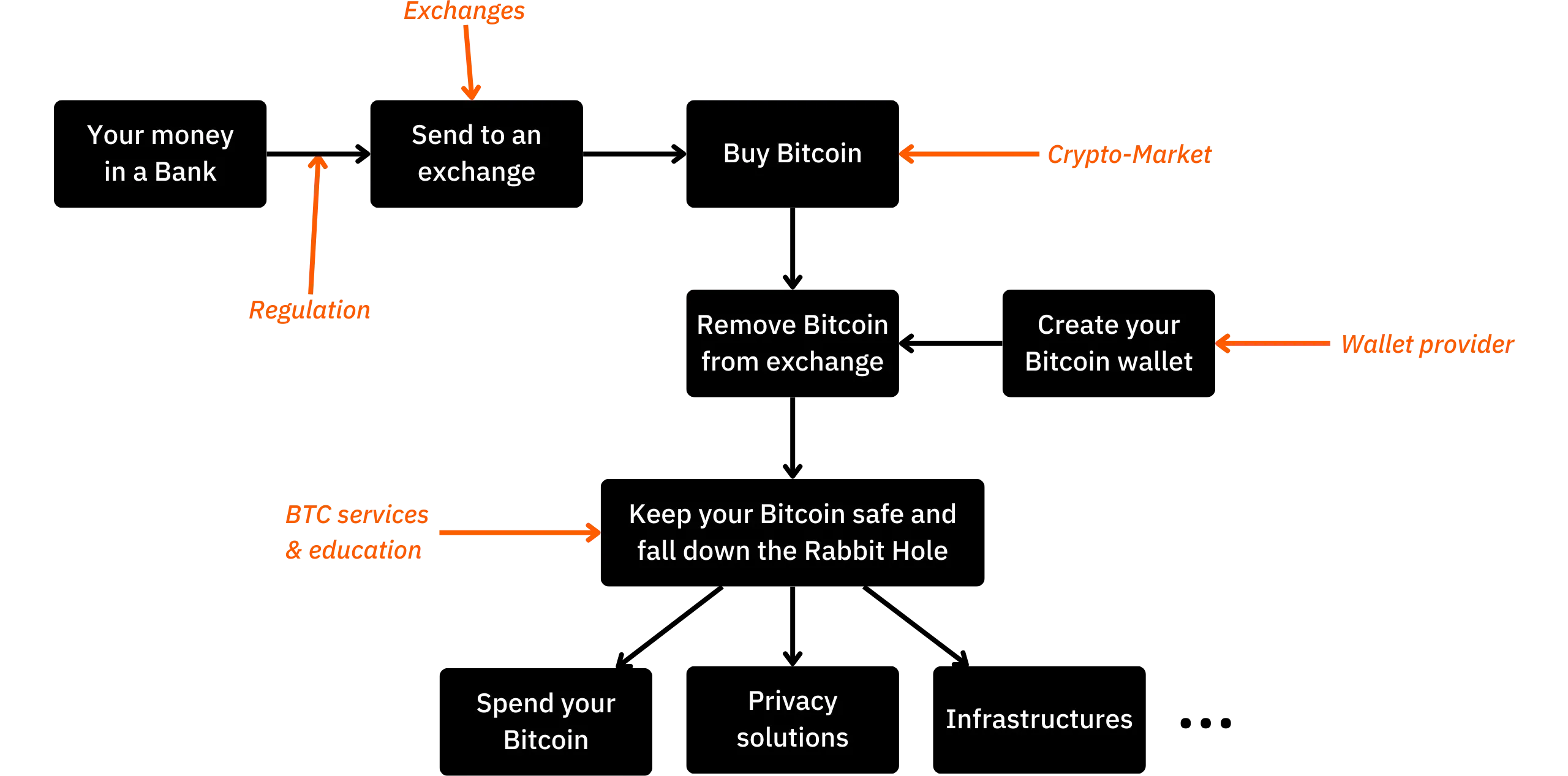

Welcome to BTC102! If you've already completed BTC101, you've explored the key theoretical concepts behind why Bitcoin is such a revolutionary technology. Now, with BTC102, it's time to put that knowledge into action. This course is designed to help you build your personal Bitcoin plan, step by step.

In the chapters ahead, we'll guide you through the practical steps to get your first bitcoins, secure them properly, and confidently take your first steps into this fast-growing ecosystem.

https://planb.network/courses/2b7dc507-81e3-4b70-88e6-41ed44239966

Although Bitcoin has existed for over 16 years, the industry is still young, dynamic, and deeply rooted in freedom. Its underlying protocol is fully decentralized and resistant to control by any central authority, allowing the ecosystem to grow in a natural and organic way. While this freedom fuels an incredible wave of innovation and opportunity, it also comes with certain risks, including scams, common mistakes and pitfalls that often stem from a lack of knowledge. The main goal of this course is to help you navigate this new ecosystem with confidence and safety.

To achieve this, the BTC102 course is divided into several sections, each focusing on a key aspect of your journey with Bitcoin:

The first section,"Prerequisites for understanding Bitcoin", effectively prepares you for the path ahead. You will learn to identify the main pitfalls related to scams and financial frauds that may exist in the Bitcoin ecosystem. We will then cover the essential basics of online security. Finally, I'll give you a few practical tips specially designed for beginners to help you avoid common mistakes when working with Bitcoin for the first time.

The second section, "Understanding what you're getting into", will deepen your overall understanding of Bitcoin. We will begin with a review to ensure you fully understand the essential concepts. Then, we'll explain why Bitcoin is fundamentally important from technological, economic, and social perspectives,strengthening your beliefs in its value. You will also explore the Bitcoin industry as a whole: its key players, its organization, and its evolution over the years. Finally, we will cover the layered architecture of the Bitcoin ecosystem, a crucial concept for understanding how this system continues to innovate without compromising the integrity of its core protocol.

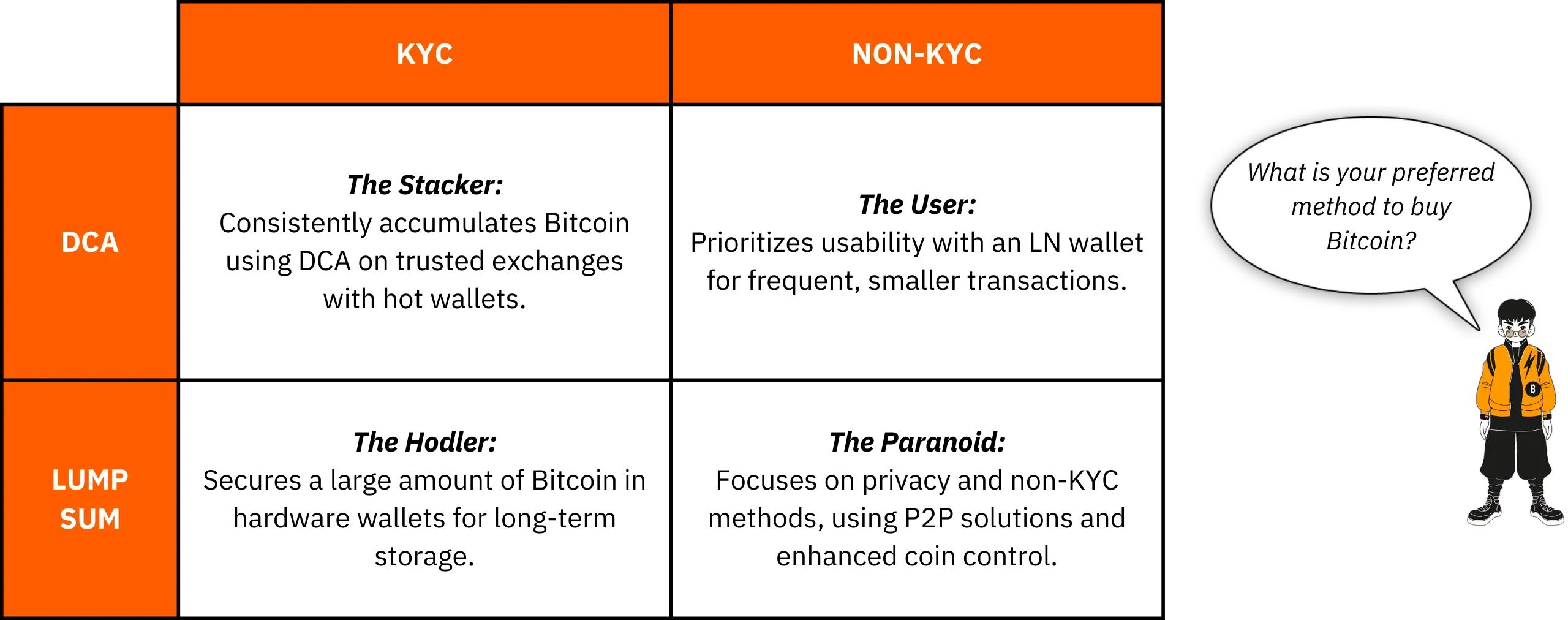

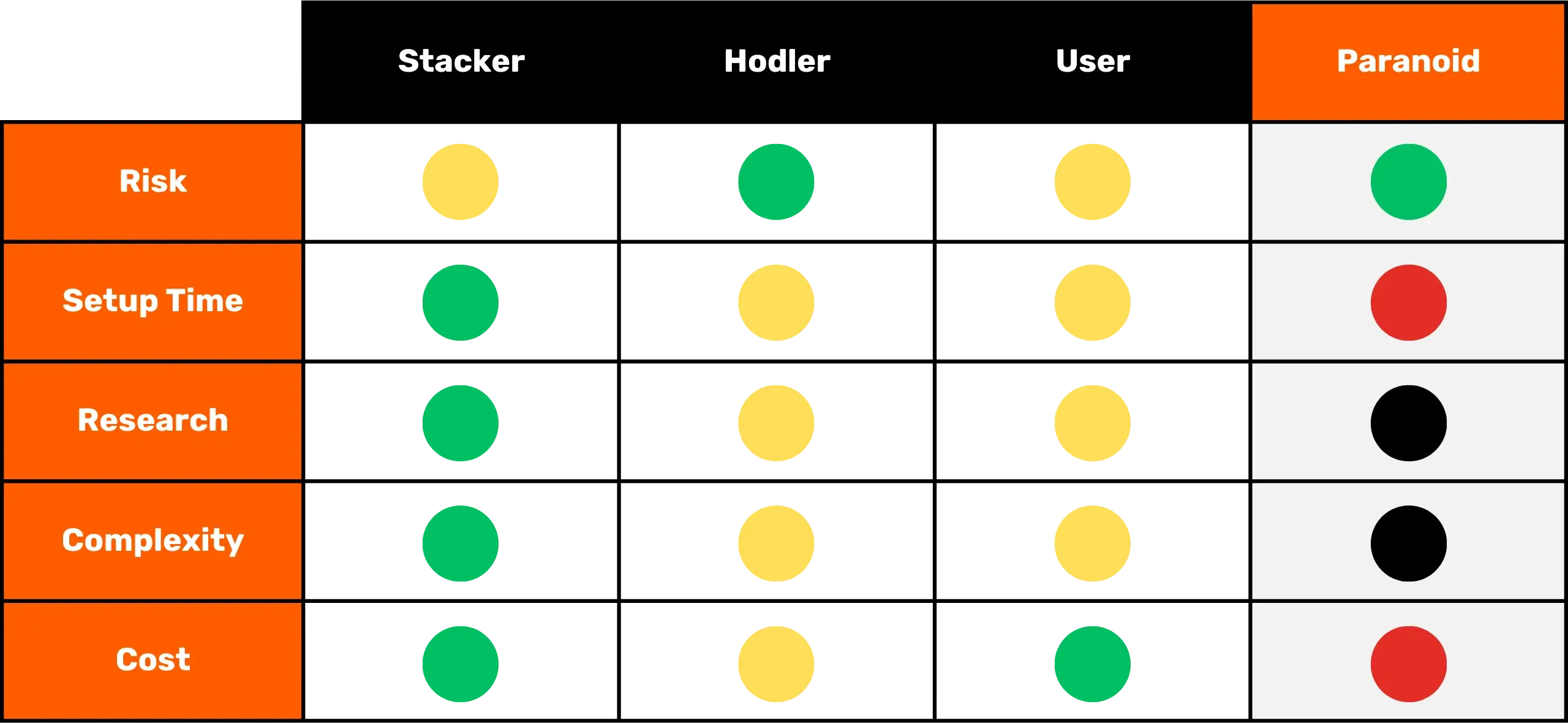

The third section, "Setting up your plan", focuses on your personal approach to Bitcoin. We'll start by helping you define your user profile from four main categories:

- the hodler, focused on holding bitcoin long-term ;

- the stacker, who buys regularly and methodically;

- the user, who prioritizes using Bitcoin daily;

- and finally the paranoid, who wants maximum security to effectively protect his assets and privacy.

We'll guide you through the implementation of a strategy that fits your profile and helps you achieve your personal goals.

Finally, the fourth section, "Protecting Your Heirs and Wealth," covers a crucial topic that's often overlooked: how to ensure your Bitcoin is passed on to your loved ones in case of an unexpected event. You'll learn how to create and set up a Bitcoin inheritance plan, ensuring the preservation of your wealth beyond your lifetime.

By the end of this course, you'll have all the practical tools you need to confidently navigate the Bitcoin ecosystem and become one of its most advanced users!

Ready to begin your journey into the world of Bitcoin? Let's go!

Prerequisites for understanding Bitcoin

Scams and financial fraud

The Bitcoin ecosystem and its surrounding environment are still relatively young and loosely regulated, depending on the country. While this freedom opens up vast opportunities, it also creates a fertile ground for financial frauds, scams, and various forms of manipulation. That's why the first chapter is so crucial: understanding the common pitfalls will help you avoid them. Your financial security is a priority because a bad experience doesn't just affect you, it impacts the entire Bitcoin community.

Bitcoin vs cryptos: understanding the differences

Before going any further, it's important to clearly distinguish between two fundamentally different worlds:

The Bitcoin ecosystem is centered around the idea of sound money, built on strong decentralization, long-term resilience, privacy, and individual sovereignty. Since its launch in 2009, Bitcoin has operated reliably and securely, supported by a global, committed community of developers. It is not a passing trend, but a stable and well-established protocol designed to preserve value over time.

The cryptocurrency industry, on the other hand, is much bigger and includes tens of thousands of different projects, each with its own token. This space is often driven by fast innovation, hype, and short-term financial speculation. Many of these projects are centralized, less secure, and don't offer much real value—despite bold promises and flashy marketing.

If you'd like to better understand where Bitcoin comes from and what truly makes it different from other projects, I recommend checking out this free follow-up course on the history of Bitcoin later on:

https://planb.network/courses/a51c7ceb-e079-4ac3-bf69-6700b985a082

As you know, the Plan ₿ Network platform is exclusively dedicated to Bitcoin. However, understanding the distinction with other cryptocurrencies will help you avoid the pitfalls associated with useless and sometimes even fraudulent projects.

The main scams to avoid

Here are the most common scams you may come across on your journey:

Pyramid schemes and Ponzi schemes

These are some of the most common scams in the crypto world. In a Ponzi scheme, early participants receive payouts using the money from newer ones; not from any real investment or product. There's no actual value being created. The system only works as long as new people keep joining. Once the flow of new participants slows down, the whole scheme falls apart.

These scams usually feature :

- Unrealistic promises of guaranteed returns (e.g. 20% guaranteed return);

- Delays or difficulties when trying to withdraw your invested funds;

- Strong incentives to recruit new members to keep the system running;

- A complete lack of transparency about the true source of the promised returns.

Ultimately, all pyramid and Ponzi schemes are doomed to fail. Their fundamental weakness lies in the constant need to bring in new investors to pay returns to earlier participants. This need becomes mathematically impossible to sustain over time because the number of new recruits required increases exponentially as the system grows. Once a critical point is reached, participants start to doubt, trust disappears, and the entire pyramid collapses. At this stage, the last people to join, often the least informed, lose their entire investment with no way to recover it, while the organizers or early investors have typically already withdrawn their funds and left the system.

In the cryptocurrency world, Ponzi schemes can take many forms, often designed to conceal their fraudulent nature behind a technological or financial mask. These scams can appear as new token offerings or Initial Coin Offerings (ICOs), which are fundraising operations where a new cryptocurrency is sold to the public. Behind technical terms like "blockchain," "smart contracts," or "staking," some projects are actually hiding complex pyramid schemes. Others claim to offer high returns by combining questionable crypto-assets with compensation systems that rely entirely on the continuous influx of new investors.

More recently, Ponzi schemes have also spread into the world of Decentralized Finance (DeFi). While DeFi is intended to provide financial services without intermediaries, some projects use it to lend a false sense of legitimacy to their scams. Certain DeFi platforms promise high, guaranteed returns in exchange for cryptocurrency deposits into automated protocols. These attractive promises are often backed by opaque and unverifiable mechanisms, with tokens created specifically for the scam. In reality, these systems have no sustainable business model—the returns are simply paid from the funds of new users, just like a traditional Ponzi scheme. When trust starts to erode or the influx of new participants slows down, these systems inevitably collapse, leading to significant losses for unsuspecting investors.

Please note that the content of this course is for educational purposes only and should not be interpreted as financial advice. Your financial security depends on your ability to remain cautious, skeptical and well-informed with every financial decision you make.

The best protection is to always ask this simple question: Where does the promised return actually come from? If the answer is unclear, run away immediately.

Pump & Dump

This type of scam involves artificially inflating the price of an asset—often a low-liquidity cryptocurrency token—through a coordinated marketing campaign, usually led by a group of investors. The typical Pump & Dump scheme follows this pattern:

- A group of insiders or influential figures quietly accumulates a large amount of the targeted asset.

- They then launch an aggressive promotional campaign to generate hype and drive up the price.

- The general public, driven by FOMO (Fear of Missing Out), starts buying the asset in large numbers, pushing the price even higher.

- At the peak of the hype, the insiders sell off their holdings all at once.

- The price crashes, leaving latecomers with heavy losses.

It's important to note that Pump & Dump strategies are illegal in many countries and are considered a form of market manipulation. Despite this, such schemes continue to flourish, especially in the cryptocurrency space, where regulation is still catching up.

Be especially cautious of private "signal" groups on platforms like Telegram, Discord, or other social media channels. These are often run by influencers or self-proclaimed experts, some of whom even charge entry fees. While these groups claim to offer exclusive investment opportunities, the reality is far more one-sided: only the organizers profit, while most participants end up losing their money.

It's true that some participants might temporarily profit from these kinds of market manipulations, but their success is usually based on nothing more than luck and perfect timing. In the long run, these schemes are not sustainable. They require constant high-risk involvement and repeated participation in fraudulent setups that inevitably collapse.

Even worse, they feed into a dangerous illusion: the belief that it's possible to make quick and easy money without understanding how financial systems actually work. This mindset not only puts individuals at risk, but also undermines the credibility of the entire cryptocurrency ecosystem

For all these reasons, the best strategy is to stick with a serious, thoughtful approach to investing, one that's grounded in financial education, a solid understanding of the fundamentals, and a long-term perspective. By patiently building your knowledge, you'll be far less vulnerable to emotional manipulation and unrealistic promises; and much better equipped to avoid the kind of financial traps that can lead to real losses.

Donation, Lottery, and Fake Giveaway Scams

This type of scam promises free Bitcoin or other rewards in exchange for you sending a small amount of money first. It's important to remember: no legitimate individual or organization will ever ask you to send cryptocurrency upfront with the promise of sending you more in return.

Scammers often impersonate well-known public figures(like Elon Musk or other celebrities)to lure victims through social media. Always double-check the legitimacy of accounts and websites before engaging with them, and never trust offers that seem overly generous or too good to be true.

Sometimes, these scams appear as "advance fee" frauds. You're promised a prize or reward(money, a product, or a service) but are first asked to pay a fee, supposedly to cover things like shipping, taxes, or transaction costs. Once the payment is made, the scammer vanishes, and the promised reward never arrives.

Shitcoins and cryptocurrencies on offer

Centralized crypto-currency projects sometimes offer free tokens ("airdrops") to attract users.These tokens typically hold little to no real value and are mainly used to create the illusion of popularity or to fuel speculation. Be extremely cautious with these kinds of promotional offers; they're often marketing traps rather than genuine opportunities.

Identity theft and phishing

Attackers often use fake websites, social media accounts, or deceptive emails to try and steal your funds. These scams can come through any communication channel: email, social networks, phone calls, or even traditional mail...

Before clicking on a link or taking any action, always double-check the sender's identity. When in doubt, visit the website manually instead of using a provided link. Most importantly, never share your private keys or passwords with anyone.

Bitcoin Hardforks

Over the years, Bitcoin has experienced several hard forks, which resulted in the creation of alternative versions of the original cryptocurrency. In simple terms, a hard fork is a split in the network that leads to two separate blockchains, both sharing the same history up until the moment of the split. These forks typically happen when part of the developer community or broader Bitcoin ecosystem wants to introduce major changes to the original protocol but can't reach widespread consensus. Instead of abandoning their ideas, they decide to launch a new version of Bitcoin(with altered rules)hoping that users and miners will choose to follow their fork instead.

Not all hard forks are fraudulent, as some arise from technical or ideological disagreements within the community. However, others are driven by commercial interests or even dishonest motives. The most well-known examples of these hardforks are Bitcoin Cash (BCH) and Bitcoin Satoshi Vision (BSV). Launched in 2017 and 2018, respectively, these alternative currencies often claim to be "better versions" of the original Bitcoin. They promote supposed advantages such as lower transaction fees or faster transactions due to increased block sizes. However, these technical changes come with significant trade-offs in terms of security, decentralization, and robustness; elements that can conflict with Bitcoin's foundational principles.

Beyond technical differences, these alternative currencies often capitalize on confusion to attract uninformed investors. They may employ marketing tactics designed to deliberately mislead newcomers who believe they are purchasing genuine Bitcoin (BTC).

To avoid falling into this trap, always verify the currency you're buying. The original Bitcoin uses the ticker BTC, while Bitcoin Cash and its derivatives use distinct acronyms, such as BCH or BSV.

Dishonest influencers and fake gurus

As cryptocurrencies gain mainstream attention, social media has seen a surge of influencers, self-proclaimed experts, and so-called "crypto gurus". While a few may offer genuine educational insights, many others take advantage of their visibility to promote dubious projects or dangerously risky (and sometimes outright fraudulent)trading strategies.These individuals are usually motivated by personal financial interests, often receiving direct or indirect compensation for promoting certain tokens or platforms.

These influencers often rely on proven tactics to attract beginners: they showcase impressive financial results (which are often fake or unverifiable), flaunt a luxurious lifestyle as supposed proof of their success, and promote “miracle” investment strategies. The goal is to trigger FOMO — the fear of missing out — and push their audience into impulsive decisions and reckless investments.

It's important to understand that most "free" advice from these personalities is never truly free. Behind the façade of generosity often lies a calculated strategy to steer people toward buying questionable assets. And even if some influencers were being honest, replicating their results would be nearly impossible; their success often depends on specific timing, insider knowledge, or unique circumstances that you simply don't have access to.

Some influencers may invite you to join private, paid groups where they claim to share exclusive trading signals or insider tips that promise quick and easy profits. In reality, these groups mainly benefit the organizers themselves. They often use their followers as a source of liquidity, essentially offloading assets for personal gain. Subscribers usually end up losing money, as they're unable to react as quickly as the insiders who orchestrate the trades (see the section on Pump & Dump schemes).

In light of this reality, here are some good habits to adopt to avoid falling into the traps set by dishonest influencers:

- Be very cautious with any crypto investment recommendations. A trustworthy and knowledgeable person will never pressure you into buying a cryptocurrency without encouraging you to do your own research first.

- Paid trading or investment courses aren't always a mark of quality. Many of these courses promote risky or overly simplistic strategies; often the same information you can find online for free.

- There's no such thing as a guaranteed way to copy someone's trades and get identical results. Every investment strategy depends on personal context, timing, knowledge, and other factors that can't be duplicated exactly.

- Be especially wary of advice that sounds too good to be true. Unrealistic promises or guaranteed profits are almost always signs of manipulation. Remember: just because someone says something confidently doesn't make it true.

Always remember, everyone you encounter in the Bitcoin or broader crypto ecosystem has a personal agenda; whether it's stated outright or hidden between the lines. There's no such thing as purely neutral information. Even this course, BTC102, has a clear goal, to promote better understanding of Bitcoin. That's why it's essential to stay aware of the real motivations behind every piece of content you consume. And never forget this golden rule of the internet: If a product or service seems free, chances are you are the product.

Ultimately, your best defense is personal education, healthy skepticism, and most importantly, the habit of verifying facts for yourself.

How to avoid scams

To stay safe online, especially in the world of crypto, keep these key principles in mind:

- Never trust blindly: "Don't trust, verify" ;

- Be skeptical of guaranteed or unusually high returns;

- Never share your private keys with anyone;

- Don't send Bitcoin (or any crypto) to unknown addresses;

- If in doubt, pause. Step back and think before taking action. FOMO is your worst enemy;

- Avoid paid trading groups or communities that make unrealistic promises;

- Most giveaways or "free" lotteries online are scams or heavily rigged;

- You'll always gain more in the long term by learning than by gambling.

Protecting yourself from scams is a crucial first step in safeguarding your assets; but it's not enough. Maintaining strong digital hygiene is just as important. That's why, in the next chapter, we'll explore how to strengthen your online security and the best practices you should adopt to protect yourself in the digital world.

Online security

As soon as you start getting into Bitcoin, you'll quickly realize that basic cybersecurity isn't optional—it's essential. Scams and fraud are just the tip of the iceberg. Accidental data loss, malware, and compromised passwords can be just as devastating, especially when you're managing your own keys.

This chapter walks you through some simple, practical steps to level up your digital hygiene and protect yourself in the space.

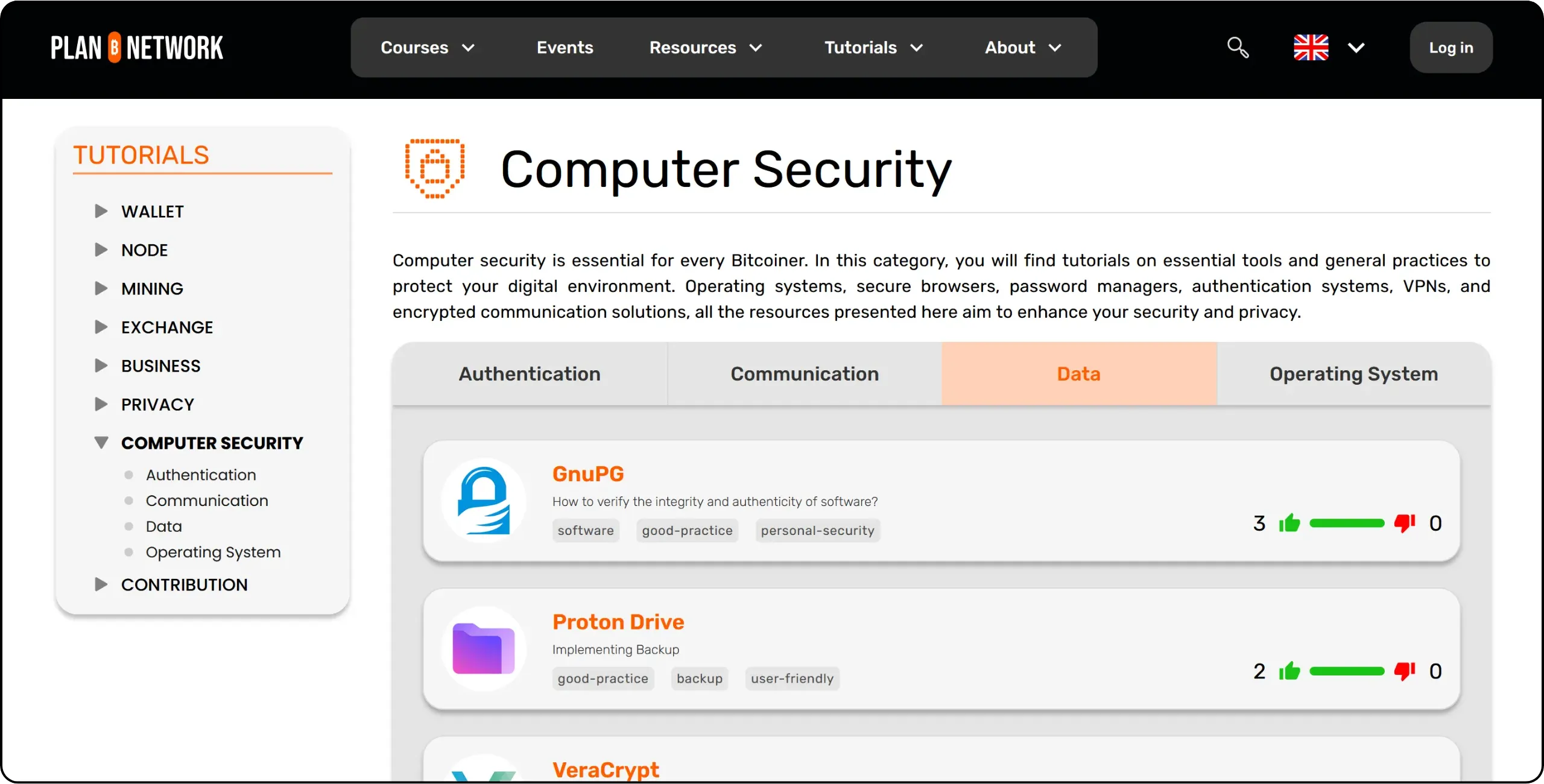

If you want to go deeper, Plan ₿ Network's SEC101 course offers a comprehensive breakdown of cybersecurity strategies specifically designed for Bitcoin users.

https://planb.network/courses/99c46148-7080-4915-a7e0-9df0e145cd47

Why Cybersecurity Matters

Bitcoin gives you the power to hold your money directly(without banks), without intermediaries. But that kind of financial sovereignty comes with serious responsibility: if your BTC gets stolen due to a security lapse, there's no way to reverse the transaction. Unlike traditional banking, there's no help desk, no fraud claim, and no insurance to bail you out.

On top of that, the financial value of Bitcoin makes it a high-value target. A hacker who compromises your wallet can instantly move your funds to an address they control(no questions asked, no way to get it back).

A clean, up-to-date computer

One of the most overlooked aspects of personal security is keeping your operating system and software up to date. Many updates patch known vulnerabilities that could otherwise be exploited by attackers. While some people avoid updates fearing performance issues, the real risk lies in running outdated software that hackers already know how to break.

It's also highly recommended to use a reliable antivirus. On Windows, the built-in Windows Defender is generally sufficient for most users. If you prefer additional features or peace of mind, commercial options like Kaspersky are also available. On macOS, malware threats are historically less common but not non-existent so it's still smart to stay cautious.

Beyond system updates and antivirus protection, be extremely wary of downloading software from sketchy websites or so-called "universal" download portals. When you need a tool or application, always go straight to the official source;This drastically reduces the risk of installing malware disguised as legitimate software. Another smart habit is to verify the authenticity and integrity of any software before installing it on your machine. If you're not sure how to do that, don't worry we've got a dedicated tutorial to walk you through the process:

Finally, make regular backups of your important data. An external hard drive or SSD is a solid option for keeping a duplicate of your files in case of sudden failure, hacking, or accidental deletion. You'll thank yourself later.

If you prefer cloud solutions, consider using a secure service like Proton Drive. Just make sure whatever option you choose respects your privacy and offers strong encryption.

A widely recommended backup strategy is the "3-2-1 rule". It is designed to protect your data from accidental loss, cyberattacks or even natural disasters. The idea is simple:

- Keep at least 3 copies of your important data,

- Store them on at least 2 different types of media (e.g., an external hard drive and cloud storage),

- And make sure 1 of those copies is stored off-site(physically separated from your main location).

This approach offers strong resilience and helps ensure your data survives even if something goes seriously wrong.

The solution to the ID nightmare

One of the biggest reasons people get hacked is using weak passwords. A significant number of users still reuse the same password across multiple accounts, or choose variations that are easy to guess. Password managers are the perfect solution to this problem.

A password manager lets you:

- Store all your passwords securely in an encrypted vault

- Generate long, complex, and unique passwords automatically for each account

- Use just one master password,to access everything securely

With a password manager, you'll never have to click "Forgot password" again or rely on weak, reused credentials. Plus, most password managers sync seamlessly across your devices(desktop, phone, tablet) and even autofill login forms, making secure access both effortless and efficient.

There are many password managers out there, but I can recommend two solid options depending on your needs. If you're looking for something easy to use that syncs seamlessly across multiple devices, Bitwarden is an excellent choice:

If you rather keep everything locally on your own device, KeePass is a great option:

2FA: double protection

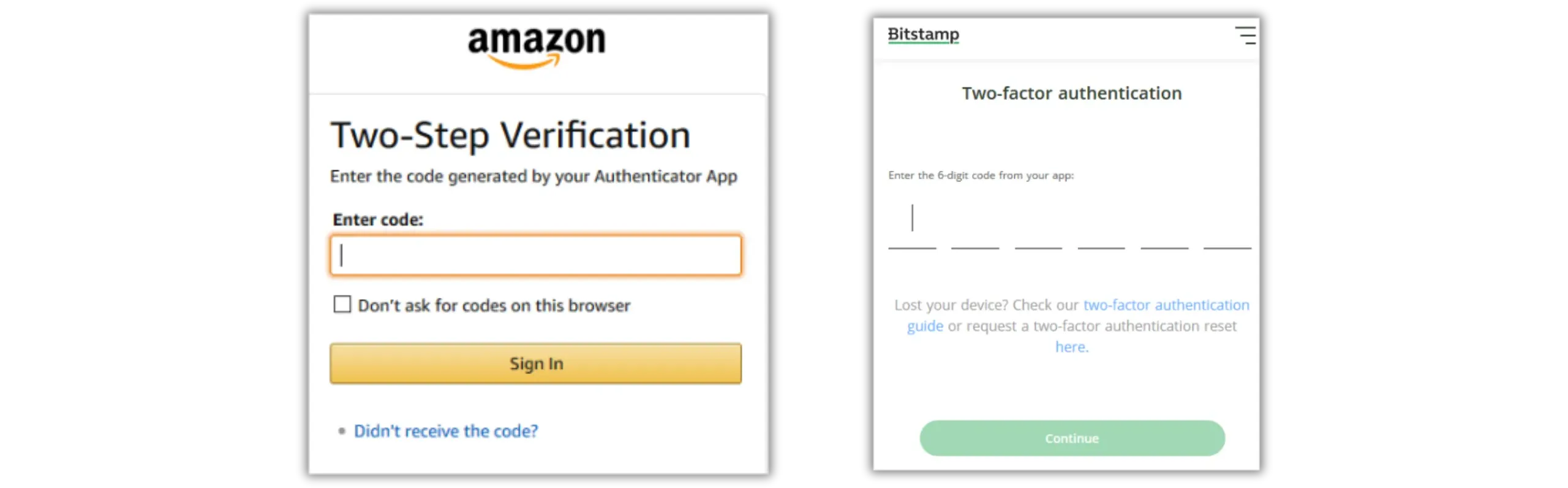

In Bitcoin, you're your own bank. That means you're also your own security team. Even with a strong password, there's no such thing as zero risk-which is why enabling two-factor authentication (2FA) is essential.

2FA adds a second layer of protection by requiring a time-based one-time code (usually 6 digits) generated by an app like Google Authenticator or Authy. So even if someone manages to get your password, they still can't access your account without physical access to your phone.

When you enable 2FA, make sure to save the recovery key for your app in a safe place. This will let you restore your codes if you lose or change your phone. While SMS or email-based 2FA is better than nothing, it's much less secure. A SIM swap attack, where someone takes control of your phone number, can easily bypass this kind of protection.

For those looking to take security a step further, physical keys like YubiKey provide an even higher level of protection.

Protecting your privacy

Privacy and cybersecurity are closely linked: the more information you leave freely accessible, the more likely you are to become a target.

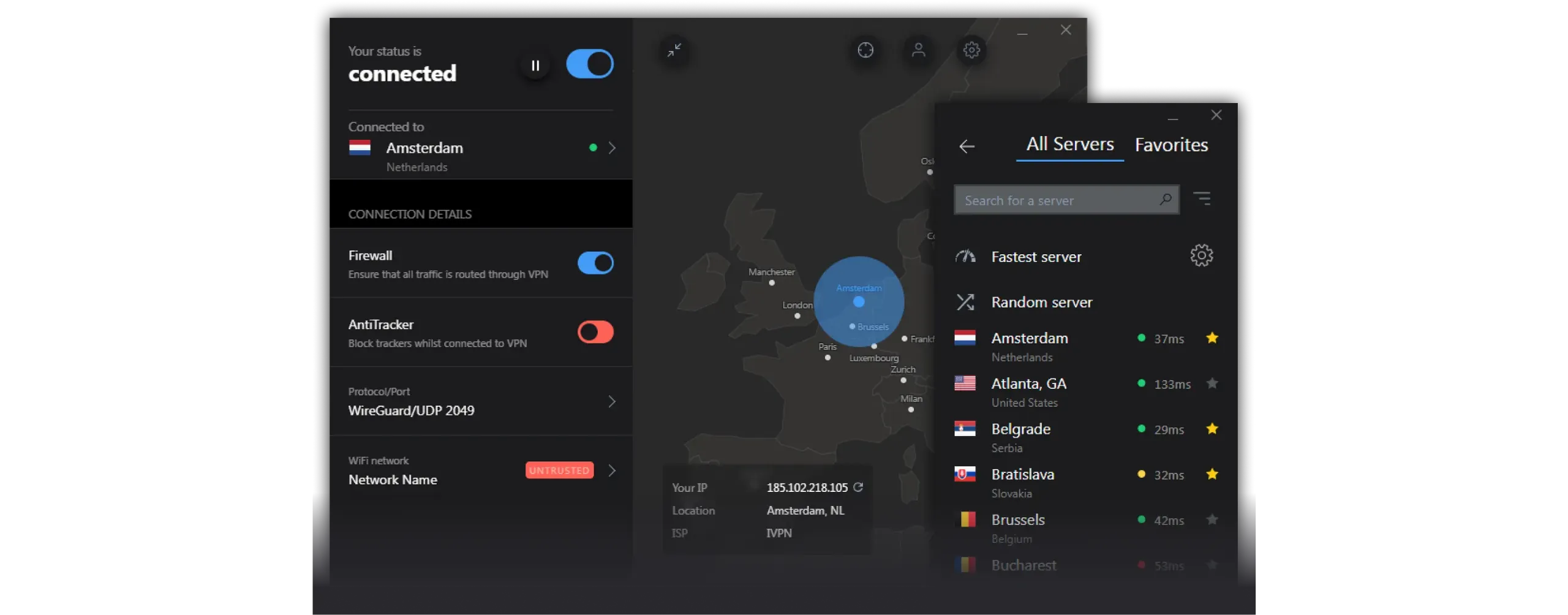

A VPN (Virtual Private Network) is a simple yet effective step to mask your IP address and encrypt your internet traffic. While it won't make you completely invisible (since the VPN provider can still see your activity), it does make it significantly harder for anyone trying to spy on you or track your browsing habits. The key is choosing a trustworthy VPN provider that:

- Doesn't require your personal information

- Allows payment via BTC

- Has a strict no-logs policy

We have several tutorials available on Plan ₿ Network that can guide you through setting up a VPN easily. I particularly recommend IVPN or Mullvad:

Essential steps to protect your privacy online also include:

- Using encrypted messaging platforms such as Signal, SimpleX or Session;

- Using privacy-focused browsers such as Firefox, Brave, or Tor (for enhanced anonymity);

- Using a secure mailbox such as ProtonMail;

- Encrypting your files with tools like Bitlocker (for Windows) or VeraCrypt (available across multi-platform).

Step-by-step progression

Cybersecurity can seem like a massive undertaking, and it's easy for beginners to get overwhelmed and give up because it seems too complex. The trick is to approach it step by step. Start with something simple, like installing a password manager. Give yourself a few weeks to get comfortable with it, then move on to the next step: like enabling 2FA on one of your accounts.

As you get more confident with these tools, you'll be ready to add more advanced practices, like using a secondary email, switching to ProtonMail, setting up a VPN, or browsing with Tor when necessary.

As you dive deeper into the world of Bitcoin, you'll notice that the risks grow as the value of your wallet increases. Building solid security habits, protecting your privacy, and setting up the right tools will not only give you peace of mind but also strengthen the sovereignty Bitcoin is all about.

In short: don't underestimate cybersecurity, take the time to set up the basics, and remember that consistency is key. Without good digital hygiene, even the best tools won't do much for you.

Also be sure to checkout our computer security tutorials on Plan ₿ Network.

In the next chapter, I'll share a few more tips to help you get started on your Bitcoin journey with confidence; and to steer clear of the many traps that can catch newcomers off guard.

Tips for newcomers

Getting into Bitcoin can be exciting; but it also comes with its fair share of risks. The world of crypto is unlike any other; wild price swings, unfamiliar technology, and the very real possibility of losing your funds for good due to simple mistakes or poor investment choices are all pitfalls that new users should be aware of.

In this chapter, I'll share some practical advice and general guidance for anyone who is taking their first steps, especially those making their first purchase or exploring the broader world of financial investment.

Here are the key points that we will go over together:

- Beware of Shitcoins and other useless cryptocurrencies;

- Only invest money you can afford to lose;

- Know the difference between trading and investing;

- Be aware of the tax implications of your investments;

- Protect your recovery phrase carefully;

- Stay humble and keep a low profile(discretion is part of security);

- Think long term, zoom out and be patient(think of it as a marathon, not a sprint).

Common mistakes to avoid

Bitcoin is open to everyone, but that doesn't mean you should dive in unprepared. Here are some of the classic mistakes made by newcomers:

Technological mistakes:

- Losing your seed phrase: Your recovery phrase (usually 12 or 24 words) is the only way to access your bitcoin if something happens to your wallet. If you lose it, your funds are gone permanently;

- Storing your bitcoins on a third-party platform: If your coins are on a centralized platform, you don't really own them. You're exposed to risks like hacks, platform failures, or even fund seizures;

- Neglecting privacy: Protecting your privacy is a core part of securing your assets. Publicly revealing how much bitcoin you hold could make you a target;

- Insufficient online security: Failing to secure your devices with basic protections (like updates, strong passwords, or 2FA) makes you an easy mark for attackers; and could cost you everything.

Financial mistakes:

Investing more than you can afford to lose: Never go into debt or put your rent money into bitcoin. Your basic financial stability should always come first.

Not knowing the difference between trading and investing: Trading requires time, skill, and serious emotional discipline. Long-term investing is far more beginner-friendly.

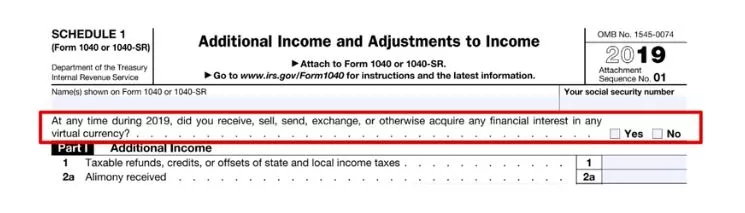

Forgetting about taxes: Every country has its own tax rules for crypto. Ignoring them can lead to painful surprises down the road.

Falling for FOMO: Buying impulsively out of fear of missing out usually leads to bad timing and bad decisions. Patience is your best ally.

Defining an investment strategy

Before buying your first satoshi, it's crucial to understand why you're investing in Bitcoin and how. This means having a clear financial plan tailored to your personal situation and long-term goals.

Start by defining your budget with precision. Don't just pick a random number. Take the time to calculate your monthly income, subtract your fixed expenses (like rent, loans, taxes, utilities), as well as your day-to-day living costs (food, transport, leisure, etc.). Whatever remains is your savings margin and it's only from this portion that you should consider investing. Approaching it this way ensures that you're not putting your financial well-being at risk, especially in the event of a market downturn. A thoughtful strategy is the foundation of long-term resilience.

Once your budget is defined, think about how you want to invest. One of the most beginner-friendly and widely recommended methods is Dollar Cost Averaging (DCA), buying a fixed amount of bitcoin at regular intervals (weekly, monthly, etc.). This strategy helps smooth out your average entry price over time and reduces the emotional impact of price swings. It's a smart approach for most people, especially newcomers.

Then, ask yourself: What's my time horizon? Are you looking to make quick moves in and out of the market (trading)? Or are you more aligned with the long-term mindset of holding Bitcoin over several years(hodler)? If you're a hodler, you're probably less concerned with daily price swings and more focused on long-term security and self-custody. If you're trading, you'll be more exposed to short-term market noise, higher risk, and the stress that often comes with rapid decision-making. There's no one-size-fits-all answer, but knowing your own approach will help guide your decisions.

Most importantly, don't make investment decisions based on emotion or fear. Set a strategy in advance, write it down, and stick to it.

If you're still unsure, start by learning. Spend a few hours exploring Bitcoin, check out the free resources on Plan ₿ Network, read a couple of books, throw in five euros just to try it out, and watch some quality content online. Stay curious. The more comfortable you get, the easier it'll be to revisit your strategy, tweak your approach, and move forward with confidence.

Understanding BTC's volatility

Bitcoin is known for its dramatic price swings. Moves of 10%, 20%, or even 50% over just a few days aren't unusual. For newcomers, this kind of volatility can be disorienting. It's easy to get swept up in the hype during bull runs or panic during downturns; both of which often lead to poor decisions, like selling at a loss.

That's why it's crucial to understand and accept Bitcoin's volatility before you invest. These price swings aren't a bug, they're a feature of a still-maturing asset. If sudden ups and downs are keeping you up at night or pushing you into emotional decisions, chances are you've put in more than you're comfortable risking. In that case, take a step back and reassess your strategy and risk tolerance. Don't hesitate to scale down your position until you feel more at ease.

Above all, never invest more than you can afford to lose. Avoid borrowing money to buy bitcoin(especially if you're still learning the fundamentals). A solid foundation starts with measured steps, not reckless bets.

Managing and securing your Bitcoin wallet

One of Bitcoin's most powerful(and often underestimated) features is self-custody. With a self-hosted wallet, you alone are responsible for your funds. These wallets are typically generated from a recovery phrase (also known as a seed phrase), a series of 12 or 24 words that grants full access to your BTC. If you lose this phrase(or if someone else gets hold of it) your bitcoins are gone for good. No customer support. No reset button.

That's why the golden rule in Bitcoin is: "Not your keys, not your coins". If you don't personally control your private keys, you don't truly own your bitcoin. While exchanges can be convenient(especially when starting out) they hold your keys for you. That means your funds are at risk if the platform gets hacked, freezes your account, or goes bankrupt.

To avoid this risk, it's strongly recommended to set up your own wallet, where only you have access to the recovery phrase. This phrase should always be written down by hand and stored offline in a safe location. Some users even maintain multiple backups, stored in separate geographic locations for added security.

Never store your recovery phrase on an internet-connected device or in the cloud. A single hack or data breach could lead to irreversible loss.

If you're ready to take ownership of your bitcoin and want to dive deeper into best practices for securing your recovery phrase, I highly recommend checking out this article:

https://planb.network/tutorials/wallet/backup/backup-mnemonic-22c0ddfa-fb9f-4e3a-96f9-46e2a7954270

Confidentiality and discretion

In today's digital world, discretion is often overlooked; yet it's a crucial part of staying safe, especially when it comes to Bitcoin. The more openly you talk about your holdings, the more likely you are to become a target for scammers, cybercriminals, or even more traditional threats like extortion or blackmail. There have been numerous cases across the world where individuals known to hold large amounts of BTC were kidnapped or attacked.

Avoid bragging about your bitcoin stash; whether on social media or even in casual conversations. There's no upside to revealing sensitive financial information, and the risks are real.

It's also wise to compartmentalize your online activity. For example:

- Use a separate email address for anything Bitcoin-related, distinct from your personal or work accounts.

- Be cautious of phishing attempts, suspicious links, and fake websites that mimic trusted platforms.

- Stay alert! discretion and vigilance are often your best defense.

If you're ready to go deeper into the topic of Bitcoin privacy, we recommend continuing with our Year 2 Privacy Course, where you'll learn more advanced techniques to keep your identity and activity secure:

https://planb.network/courses/65c138b0-4161-4958-bbe3-c12916bc959c

Tax implications

Despite being a decentralized currency, Bitcoin is not exempt from the tax laws and regulations of your country. Every jurisdiction has its own approach to how gains from cryptocurrencies are taxed. In some places, profits are taxed as capital gains upon selling. Others may require you to declare every trade, and some apply less common rules, such as wealth taxes or social contributions.

Before making any significant transactions, it's strongly recommended to consult a tax professional or review your government's official guidance. Taking time to understand your tax obligations in advance can save you from unexpected issues later (like fines, audits, or penalties) especially if you're planning large sales or portfolio reallocations.

The Difference Between Trading, Investing, and Holding

Bitcoin is often surrounded by popular misconceptions; one of the most common being the idea that it's a fast track to getting rich through trading. But it's important to understand the clear distinction between trading, investing, and holding, as each approach comes with its own mindset, skillset, and level of risk.

- Trading :

Let's be honest:you probably shouldn't be trading. Trading involves short-term speculation(sometimes with leverage) aiming to profit from Bitcoin's price swings. While it may sound appealing, successful trading requires advanced technical knowledge (like chart analysis and risk management), emotional discipline, and constant attention to the market. It's mentally taxing and time-consuming, and the hard truth is that most beginners lose money because they underestimate how demanding it really is. As Warren Buffett famously said: "If you're not willing to hold a stock for ten years, don't even think about holding it for ten minutes." Bitcoin isn't a get-rich-quick scheme.

- Investment:

Investors take a medium to long-term view, buying bitcoin with the belief that its value will grow over time(months, years, or even decades). There's still risk, of course, since the price of bitcoin can fluctuate significantly. But this approach is generally calmer and far more practical for most people, especially those who don't want to spend hours glued to the charts every day.

- Holding (HODL) :

"HODL" started as a typo for "hold" and quickly became part of Bitcoin culture. Today, it's a badge of honor. Hodlers are in it for the very long game; sometimes ten years or more. They store their bitcoin safely and simply wait, driven by strong conviction in Bitcoin's long-term potential. They aren't fazed by daily price swings or bear markets. Their mindset is simple: accumulate, secure, and sit tight.

| Trading | Investment | Holding | |

|---|---|---|---|

| Leverage | Yes | No | No |

| Timeframe | Short-term | Medium-term | Very long-term |

| Asset Type | Contracts | Actual BTC | Actual BTC |

| Risk Level | Very high | High | High |

| Difficulty | Very Hard | Hard | Hard |

| learning curve | Long learning curve | Long learning curve | Long learning curve |

| Potential Loss | UnLimited | Limited | Limited |

| Best For | A few experienced users | Most People | Long-term Believers |

Keep Learning

It's never too early(or too late) to start educating yourself about money, investing, and how the financial system really works. You don't need to become an expert or dive into every technical detail; having a solid, big-picture understanding is enough to make informed decisions and avoid being misled by financial products that don't serve your interests (often promoted by banks or advisors).

A great starting point is the book Rich Dad, Poor Dad by Robert T. Kiyosaki. It's widely known for its approachable style and foundational lessons; like understanding the difference between assets and liabilities, and why financial education is key to long-term independence.

If you're ready to go deeper, podcasts like The Investors Podcast offer insightful discussions on investing, markets, and economic principles. They occasionally cover Bitcoin too, making it a solid next step for those curious to understand how Bitcoin fits into the broader financial landscape.

Golden Rules to Keep in Mind

To wrap things up, here are a few timeless principles that every Bitcoiner(especially beginners) should keep in mind:

- Rule n°1: Never invest more than you can afford to lose. Bitcoin is a volatile asset. Don't risk your financial stability chasing gains. Your essential needs and peace of mind should always come first.

- Rule n°2: Don't blindly follow the hype or trust miracle advice. Ignore trends and flashy promises. Instead focus on making well-informed, rational decisions. When in doubt, sleep on it; talk it through with people you trust. It's better to move slowly and thoughtfully than to rush into costly mistakes.

- Rule n°3: Build a plan and stick to a long-term vision. Consistency, patience, and discipline will take you further than short-term excitement. Don't aim for moonshots; aim for sustainable growth. Avoid fatal mistakes and let small wins compound over time.

By following these principles, you'll be able to approach Bitcoin investing with more clarity and peace of mind. Yes, Bitcoin is volatile, and it can be intimidating at first; but when approached with caution, patience, and a grounded mindset, it holds undeniable potential. Take the time to build your knowledge, revisit your strategy when needed, and above all, remember: slow and steady progress will always serve you better than rushing in out of fear or impatience.

Understanding what you're getting into

Bitcoin in 5 minutes

In this course, the primary goal is to guide you through acquiring and securing your first bitcoins. But before diving into the practical steps(how to buy BTC, which wallets to use, and so on) it's important to take a step back and understand what Bitcoin really is. Grasping the deeper nature of Bitcoin will help you see why millions of people are turning to this technology, and why it's crucial to understand the fundamentals before putting your savings into such a new and volatile asset.

Over the years, Bitcoin has gained recognition as a global monetary network. It's been called "digital gold", a "trust protocol", and even a "parallel financial system." But what do those terms really mean? To answer that, we'll take a closer look at Bitcoin's core: its origin story, technical foundations, monetary properties, and its potential impact; not only on individuals, but on the global financial system as a whole.

The Origins: A Project Born from a Longstanding Quest

Cypherpunks and the invention of a system beyond banking control

Bitcoin wasn't born overnight. Its the result of decades of research and experimentation in cryptography, computer science, and monetary theory. Prior to its launch in 2009, several projects(like eCash, b-money, Bit Gold, and RPOW) attempted to create digital currencies. All faced the same core issue: how to prevent double spending in a decentralized system without relying on a central authority.

That challenge remained unsolved until late 2008, when someone using the name Satoshi Nakamoto published the Bitcoin white paper. A few months later, the first version of Bitcoin's open-source software went live, launching a system that could operate independently of banks or governments.

The project was heavily influenced by the Cypherpunk ethos; a community of developers and thinkers who believed in using cryptography to protect individual freedoms online. For them, privacy and decentralization weren't technical preferences, but ideological necessities. Bitcoin emerged as the most successful embodiment of those ideals: a peer-to-peer monetary network that anyone could use, no one could control, and everyone could verify.

The Cypherpunks are an informal, international community of individuals who advocate for the use of cryptography to defend personal freedoms online. They strongly believe in the individual's right to privacy; especially in a world increasingly shaped by government surveillance and corporate data exploitation.

The roots of the Cypherpunk movement go back to the early 1990s, when groups of cryptographers, programmers, and libertarians began exploring the political implications of cryptography during meetups in Silicon Valley. One of the most prominent voices in the community was Tim May, who authored the Crypto Anarchist Manifesto in 1988; a foundational text outlining a vision for a world where encryption would empower individuals to operate beyond the reach of governments and centralized control. A major milestone in the movement came in 1992 with the creation of the Cypherpunks mailing list, a forum where ideas, projects, and political discussions about privacy and cryptography could flourish. Then, in 1993, Eric Hughes published the Cypherpunk's Manifesto, a brief but powerful declaration that clearly expressed the community's mission and beliefs.

The idea of a digital currency that operates independently of any central authority(like Bitcoin)is deeply rooted in Cypherpunk philosophy.

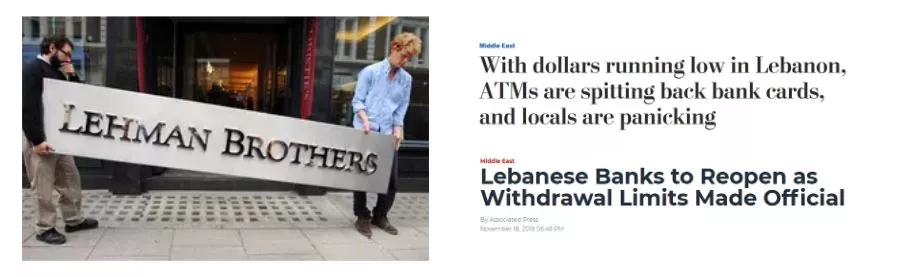

Post-Financial Crisis Moment

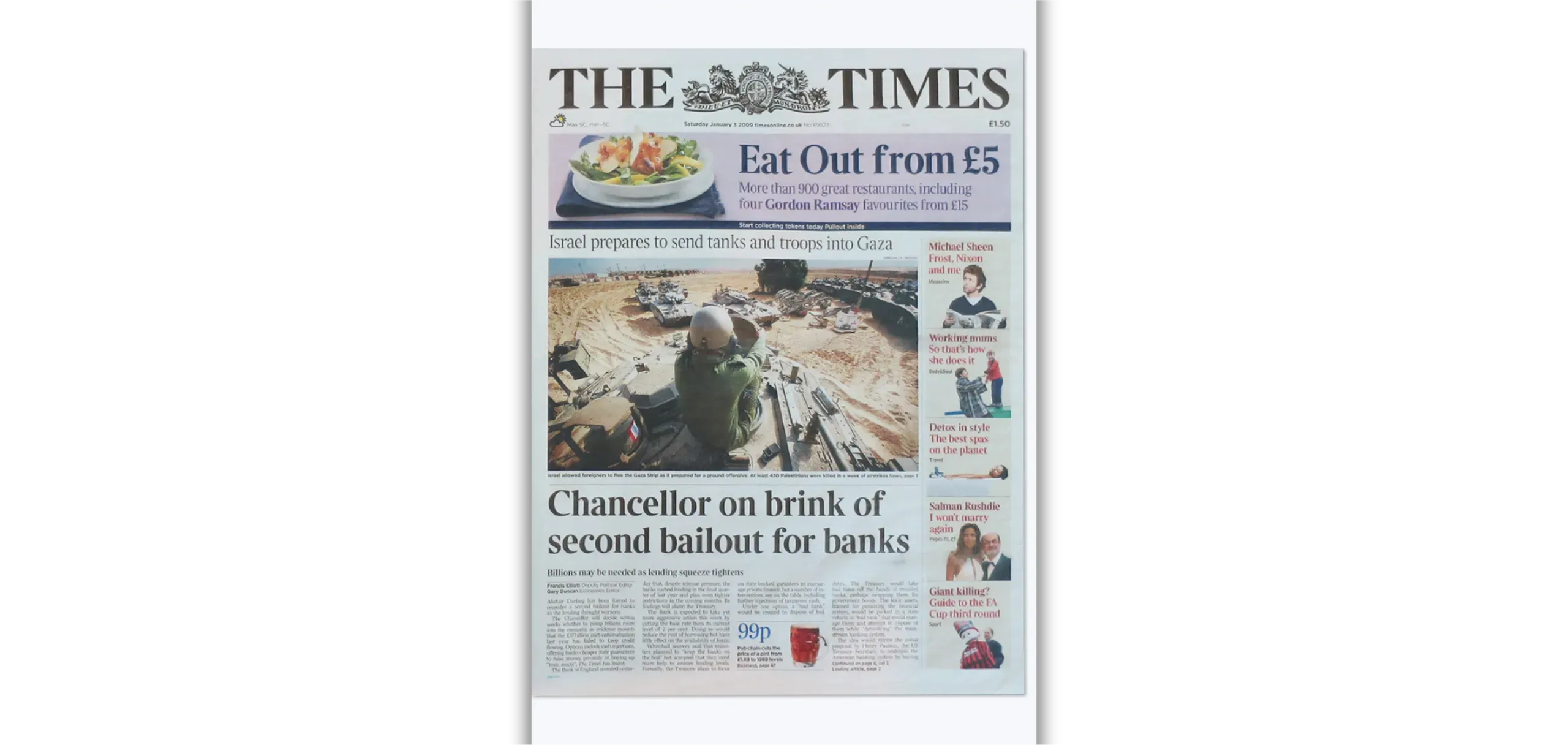

Bitcoin didn't just appear out of nowhere. It was created at a very specific moment—right after the global financial crisis of 2008. The collapse of the U.S. housing market and the subprime loan crisis caused major banks to fail and shook people's trust in the entire financial system.

It was in this environment of fear and uncertainty that Bitcoin was born. The creator, known as Satoshi Nakamoto, included a very symbolic message in the very first block of the Bitcoin blockchain, known as the Genesis block. The message was:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks"

This wasn't just a date or a technical note; it was a quiet but powerful protest. It showed that Bitcoin was designed to be something radically different: a financial system that doesn't depend on banks, bailouts, or government decisions.

Many interpret this as Bitcoin's goal: to offer a way to transfer value without needing middlemen, controlled by clear rules instead of the often unclear decisions made by central banks or governments.

To deepen your knowledge of Bitcoin's origins, we offer a free, comprehensive and well-documented training course on the subject:

https://planb.network/courses/a51c7ceb-e079-4ac3-bf69-6700b985a082

A decentralized network to transfer value

Peer-to-peer and no central body

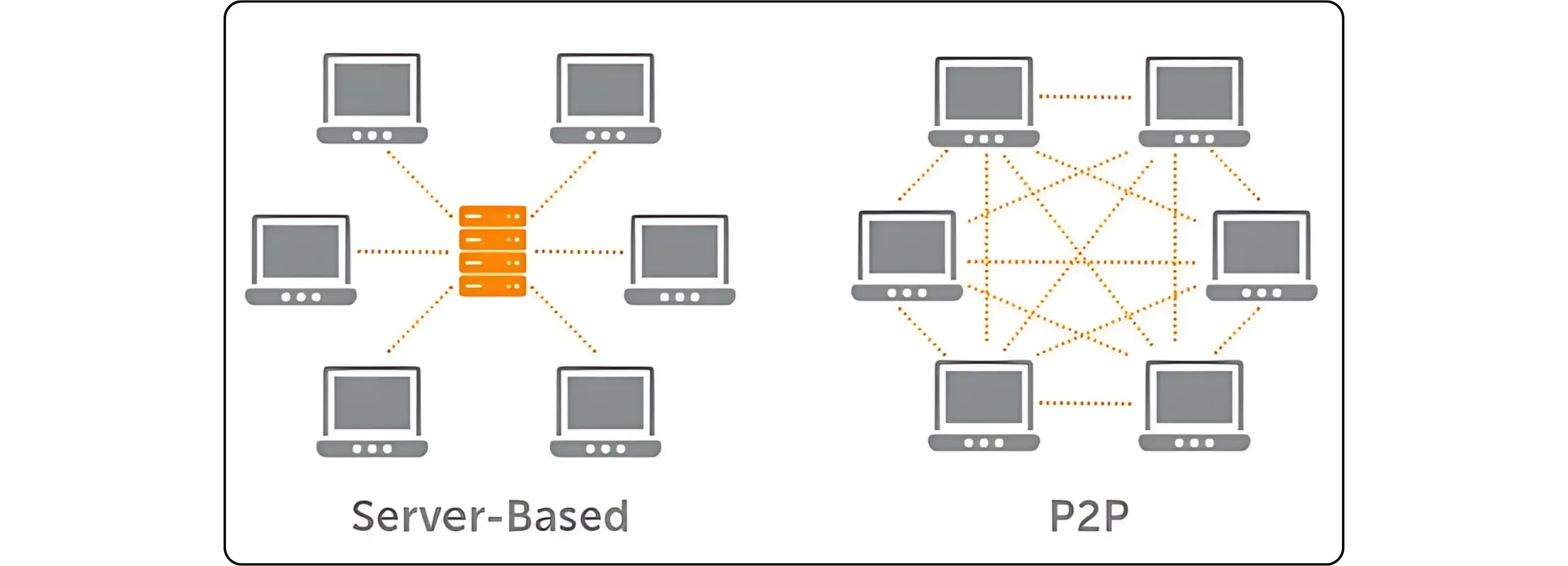

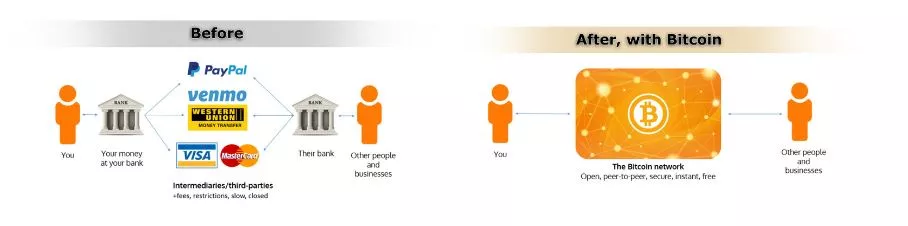

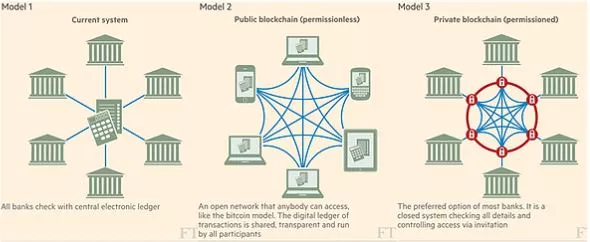

Bitcoin is defined as a "peer-to-peer electronic cash system." This means that anyone can connect to the network using the appropriate software (a Bitcoin node) and interact directly with other users, without relying on a central server. The goal of this decentralization is to prevent any single entity (such as a bank, government, or large corporation) from controlling, censoring, or halting the system. Bitcoin operates 24/7, globally, and is accessible to everyone without any conditions.

In simple terms, every participant in the Bitcoin network (called a "node") has a full copy of the transaction ledger, known as the blockchain. When a new transaction happens, it's broadcast to the network. Miners then confirm these transactions by grouping them into blocks which are then added to the end of the chain (hence the name "Blockchain").

Blockchain: an accounting ledger

Think of the blockchain as a giant accounting ledger, where every line represents a transaction. In a traditional banking system, the database is stored on a bank's servers, which can make changes whenever they want. On the other hand, in Bitcoin, all changes are validated across the entire network: once a new block of transactions is added to the blockchain, it's nearly impossible to alter it later. This decentralized validation makes Bitcoin's ledger secure and transparent.

The Role of Miners and Proof-of-Work

How Blocks Are Created: Mining

Mining is the process by which computers (or large mining farms) contribute computational power to secure Bitcoin's transaction history and create new blocks. Miners compete to solve a mathematical puzzle—specifically, finding a partial hash collision. This process requires significant energy and resources. Once a miner finds a valid solution, they broadcast the block to the network, which verifies and accepts it as valid. As a reward, the miner receives newly created bitcoins (called the block subsidy) along with the transaction fees from all transactions included in that block.

The Halving: Decreasing Block Subsidy

To ensure Bitcoin's scarcity, the block subsidy is programmed to halve every 210,000 blocks; roughly every four years. This event is known as the "halving." When Bitcoin launched, miners earned 50 BTC per block. In 2025, that reward has dropped to 3.125 BTC and will continue to decrease over time. Eventually, around the year 2140, the subsidy will reach zero, as Bitcoin's total supply will cap at 21 million coins. This predictable issuance curve mimics the scarcity of physical commodities like gold; one reason Bitcoin is often referred to as digital gold.

Bitcoin Monetary Properties

Scarcity and a Fixed Monetary Policy

One of Bitcoin's most powerful features is its predictable and unchangeable monetary policy. Unlike traditional fiat currencies (like the dollar, euro, or yen), which can be printed at will by central banks(often leading to inflation or economic distortions)Bitcoin operates under a transparent set of rules embedded in its code. There will only ever be 21 million bitcoins, and the rate at which new coins are issued is known in advance by everyone in the network.

No government, institution, or individual can unilaterally change this supply cap or the distribution rules. The only way to alter these parameters would be to change Bitcoin's protocol; and even that would require consensus from a majority of the network's economic participants.

This built-in scarcity is a major draw for those looking to opt out of unpredictable monetary policies or avoid the gradual erosion of their purchasing power through inflation. Over time, this could represent a shift in financial thinking, where saving in a deflationary asset like Bitcoin becomes more attractive than relying on traditional, inflation-prone currencies.

Divisibility and Accessibility

One of Bitcoin's most underrated strengths is its divisibility. Each bitcoin can be broken down into 100 million units, known as satoshis (or sats for short). This means you don't need to spend tens of thousands of euros or dollars to get started; you can buy just a few euros worth of bitcoin, down to tiny fractions.

Openness and Transparency

A public protocol, verifiable by all

Bitcoin runs on a public, open-source protocol(most notably through Bitcoin Core). This means its code is freely available for anyone to inspect, audit, and improve. There are no hidden mechanisms or closed systems; everything about how Bitcoin works is out in the open. This level of transparency makes it incredibly difficult to introduce backdoors or make secret changes. Anyone with the technical skills can run a node, contribute to development, or build compatible tools. In Bitcoin, trust is earned through code and consensus, not through centralized control.

This transparency is one of the key reasons people trust the Bitcoin protocol; it prevents a small group of developers from manipulating the network for their own gain. Bitcoin operates on a simple but powerful principle: if you disagree with proposed changes, you're free not to update your software. In some cases, this won't cause any disruption; you'll still stay in sync with the rest of the network. But in other cases, this can lead to what's known as a hard fork, where the network splits in two, and a new version of Bitcoin is created. That's exactly what happened in 2017 with the split between Bitcoin (BTC) and Bitcoin Cash (BCH).

While this kind of governance can be slow and sometimes messy, it's also a strength; it ensures that no single entity can unilaterally take control, helping Bitcoin remain stable, neutral, and resistant to centralization.

Individual Validation: nodes

Bitcoin allows anyone to check the accuracy of the blockchain by running a "node" on their computer or server. This means downloading the Bitcoin Core software (or another version of the Bitcoin protocol) and verifying all transactions and blocks since 2009. Once your node is set up and synced, it becomes a full copy of the blockchain and helps support the network.

Although this approach is more technical, it offers the most demanding users the ability to opt-out of trusting third parties. Running a node ensures that users can participate in the consensus process and remain uncensorable, contributing directly to the security and decentralization of the network.

Use cases

A Resilient, Cross-Border Payment Method

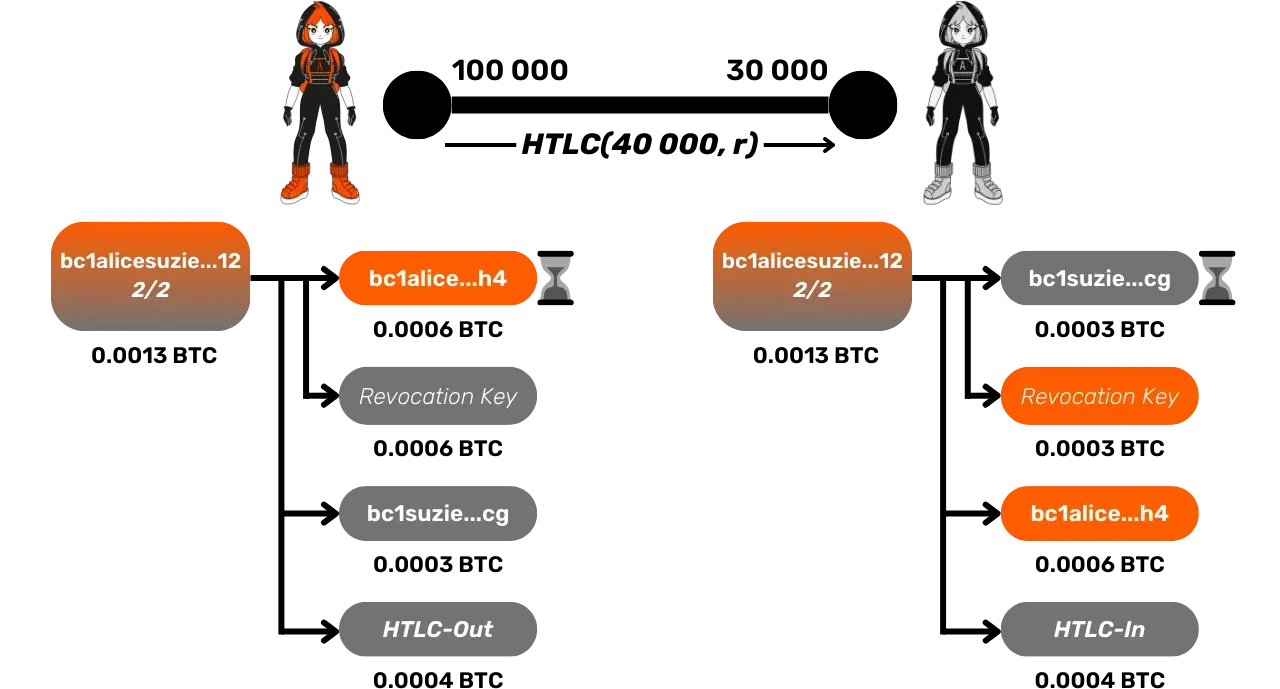

Due to its decentralized nature, Bitcoin operates 24/7, unaffected by borders or time zones. In regions where traditional banking infrastructure is lacking, Bitcoin is often used as a fast, low-cost solution for sending or receiving funds without relying on expensive intermediaries. While transaction fees can vary based on network congestion, they are generally much lower than the fees charged by banks for international transfers. Additionally, layer-2 solutions like the Lightning Network allow for even faster and cheaper Bitcoin transactions.

A store of value

Due to its scarcity (capped at 21 million BTC) and inherent resilience, Bitcoin is often seen as a long-term savings safeguard. While its price can be volatile in the short term, Bitcoin has generally followed an upward trend over the years since its inception. Some investors purchase BTC with the belief that it could serve as a store of value, particularly in the face of inflation or financial crises.

A tool for financial freedom and resilience

Beyond investment, Bitcoin offers a way to protect financial sovereignty. In countries under authoritarian regimes or facing heavy monetary restrictions, having a Bitcoin wallet (with private keys) provides a form of freedom. No one can block or confiscate these BTC, as long as the holder secures their recovery phrase.

This characteristic is especially appealing to those who fear censorship or the freezing of bank accounts. It also resonates with populations suffering from hyperinflation, as seen in Venezuela or Zimbabwe, where holding BTC proved more stable than keeping local currency, which was rapidly depreciating.

A long way to go

Bitcoin can be seen as a "Zero to One": a radical break with established financial paradigms. For the first time in history, a global monetary network, accessible to all, operates without a central authority, enabling censorship-resistant and private transactions.

Nevertheless, after more than a decade of existence, Bitcoin continues to spark debates and passions. Its adoption is growing, second-layer solutions (like the Lightning Network) are emerging to improve transaction speed and lower fees, and businesses worldwide are experimenting with new use cases. It is likely that Bitcoin will continue to influence payment systems and even the way we perceive money for decades to come.

If you'd like to expand your knowledge further, you can take the BTC101 course on Plan ₿ Network, which offers a more in-depth exploration of Bitcoin's technical and economic fundamentals.

https://planb.network/courses/2b7dc507-81e3-4b70-88e6-41ed44239966

After this introduction to Bitcoin (which may have taken a bit longer than 5 minutes!), you're now better equipped to consider buying and securing bitcoins. In the following chapters of the course, we will dive deeper into the significance of Bitcoin, the workings of its industry, and the development of its various layers. Next, in the upcoming section, we'll discuss how to set up your own personal plan.

Why is Bitcoin important?

Why is Bitcoin so important? That's the central question of this course. Whether it's related to your studies or your investment strategy, without a clear understanding of Bitcoin's significance, there's a risk of deviating from your plan. The goal is to always keep the fundamental principles of Bitcoin in mind to ensure that your strategy remains aligned with your beliefs.

A universal currency

Barack Obama once referred to Bitcoin as a "Swiss bank in your pocket," and for good reason. Bitcoin offers the same opportunities to everyone, no matter who they are. Whether you're a teenager, a president, a protester in Hong Kong, or a "Yellow Vest" in France, everyone has equal access to the same protocol and tools:

- Create free and unlimited wallets (with Bitcoin, we don't really talk about "accounts," but rather "wallets").

- Send money anywhere, to anyone.

- No need for identification or any administrative procedures.

- Accessible to all, regardless of age, gender, religion, country, or income level.

- Privacy and transparency available at your discretion.

- No intermediaries or hidden fees.

- Bitcoin is native to the internet, meaning anyone with web access can use it.

Bitcoin can be seen as the true "currency of the people," an alternative monetary system that doesn't rely on any central authority and is based on immutable rules rather than arbitrary decisions. Its open and accessible nature makes it a potentially revolutionary tool for billions of people worldwide, whether they are excluded from the traditional banking system or simply seeking a more sovereign alternative.

This leads us to a fundamental, almost philosophical question that divides Bitcoin enthusiasts into two main worldviews. On one side, some see Bitcoin as a solution to promote financial inclusion, enabling the billions of unbanked individuals to finally access a global monetary infrastructure. On the other side, some view Bitcoin as a financial liberation tool aimed at offering a way out for the billions of people already integrated into the banking system, but who wish to free themselves from its dependency and regain full control over their money. This reflection deserves our attention, and we will return to it in more detail later on.

Protection against currency crises

For centuries, the world has experienced monetary crises that have had devastating effects on populations. Billions of people are still suffering from the consequences of poorly managed monetary policies, where the manipulation of money supply and interest rates creates systemic imbalances. These crises aren't just random events—they're the result of a system built on intervention and the manipulation of money and time values.

These crises can take many different forms. Hyperinflation, for instance, wipes out a currency by gradually destroying people's purchasing power; as seen in countries like Zimbabwe and Venezuela. On the other hand, strict monetary controls can limit access to funds and strip individuals of their economic freedom, as happened with banking restrictions in Greece and Lebanon.

And finally, when governments devalue their national currencies, it gradually erodes people's savings; an invisible but constant drain on their wealth. In many ways, it acts like a hidden tax. As long as monetary policy remains in the hands of centralized authorities, these cycles are destined to repeat.

Bitcoin presents a bold alternative to this cycle of chronic monetary instability. Unlike state-issued currencies, it's built on unchangeable, math-based rules enforced by consensus; not by governments or central banks. Its issuance is predictable and capped at around 21 million coins, making it a form of sound money designed to hold its value over time. Because it resists censorship, anyone can store and transfer value without relying on an institution. And thanks to its divisibility and portability, it's both accessible and practical; financial infrastructure for anyone, anywhere.

Did you know? Throughout history, there have been at least 56 documented cases of hyperinflation worldwide. In many of those cases, entire economies collapsed, life savings were wiped out, and millions were pushed into extreme poverty. Even worse, these monetary failures often acted as a springboard for political upheaval; sometimes leading to authoritarian regimes, as happened in Germany in the 1920s and Chile in the 1970s.

Hanke, S. H., & Krus, N. (2013). World Hyperinflations. In R. Parker & R. Whaples (Eds.), The Handbook of Major Events in Economic History. Routledge Publishing. Retrieved from https://ssrn.com/abstract=2130109

The collapse of fiat currencies isn't some historical fluke; it's a pattern that repeats itself. Today, Bitcoin offers a way out: a unique opportunity to protect your wealth outside of government-controlled monetary systems. At this point, the question isn't if another crisis will happen, but when. With Bitcoin, you now have the option to opt out of these destructive cycles and choose a monetary system built on transparency, predictability, and individual sovereignty.

A response to state control and injustice

Growing economic inequality around the world has always been fertile ground for social unrest and the rise of political extremism. History shows that when the gap between rich and poor becomes too wide, it often leads to tension, crisis, and even the rise of authoritarian regimes. In the face of these risks, protecting your financial freedom isn't just a luxury; it's a necessity for anyone who wants to preserve their autonomy and safeguard their family's future.

But in a world where the state can exercise full control over assets and transactions, what real options are there to protect your savings?

Bank accounts can be frozen in an instant, seized by a simple government order, or drained through excessive monetary restrictions.

Gold, though it has served as a store of value for millennia, is hard to divide, inconvenient to transport, and impractical for use in urgent crisis situations.

Cash, while anonymous, is bulky, easy to confiscate, and constantly losing value due to inflation.

But Bitcoin is more than just a practical tool. It is also a peaceful form of protest; a declaration of independence from a financial system based on arbitrary power, centralization, and systemic inequality. Choosing Bitcoin means rejecting manipulation, devaluation, and surveillance. It's about reclaiming your sovereignty, securing your future, and defending your right to control your own wealth.

In this light, Bitcoin is more than technology. It's a tool of natural law, a way for individuals to assert their fundamental rights, even when those rights are denied by the laws of the land. It gives power back to the people, not through revolution, but through code.

Did you know? Bitcoin is pseudonymous, not anonymous. Users can create wallet addresses without revealing their real identity, allowing them to send and receive funds outside the traditional banking system.

However, contrary to popular belief, Bitcoin does not offer full anonymity. Every transaction is recorded on a public ledger(the blockchain) which anyone can access and verify. While wallet addresses aren't tied to names, a user's financial activity can still be traced and analyzed if proper privacy practices aren't followed.

A Solution to Monetary and Banking Corruption

Central banks, through their expansionary monetary policies, are constantly eroding your purchasing power. Through inflation and excessive money printing(often disguised as Quantitative Easing) they steadily dilute the value of the currency in circulation. This acts as an invisible tax that, year after year, diminishes the wealth of those who save in government-issued money.

Contrary to the common belief that inflation is a natural economic phenomenon, it is in fact a monetary control tool; one that slowly impoverishes the general population while benefiting those who hold financial assets.

If your wealth isn't secured in non-monetary assets(such as real estate, bonds, or stocks);your savings will inevitably lose value over time. Meanwhile, those with access to financial instruments continue to grow their wealth, widening the gap between the economic elite and the rest of society.

This isn't a flaw in the system; it's a deliberate mechanism. Central banks and governments use it to artificially stimulate economic growth and to push people toward constant consumption and increasing debt.

Our modern financial system is built on a cycle of debt; one where borrowing isn't just encouraged, it's practically unavoidable. Individuals take on loans to maintain their lifestyle, only to find themselves trapped in a system where they must repay interest to banks that create money out of thin air. This isn't accidental; it's a structural design meant to benefit financial institutions at the expense of everyday citizens.

The system is corrupted by central bank influence and their unchecked power to manipulate the monetary supply. Bitcoin is the alternative.

Unlike fiat currencies, Bitcoin is governed by rules enforced by consensus. Its supply is capped; there will never be more than 21 million bitcoins in existence (in fact, slightly fewer due to how issuance is structured). No government, central bank, or single economic actor can alter this limit.

This means Bitcoin operates under a predictable monetary framework; one where inflation is not only transparent, but designed to taper off completely once the final bitcoin is mined.

In the past, gold served as a check against unchecked monetary expansion. But since the collapse of the gold standard in 1971, no national currency(be it the dollar, euro, or yen) is backed by a tangible asset. This detachment gave central banks free rein to print money without restraint, paving the way for decades of aggressive monetary expansion, repeated asset bubbles, and recurring financial crises.

When You Deposit Money in a Bank, It's No Longer Truly Yours. Most people don't realize this: the money you hold in a bank account is technically not your property. In legal and practical terms, it's a loan you're giving to your bank; one that the bank is free to use for its own operations and investments. This system is built on blind public trust in financial institutions, but it carries serious risks:

- If your bank collapses, your money could vanish. Even with deposit insurance schemes, history has shown that these guarantees may fail during systemic crises.

- If your bank restricts access to your funds, you may be unable to withdraw or use your own money. This has happened many times; during economic meltdowns in Greece, Lebanon, and Argentina, or amid political crackdowns like the trucker protests in Canada.

Bitcoin offers a radically different mode; open, neutral, and incorruptible. Its rules are hardcoded by consensus and apply equally to all network participants.

This is where the core principle comes in: "Not your keys, not your Bitcoin." If you don't control the private keys to your bitcoins, then you don't truly own them. They're in the hands of a third party; just like fiat in a bank. But if you hold your private keys, you and you alone have full control over your funds. No institution, no government, no authority can freeze, seize, or restrict your access. This is what makes Bitcoin a powerful alternative to the vulnerabilities and overreach of the traditional financial system: monetary sovereignty.

Bitcoin: A Political Movement?

Bitcoin reshapes the balance of power between individuals and financial institutions. It empowers anyone to take full control of their money, protect their savings from inflation, and break free from the monetary restrictions imposed by states. As an open and borderless system, Bitcoin offers a fairer alternative; accessible to all, regardless of social status, nationality, or origin. To embrace Bitcoin is to choose sound money. It's a refusal to remain just another cog in the inflationary, debt-driven machinery of the current financial system. It's an act of personal sovereignty and a peaceful resistance against monetary corruption and the erosion of wealth.

Bitcoiners come from all walks of life, yet they share a common vision: a world where monetary sovereignty lies in the hands of individuals, not institutions. Among them are:

- Cypherpunks, who champion privacy and resist surveillance;

- Oppressed citizens, seeking refuge from authoritarian regimes and capital controls;

- Anarchists, who view Bitcoin as a tool for liberation from state control;

- Austrian economists, advocating for sound money and freedom from government manipulation;

- Engineers, financiers, and free speech advocates, who recognize the profound societal implications of this new monetary paradigm.

Bitcoin, by design, transcends political and ideological divides. It is not left or right, libertarian or collectivist. It is a neutral protocol, governed by rules(not ruler) applied equally to everyone. Yet its mere existence challenges the global financial status quo. Bitcoin has become a symbol of resistance because people have adopted it as an alternative to fiat currencies and centralized financial infrastructure; systems increasingly seen as unjust, manipulable, and exclusionary.

To the cypherpunk mind, Bitcoin is more than a digital asset. It stands against the steady erosion of privacy in a world where the disappearance of cash is often justified under the guise of "security." Bitcoin enables censorship-resistant, peer-to-peer digital transactions; free from intermediaries or gatekeepers. As Satoshi Nakamoto envisioned, it offers the digital equivalent of cash: a way to exchange value freely, without needing permission.

Bitcoin is not an organization or a political party, but it undeniably carries a powerful philosophical message. It redefines the relationship between the individual and the state, challenging central banks' monopoly on money creation and economic control. Whether adopted by freedom fighters or by those simply seeking to preserve their purchasing power, Bitcoin marks the beginning of a new era; one where financial sovereignty becomes a basic human right, accessible to all.

Now that we've explored the profound significance of Satoshi Nakamoto's invention, the next chapter will take us into the extraordinary industry that has grown around this protocol; an entire ecosystem reshaping finance, technology, and society.

Understanding the Bitcoin industry

Since its launch in 2009 by the pseudonymous creator Satoshi Nakamoto, Bitcoin has sparked the rise of an entirely new industry; now valued in the hundreds of billions of dollars. Despite its relatively short history, this ecosystem has experienced explosive growth, evolving at an exponential pace over the past decade. Every day, new players(ranging from institutional investors and agile startups to tech giants) pour significant capital and resources into staking their claim in this rapidly expanding sector.

Today, Bitcoin has reached a critical threshold; a point of no return. Governments, central banks, fintech corporations, and traditional financial institutions can no longer afford to ignore it. Whether through regulation, cautious adoption, or open confrontation, they now recognize Bitcoin's inevitable impact on the global economy.

The birth of a global industry

Bitcoin is a radical innovation, a leap from zero to one. It represents a total break from the traditional monetary paradigm. To some, this disruption is a threat; an existential challenge to their established power and privileges. For them, Bitcoin is a Pandora's box that should never have been opened, and they will use every means at their disposal to resist it.

Others, however, see Bitcoin as a once-in-a-generation opportunity: a tool for individual freedom, a catalyst for transforming the global financial system, and a path toward a more transparent and equitable alternative. These are the builders, adopters, and contributors(the ones shaping the future).

Bitcoin itself remains neutral. It doesn't seek permission. It doesn't ask for approval. It simply exists.

In this chapter, we'll explore the key players driving the Bitcoin industry forward. Understanding their roles, incentives, and interactions is essential to grasp the dynamics of this growing ecosystem and to better navigate the opportunities and challenges it presents.

The proliferation of altcoins

Technically speaking, creating a new cryptocurrency is incredibly easy; it can take just a few minutes and requires little to no actual innovation. The real challenge isn't in the creation, but in the value. And value, in the world of digital assets, is purely determined by the market; by the confidence and demand of its users. Back in December 2019, CoinMarketCap listed over 5,000 tokens. By 2025, that number has exploded into the millions, thanks to the rise of NFTs, decentralized finance (DeFi), and countless other applications(some legitimate, many questionable). These tokens come in all shapes and forms: some claim to be currencies, others function as securities, platform utilities, sidechains, or tokenized representations of digital art.

But let's be clear: most of these cryptocurrencies are little more than scams.. Behind the veil of flashy technology and slick branding, many of these projects are powered by aggressive marketing strategies designed to do one thing, extract your bitcoin. They play on investor greed and ignorance, spinning seductive narratives about revolutionary tech or guaranteed returns; claims that rarely hold up under scrutiny.

Of course, within this sea of noise, a small handful of projects genuinely attempt to push the boundaries. Some focus on solving real technical challenges(scalability, privacy, programmability) and may contribute valuable ideas to the broader space. It's likely that over time, a few of these experiments will lead to useful innovations

But the fundamental question remains: Can these innovations thrive outside of Bitcoin?

So far, one truth stands out: Bitcoin remains the only truly decentralized, censorship-resistant digital money, backed by a global network and growing adoption. Unlike altcoins, Bitcoin isn't propped up by centralized companies or governed by a handful of developers and early investors. It's the only project that has earned the weight of thousands of hours of research, development, and relentless refinement.

| Feature | Bitcoin | Altcoins (99.9% of them) |

|---|---|---|

| Liquidity | High | Low |

| Adoption (Real-World) | Global and growing | Very limited |

| Team | Decentralized and robust | Centralized and opaque |

| Reputation | Strong and globally recognized | Varies, often questionable |

| Infrastructure | Stable and secure | Unstable and vulnerable |

| Decentralization | Yes | Rarely |

| Scam Risk | No | Very likely |

| Real utility? | Yes | Debatable |

Be wary of misleading claims like:

- "Blockchain, not Bitcoin"

- "XRP is the next Bitcoin"

- "Libra will replace Bitcoin

- "My project is a better version of Bitcoin"

- "Central bank digital currencies will make Bitcoin obsolete"

Before investing your time or resources into any altcoin, do your own research as that's not what we're here to cover. We're here to cover Bitcoin and Bitcoin only.

Adoption by major institutions

After the ICO boom of 2017, institutions began showing serious interest in blockchain; but often without grasping what truly makes it revolutionary. Central banks and governments are now exploring Central Bank Digital Currencies (CBDCs), hoping to modernize financial infrastructure while maintaining complete control over user transactions. Projects are already underway in countries like Sweden, the EU, Russia, and China.