name: Biz School Previous Editions goal: learn the basics of Bitcoin, with particular focus on its economical rationale, historical context, social, financial and business implications. objectives:

- Master Bitcoin's economic principles and market impact.

- Explore Bitcoin-based business models and case histories.

- Cover the basics of Bitcoin tecnology from both theoretical and practical standpoints.

Welcome to the 2024 edition of the “Plan ₿ Biz School”, an annual Bitcoin centered educational program curated by Giacomo Zucco and Plan ₿ Network. With almost 102 hours of class spread across 34 lectures, this curriculum provides a comprehensive exploration of Bitcoin fundamentals and practical applications, specifically tailored for future startup entrepreneurs, business students and professionals willing to work in the growing Bitcoin ecosystem in non-technical roles: from finance to marketing, from accounting to operations, from compliance to strategy. The desired target spans from students looking into a first internship, to established professionals eager to apply their skills and knowledge in the new Bitcoin economy.

Our course features insights from world famous experts who contribute as guest lecturers, offering valuable perspectives on Bitcoin's principles and its potential impact on the global economy, beyond the hype and the buzzwords. From the theoretical understanding of the basis of the technology, to the practical exploration of tools, business cases and best practices, participants will gain a thorough understanding of this disruptive phenomenon, learning about its sociological roots, political implications, economic foundations, and business impact.

The 18 curricular lectures are in English, and were recorded from the Plan ₿ Hubs of Lugano (CH) and San Salvador (SV), while the 16 guest lectures were delivered thanks to the collaboration of the Plan ₿ Nodes, which include Turin (IT), Bangkok (TH), and Belgrade (RS). You will find all the video recordings of the 2024 edition, together with a brief text summary of what is explained by the lecturers.

We strongly invite you to also check the other half of the Plan ₿ Network educational offer, the “Plan ₿ Tech School” targeting engineers, cryptographers, computer scientists and tech focused students!

Teachers: Giacomo Zucco, Alekos Filini, Alexandre Bussutil, Rogzy, Riccardo Masutti, Marco Giorgetti, Gael Sánchez Smith, Alejandro Munoz, Ajelex, Mario Jose Flamento Riva, Adi Shankara

Guest Lecturers: Pierre Rochard, Obi Nwosu, Oleg Mikhalsk, Cathie Wood, Knut Svanholm, Allen Farrington, Jack Mallers, Elizabeth Stark, Yan Pritzker, Paolo Ardoino, Jan-Willem Burgers, Eric Yakes, Rockstardev, Stiven Kerestegian.

Note: this course is no longer available for purchase, and the 2025 BizSchool edition will be published soon. In the meantime, you can send an email to contact@planb.network to show your interest and be informed when it will be published.

School Introduction

School Introduction

Welcome to this introductory lecture on the Plan ₿ Biz School. In this session, Giacomo walks us through their journey from a traditional fiat job to becoming a leader in the Bitcoin space, and the exciting educational initiatives we will explore throughout this course.

Overview of the course

Giacomo begins by explaining how this school aims to provide a structured learning experience around Bitcoin. Starting with a background in fiat payments, the professor transitioned into the world of Bitcoin in 2013, founding several Bitcoin related ventures. Some failed, but those experiences shaped the educational approach you will benefit from in this course.

In this course, you will learn about various aspects of Bitcoin, including:

- Why Bitcoin matters

- The technical components of Bitcoin

- The cultural and business dimensions surrounding Bitcoin

Why Bitcoin?

Running a Bitcoin based business comes with its own challenges and opportunities. Sharing personal anecdotes about how abandoning blockchain buzzwords led to success in certain ventures and how important it is to deeply understand Bitcoin to avoid common pitfalls.

Education initiatives in Bitcoin

The Plan ₿ Network initiative, supported by Fulgur Ventures and Tether, is rooted in Lugano and focused on developing Bitcoin education globally. The Plan ₿ School offers comprehensive programs covering technical aspects of Bitcoin, its history, and the business side of running Bitcoin related ventures.

Conclusion

This lecture sets the stage for a deeper dive into Bitcoin's transformative potential. Stay tuned for upcoming lessons where we’ll cover a range of topics from technical skills to the broader Bitcoin ecosystem. To download this presentation slides, together with the ones belonging to the following lectures, please click here.

Why Bitcoin?

Discovery Of Money

Understanding money and Bitcoin: principles and perspectives

In this chapter, we will embark on a comprehensive exploration of the core concepts of money, beginning with its fundamental functions as recognized in classical economic theory: a store of value, medium of exchange, and unit of account. We will also delve into how these concepts align with Bitcoin and why it stands as a transformative force in modern economics. Drawing from Austrian Economics and the Cypherpunk ethos, we will assess the unique role Bitcoin plays in addressing the limitations of traditional money.

What is money?

Money, in its simplest form, is a tool used to facilitate trade and store wealth over time. It serves three primary functions:

- Store of Value: money must be able to retain value over time, allowing individuals to save and preserve wealth for future use.

- Medium of Exchange: money facilitates the exchange of goods and services by eliminating the inefficiencies of barter, such as the need for a "double coincidence of wants."

- Unit of Account: money provides a consistent measure of value, enabling individuals to compare the worth of goods and services.

Classical roots: Aristotle and the birth of monetary theory

Aristotle was one of the first to define these essential characteristics of money in ancient Greece. He recognized that, for something to function effectively as money, it must be durable, divisible, portable, and intrinsically valuable. This foundation set the stage for modern economic thought on money and its role in society.

Store of value: from gold to Bitcoin

Historically, gold has been the premier store of value due to its scarcity, durability, and intrinsic worth. Gold's limited supply ensures that it holds its value over time, even in the face of inflation or economic downturns.

- Gold as the Traditional Store of Value: gold has been used for centuries as a way to preserve wealth across generations. Its physical properties — scarcity, durability, and malleability — made it an ideal choice for this function.

- Bitcoin as Digital Gold: Bitcoin offers a modern equivalent to gold, with the added advantages of being digital and decentralized. Like gold, Bitcoin is scarce, with a capped supply of 21 million coins, making it an attractive asset for those seeking to hedge against inflation and monetary devaluation.

Why Bitcoin excels as a store of value

Bitcoin’s fixed supply means it is immune to the inflationary pressures that plague fiat currencies. Central banks, such as the Federal Reserve, can print an unlimited amount of money, thereby devaluing the currency over time. In contrast, Bitcoin’s decentralized nature ensures that no single entity can alter its supply. This scarcity, combined with its security and divisibility, positions Bitcoin as a superior store of value in the digital age.

- Comparison to Fiat Currencies: while fiat currencies like the US dollar or the Euro can lose purchasing power through inflation, Bitcoin’s fixed issuance schedule ensures long term scarcity, making it an ideal digital asset for preserving wealth.

Medium of exchange: overcoming the double coincidence of wants

In a barter system, trade is limited by the necessity for both parties to want what the other has — this is known as the "double coincidence of wants". Money solves this problem by acting as an intermediary, allowing individuals to trade freely without the need for a direct exchange of goods.

- Bitcoin as a Medium of Exchange: while Bitcoin is often criticized for its volatility, its use as a medium of exchange is growing, particularly in contexts where traditional financial systems are unreliable or overly restrictive. Bitcoin enables peer-to-peer transactions across borders without the need for a trusted intermediary, such as a bank or payment processor.

The role of technology in facilitating exchange

With the rise of Bitcoin and other cryptocurrencies, the way we think about money as a medium of exchange has evolved. Traditional financial systems rely on intermediaries—banks, payment processors, governments—to facilitate transactions. However, these intermediaries often add friction in the form of fees, delays, and censorship. Bitcoin’s decentralized protocol removes the need for intermediaries, making transactions faster, cheaper, and censorship-resistant.

- Examples of Bitcoin as a Medium of Exchange: in countries with hyperinflation or authoritarian governments, Bitcoin is increasingly being used as a medium of exchange, allowing individuals to store and transfer value without fear of government interference or currency devaluation.

Austrian economics and Bitcoin: a natural alignment

Bitcoin’s alignment with Austrian economic principles is one of its most compelling features. Austrian Economics, which emphasizes the importance of individual choice, free markets, and sound money, provides a theoretical framework that explains Bitcoin’s appeal as an alternative to government controlled fiat currencies.

Key figures in Austrian economics

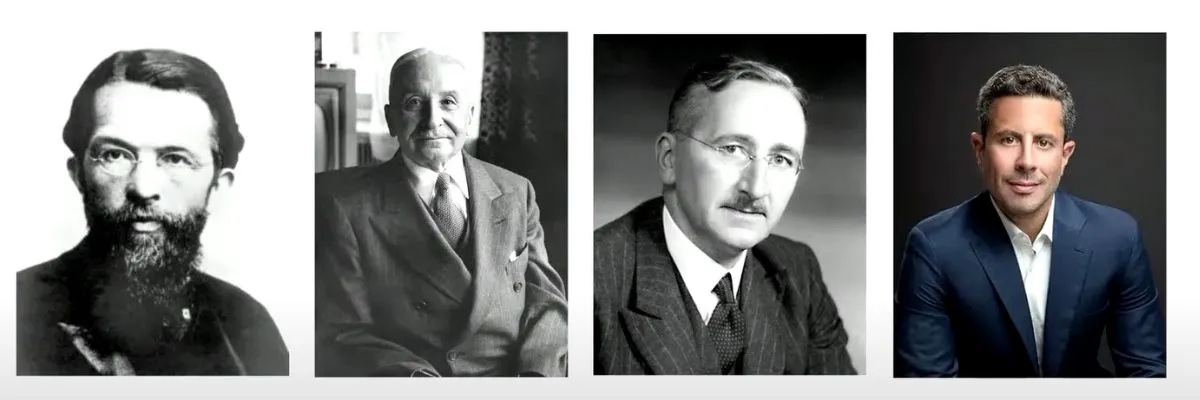

- Carl Menger: the founder of Austrian Economics, Menger introduced the theory of marginal utility, which explains that the value of goods is not intrinsic but is determined by the subjective preferences of individuals. This concept is crucial to understanding why Bitcoin, like gold, is valuable despite being intangible.

- Ludwig von Mises: mises expanded on Menger’s work with his Mises Regression Theorem, which traces the origin of money back to commodities with intrinsic value. Bitcoin, as a digital commodity, fits neatly into this framework.

- Friedrich von Hayek: hayek’s advocacy for the denationalization of money laid the intellectual groundwork for Bitcoin. He believed that money should be separated from government control to prevent inflation and preserve individual liberty.

Marginal utility and Bitcoin

The concept of marginal utility helps explain why Bitcoin is valuable despite its digital nature. Marginal utility suggests that the value of an additional unit of a good decreases as the supply of that good itself increases. Since Bitcoin has a finite supply, its marginal utility remains high, especially as more people adopt it.

Cypherpunk ideals: privacy, decentralization, and control resistance

Bitcoin is not just a product of economic theories — it is also a direct response to the ideals of the Cypherpunk movement. This movement, which emerged in the early 1990s, sought to protect individual privacy and freedom in an increasingly digital world. The Cypherpunks believed that cryptography could be a powerful tool to resist surveillance and censorship by governments and corporations.

- Founders of the Cypherpunk Movement: key figures such as Eric Hughes, Timothy May, and John Gilmore pioneered the use of cryptography to create secure, private systems for communication and commerce. Bitcoin embodies these ideals by allowing individuals to transact without revealing their identities and without relying on centralized authorities.

- Bitcoin and Decentralization: Bitcoin’s decentralized nature ensures that no single entity can control the network. This makes it resistant to censorship and manipulation, aligning with the Cypherpunk vision of a free and open internet.

Privacy as a core principle

The importance of privacy in the Bitcoin network cannot be overstated. In traditional financial systems, transactions are monitored and controlled by central authorities, which can block or reverse payments. Bitcoin, by contrast, allows for pseudonymous transactions, meaning that while all transactions are recorded on the public blockchain, users’ identities are not directly tied to their Bitcoin addresses.

- Bitcoin’s Role in Financial Sovereignty: by allowing individuals to store and transfer value without the need for a bank or government, Bitcoin provides financial sovereignty to those who may not have access to traditional financial services.

Unit of account: a new measure of value

A unit of account is a standard by which the value of goods and services can be measured. Historically, fiat currencies have served this function, providing a stable reference point for pricing goods and services. However, Bitcoin’s growing adoption and the increasing use of Bitcoin-denominated assets suggest that it may eventually serve as a global unit of account.

- The Potential for Bitcoin as a Unit of Account: although Bitcoin’s volatility currently prevents it from being widely used as a unit of account, some economists argue that as adoption increases and volatility decreases, Bitcoin could one day replace fiat currencies as the primary measure of value.

Conclusion

In this chapter, we have explored the evolution of money, from its classical functions to its modern incarnation in the form of Bitcoin. By serving as a store of value, medium of exchange, and a potential unit of account, Bitcoin represents a fundamental shift in how we think about and use money. Rooted in Austrian Economics and inspired by the Cypherpunk ethos, Bitcoin offers a decentralized, secure, and censorship-resistant alternative to traditional financial systems. As we continue to explore the world of Bitcoin, it becomes clear that its impact on economics, privacy, and individual freedom is just beginning to unfold.

Corruption Of Money

Introduction to the corruption of money

The journey of money has evolved from physical exchanges, like gold and silver, to the digital world of fiat and cryptocurrencies. However, this evolution has faced several challenges. In this chapter, we will explore the historical patterns of the corruption of money, how legal tenders have exacerbated these problems, and how Bitcoin offers a potential solution to these long-standing issues. We will break this discussion into three sections: the evolution of money, the challenges of verification and trust, and the role of Bitcoin in combating monetary corruption.

The evolution of money: from commodity to fiat

From barter to commodity money

Early civilizations struggled with the inefficiencies of barter, leading to the adoption of commodity money like gold and silver. These metals were chosen for their intrinsic value, durability, and divisibility. Over time, the need for more efficient means of trade gave rise to coinage, where trusted authorities minted coins to standardize the value of these commodities.

- Coinage and Verification: coinage introduced the concept of delegated verification. Rather than individuals needing to verify the purity and weight of gold themselves, trusted entities like temples and governments would stamp coins to certify their authenticity.

Paper money and the emergence of fiat

As economies grew, carrying large quantities of gold or silver became impractical. This led to the development of paper money and banknotes, which initially represented a claim on stored commodities. Over time, however, governments began issuing paper money without any commodity backing, giving rise to fiat currencies. Fiat money derives its value solely from government decree rather than any intrinsic value.

- Fiat and Legal Tender: the transition to fiat money was accompanied by legal tender laws, which forced citizens to accept government issued money for transactions. This created a system where governments could print money at will, leading to inflation and the erosion of the currency’s value.

The role of trust and verification in monetary systems

Delegated verification: a historical perspective

Throughout history, the authenticity of money has always required verification. In ancient times, this was done by weighing and assessing the purity of metals. As the monetary system evolved, trust shifted from the individual to institutions. For example, goldsmiths and religious institutions began issuing certificates that represented claims on gold, which could be redeemed later.

- The Problem of Trust: with fiat money, trust shifted entirely to governments and central banks, raising concerns about their ability to manage the money supply responsibly. In fact, the risks of fractional reserve banking and inflation have become more pronounced as the power to create money is concentrated in fewer hands.

The erosion of trust

As governments expanded their control over monetary systems, they began to engage in practices like seigniorage — the profit made by issuing currency at a higher value than the cost of producing it. Over time, these practices have led to the debasement of currency, where the actual value of money decreases, yet the nominal value remains unchanged.

- Fractional Reserve Banking: banks, in a bid to increase liquidity, began practicing fractional reserve banking, meaning they lent out more money than they actually held in reserves. This system has allowed banks to create money, but it also introduced systemic risks that can lead to insolvency during financial crises.

The emergence of Bitcoin: a response to monetary corruption

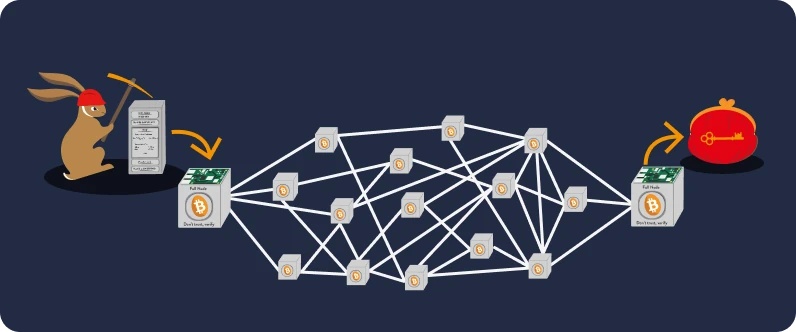

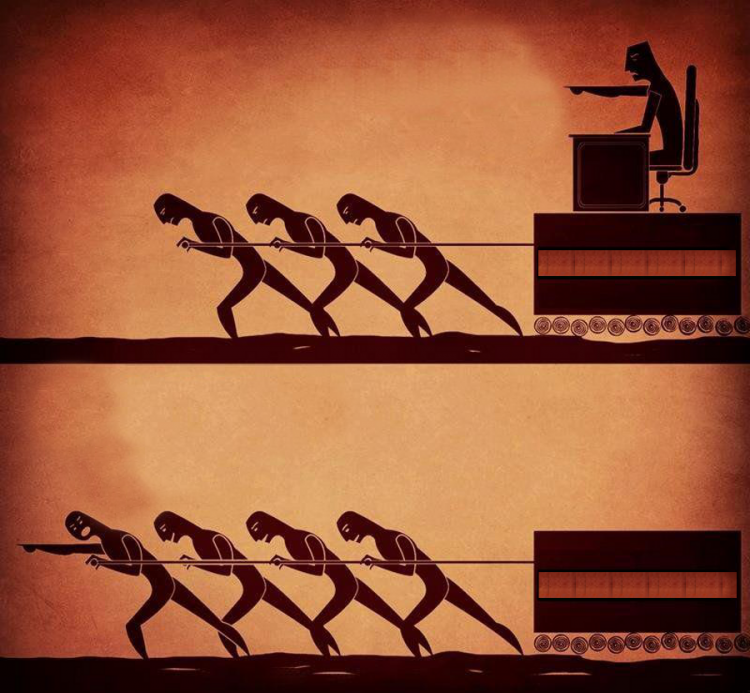

Bitcoin’s decentralized framework

Bitcoin was conceived as a decentralized alternative to traditional fiat currencies. By using a distributed ledger known as the blockchain, Bitcoin eliminates the need for trusted intermediaries like banks or governments to verify transactions. Instead, a network of nodes validates and records each transaction, ensuring transparency and security.

- Trustless Verification: unlike traditional monetary systems, Bitcoin does not require trust in a central authority. The blockchain allows individuals to verify transactions themselves, removing the need for delegated verification.

Bitcoin as a store of value and hedge against inflation

One of Bitcoin’s most significant advantages is its fixed supply of 21 million coins. This scarcity makes it a deflationary asset, contrasting sharply with fiat currencies that can be printed in unlimited quantities. As governments continue to print money, leading to inflation, Bitcoin’s value is likely to appreciate over time, providing a reliable store of value.

- De-virtualization of Money: while fiat currencies are increasingly detached from physical assets, Bitcoin represents a return to sound money principles. It operates as a form of "digital gold," offering a way to store wealth without the risk of devaluation through inflation.

Conclusion: Bitcoin and the future of money

The corruption of money through inflation, seigniorage, and fractional reserve banking has eroded trust in traditional monetary systems. Bitcoin, by contrast, offers a decentralized, transparent, and secure alternative that addresses many of the issues plaguing fiat currencies. As we continue to explore the world of Bitcoin and decentralized finance, it becomes clear that Bitcoin is not just another form of money, but it represents a fundamental shift in how we think about and use money in the modern world.

How Bitcoin? (Theoretical)

Before Satoshi

The evolution of cryptography and its role in Bitcoin

In this chapter, we will trace the foundations that led to the creation of Bitcoin. Before Satoshi Nakamoto’s whitepaper, a series of technological inventions and concepts laid the groundwork for its creation, especially those related to cryptography, digital signatures, and decentralized systems. Thus, we will explore the history and key cryptographic principles that helped make Bitcoin possible.

Cryptographic foundations

Bitcoin relies on cryptography for security, trustlessness, and decentralization. Two key types of cryptography have been essential:

- Symmetric cryptography: this system uses the same key for encryption and decryption, requiring a secure channel for exchanging keys. Though effective, symmetric cryptography has limitations, especially when secure communication channels are not possible.

- Asymmetric cryptography (public key cryptography): introduced in the 1970s, this system allows users to have a pair of keys—a public key for encrypting data and a private key for decrypting it. This breakthrough removed the need for secure channels to share encryption keys, making it possible to communicate securely over public channels.

Bitcoin makes extensive use of Elliptic Curve Digital Signature Algorithm (ECDSA), a form of asymmetric cryptography where users generate a public and private key pair. The public key is shared openly, but the private key must remain secret. These keys are critical for verifying and signing Bitcoin transactions.

Hash functions: the backbone of Bitcoin's security

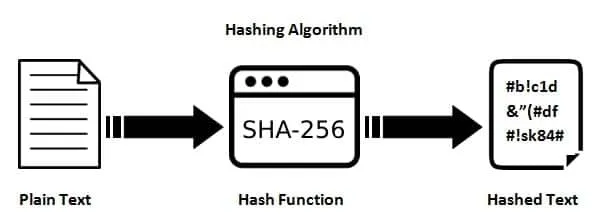

A hash function takes an input (or message) and returns a fixed length string of characters, which is typically a hash value. This way, even the smallest change in the input drastically changes the hash output, making it nearly impossible to reverse engineer the input from the output. Hash functions are integral to Bitcoin’s proof-of-work system and ensure the integrity of the blockchain.

Bitcoin uses SHA-256, a highly secure hash function developed by the NSA which has two critical properties:

- Preimage resistance: given a hash, it is computationally infeasible to determine the input.

- Second preimage resistance: it is nearly impossible to find two different inputs that produce the same hash output.

Proof-of-work: solving the double spending problem

Before Bitcoin, digital money had long struggled with the double spending problem, where the same digital token could be spent more than once. Bitcoin’s innovation was the introduction of proof-of-work (PoW), a system that requires participants to solve complex computational puzzles to validate transactions and add new blocks to the blockchain.

Proof-of-work ensures the security of the Bitcoin network by requiring miners to expend energy (via computational resources) to solve a hash puzzle. This solution deters malicious actors from manipulating the blockchain because altering any part of the chain would require recalculating the proof-of-work for all the subsequent blocks — a computationally impossible feat.

The cypherpunk movement: privacy, decentralization, and Bitcoin’s ideals

The cypherpunk movement, which emerged in the 1990s, mastered the use of cryptography to enhance privacy, resist censorship, and enable decentralized systems. Founders like Timothy May, Eric Hughes, and Nick Szabo were instrumental in shaping the ideals that would later influence Bitcoin’s creation.

One of the earliest attempts to create digital cash was Hashcash, developed by Adam Back. Hashcash was initially designed to prevent email spam by requiring proof-of-work to send messages. Although it wasn’t widely adopted for its original purpose, the idea of proof-of-work was later adapted by Bitcoin to secure transactions.

Reusable proof-of-work and the move towards decentralized digital money

The concept of reusable proof-of-work (RPoW), introduced by Hal Finney, was another step toward digital money. Finney’s system allowed proof-of-work tokens to be transferred from one person to another, mimicking the properties of cash. However, the system relied on a central server to verify transactions, which posed limitations in terms of decentralization.

Bitcoin solved this matter by eliminating the need for a trusted central authority. It combined Finney’s idea of reusable proof-of-work with a decentralized ledger (the blockchain), where all participants in the network independently verify transactions.

Smart contracts: expanding Bitcoin’s use cases

Another key precursor to Bitcoin was Nick Szabo’s concept of smart contracts: self-executing contracts with the terms of the agreement directly written into code. Smart contracts enhance the functionality of decentralized systems by enabling complex transactions, such as multi-signature accounts or escrow services, without needing intermediaries.

Szabo also proposed Bit Gold, a decentralized currency system based on proof-of-work. While Bit Gold was never implemented, it provided much of the conceptual framework for Bitcoin.

Conclusion: laying the foundation for Bitcoin

Before Satoshi Nakamoto, technologies like cryptographic signatures, proof-of-work, and smart contracts were all explored by cypherpunks and cryptographers. These concepts laid the groundwork for the invention of Bitcoin in 2009, providing the technological and philosophical foundation that has since transformed how we view money and decentralized systems.

After Satoshi

The impact of Bitcoin post Satoshi

After Satoshi Nakamoto’s groundbreaking release of Bitcoin in 2008, the cryptocurrency world evolved rapidly, with significant technological advancements and broader implications for decentralized digital currencies. In this chapter, we will explore the foundations laid by Bitcoin, the technological innovations it introduced, and the key challenges and solutions that have emerged since its inception. The "After Satoshi" era delves deep into the mechanics that ensure Bitcoin’s trustless security and how it handles challenges like scalability, privacy, and consensus.

The theoretical framework of Bitcoin

Bitcoin revolutionized the concept of decentralized finance by introducing a system that allows peer-to-peer transactions without intermediaries like banks or governments. Satoshi Nakamoto’s whitepaper introduced the framework for a system that solved the double spending problem while creating digital scarcity through proof-of-work. This section will revisit and expand on the core principles that underpin Bitcoin’s mechanics.

Time chain vs. blockchain

Contrary to modern terminology, Satoshi Nakamoto never referred to the system as a "blockchain" but rather as a "proof-of-work chain" or "chain of blocks." Even in his early code, Satoshi used the term time chain to refer to Bitcoin’s way of organizing transactions chronologically. This time based ordering is critical for ensuring the immutability of Bitcoin’s ledger and preventing double spending.

- Proof-of-Work Chain: proof-of-work ensures that transactions are verified by requiring nodes to solve complex computational problems. The solution ties the time chain, securing Bitcoin’s transaction history and making it resistant to tampering.

The global consensus mechanism

One of Bitcoin’s key innovations is its global consensus mechanism, which prevents Sybil attacks and ensures that all participants in the network agree on the order and validity of transactions. Unlike earlier systems that relied on centralized servers to verify transactions (e.g., reusable proof-of-work), Bitcoin uses a decentralized global network to validate each transaction through majority consensus.

Proof-of-work and sybil resistance

Bitcoin proof-of-work mechanism prevents Sybil attacks, where malicious actors create multiple fake identities (or nodes) to control the network. Since proof-of-work requires real computational effort, it ensures that only those who expend resources (electricity, computational power) can influence the voting process. As a result, it becomes economically impractical for an attacker to take over the network.

- 51% Attack: in a 51% attack, an aggressor would need to control more than half of the network’s computational power to manipulate the blockchain. The cost of acquiring and maintaining this amount of computing power makes such attacks nearly impossible under normal circumstances.

Global voting for double spending protection

In earlier attempts at digital currencies, double spending — where the same digital asset is spent more than once — was a persistent problem. Bitcoin solves this through a decentralized global voting system. All network participants (nodes) must agree on the validity of transactions, making it impossible for any single party to spend the same Bitcoin twice without detection.

Scalability and the challenge of growth

As Bitcoin’s network expands, so do its challenges too, particularly regarding scalability. In fact, each node in the Bitcoin network must store the entire transaction history, which grows, as more users join and transactions accumulate.

The scalability problem

Bitcoin’s decentralized structure requires that every participant in the network stores a copy of the Unspent Transaction Output (UTXO) set, a record of all unspent Bitcoins. As the network grows, the amount of data each node must store increases, leading to concerns about centralization (where only large, resource-rich participants can afford to run nodes).

- Layered Solutions: to address these issues, Bitcoin has embraced layered solutions like Lightning Network, which allows for fast, off chain transactions that don’t burden the main blockchain with additional data. Off chain solutions help reduce congestion on the primary blockchain while maintaining its decentralized principles.

Privacy concerns in a global consensus system

While Bitcoin offers pseudonymity, where public keys are not directly tied to real world identities, the permanence of the blockchain poses privacy risks. Every transaction is recorded forever, which allows for the potential de-anonymization of users through public key analysis. Privacy solutions, such as coin mixing or privacy coins like Monero and Zcash, have attempted to mitigate these risks, though they come with their own challenges.

Second layer solutions and the future of Bitcoin

As Bitcoin continues to grow, second layer solutions like Lightning Network and sidechains have emerged to enhance scalability and privacy while preserving the integrity of the core network. These layers enable faster transactions, lower fees, and more flexible use cases, all while maintaining Bitcoin’s decentralized ethos.

- Lightning Network: a second layer protocol that allows users to conduct transactions off chain, significantly reducing the load on the main Bitcoin blockchain. Transactions are settled off chain and only recorded on the main chain when necessary, enhancing scalability.

- Sidechains: separate blockchains that run alongside Bitcoin, allowing for experimentation with new features and functions without compromising the main blockchain's security.

Conclusion: Bitcoin’s evolution after Satoshi

The period after Satoshi Nakamoto’s disappearance saw rapid developments in the Bitcoin ecosystem, driven by technological innovations that addressed its limitations. Proof-of-work remains a cornerstone of Bitcoin’s security, ensuring the network’s resistance to Sybil attacks and double spending, but scalability, privacy, and decentralization remain ongoing challenges. Through layered solutions like the Lightning Network, Bitcoin is evolving to meet these demands while staying true to Satoshi’s original vision of a decentralized, trustless monetary system.

How Bitcoin? (Practical)

Basic

Let’s begin this session by exploring the foundational aspects of Bitcoin.

Essential Bitcoin knowledge and key management

In the rapidly evolving world of Bitcoin, understanding key concepts such as private keys and addresses is fundamental. These components are the cornerstone of Bitcoin ownership and transaction management, ensuring secure and verifiable exchanges of value.

- Private Keys: private keys are secret cryptographic materials that are crucial for Bitcoin ownership. They are large, hard to guess numbers, enabling the creation of the cryptographic signatures that are necessary for transaction authentication. Generating private keys requires high quality entropy to ensure security, so it's important to avoid biased random generators, which can create keys that are vulnerable to attacks. Historical incidents underscore the importance of proper entropy management like those examples.

The blockchain.info wallet weak rng issue (2013-2014)

- Blockchain.info, a popular Bitcoin wallet at the time, had a flaw in its random number generator (RNG) when generating private keys in browser-based wallets. The bug caused the wallet to sometimes generate weak keys with low entropy, making them predictable.

- Hackers exploited this weakness, brute forcing the private keys and stealing funds from affected wallets.

- This incident highlighted the importance of secure entropy sources when generating private keys, ensuring they cannot be easily guessed or reproduced.

Android securerandom bug (2013)

A flaw in the Android SecureRandom function used in Bitcoin wallets resulted in weak cryptographic signatures (nonces) when signing transactions.

This bug led to the compromise of private keys in wallets like Bitcoin Wallet, Mycelium, and others, allowing attackers to recover private keys from signatures and steal Bitcoin.

The issue was fixed, but it demonstrated how poor entropy in random number generation could compromise Bitcoin security.

Key Generation: use reputable, Open Source software for generating Bitcoin keys, ensuring high quality entropy. For those who are particularly concerned about entropy, methods like throwing dice can offer additional security, albeit with complexity.

Key Backup: always back up your keys to prevent loss due to device failure. Physical methods like paper or steel plaques are recommended, as digital backups can be vulnerable to hacking and are difficult to erase.

Security Precautions: avoid storing keys on digital media such as smartphone apps or computers, which are prone to unauthorized access. Use well-known, reputable software for key management, ensuring that backups are resistant to physical damage and security breaches.

These foundational practices are critical to securing your Bitcoin assets and ensuring safe transaction management, protecting against loss, theft, or accidental damage.

Advanced Bitcoin wallets and transaction optimization

As we advance to more complex topics, understanding Bitcoin wallets and optimizing transaction strategies becomes essential, especially for those aiming to improve efficiency and scalability in their Bitcoin usage.

BIP32 Basics: this standard allows to starts from a master seed to create a hierarchical tree structure of keys, allowing for unlimited depth in key generation. BIP32 is particularly useful for businesses that need segmented wallets for different clients without generating new keys each time.

Transaction Optimization: optimizing Bitcoin transactions involves strategies like batching to reduce fees and prioritizing transactions based on the fee per byte. Tools such as Partially Signed Bitcoin Transactions (PSBT) facilitate secure transaction transfers between different wallet applications, enhancing interoperability.

UTXO Management: unspent Transaction Outputs (UTXOs) are critical to transaction management. Avoid creating dust UTXOs, as they may cost more in fees than their value. Use wallets that minimize UTXO fragmentation and consider full UTXO usage when transferring funds to an exchange to avoid creating change.

Mastering these advanced aspects of Bitcoin wallet management and transaction optimization will not only enhance security but also improve the efficiency of your Bitcoin operations, allowing for more sophisticated use of digital assets.

Security practices and privacy considerations in Bitcoin usage

When using Bitcoin, both security and privacy are paramount, due to its decentralized and pseudonymous nature. Protecting your funds and personal data from potential risks requires a deep understanding of the following practices.

Security practices

To mitigate the risk of losing Bitcoin due to private key exposure, advanced security strategies like Shamir Secret Sharing and multi-signature setups can be employed. These methods distribute the control of private keys among multiple trusted parties, preventing a single point of failure. Hardware wallets also offer robust security through offline key storage, although users must carefully consider the potential risks related to the trustworthiness of the hardware vendor.

Privacy considerations

Using third party blockchain explorers or services can compromise privacy, as these services may collect identifiable user data. To mitigate this, running a personal Bitcoin node or using privacy enhancing tools such as Tor can anonymize your IP address, reducing the chances of your identity being linked to your Bitcoin transactions.

Wallet types

Bitcoin users must choose between two main types of wallets: software wallets (hot wallets), which offer greater convenience but are more vulnerable to hacking, and hardware wallets, which are more secure as they store private keys offline. Balancing security and convenience is crucial, depending on your specific threat model and how frequently you need to access your Bitcoin.

Advanced features

For those dealing with high value transactions or more complex business needs, advanced features like Miniscript (a simplified scripting language) and time locks can add layers of security and control over how and when Bitcoin transactions are executed. These tools are invaluable for establishing complex spending policies without sacrificing security.

By adhering to these security and privacy best practices, you can better safeguard your Bitcoin holdings and ensure that your transactions remain both secure and private, reducing the risk of unauthorized access or data breaches.

Conclusion

This concludes the lecture on Bitcoin’s essential knowledge, key management, wallets, and security practices. In the next one, we will move into more technical aspects, such as running a Bitcoin node and connecting wallets to the network. Feel free to share your thoughts or ask any questions, as we aim to build your understanding progressively through each step of this series. Thank you for your participation, and we look forward to continuing this journey together.

Intermediate

Lecture on Bitcoin node setup and multisig configuration

Welcome to today's comprehensive lecture on setting up a Bitcoin node and configuring multisig wallets. Led by Alekos Filini, this session is designed to provide a hands on experience, guiding participants through the practical steps of creating a Bitcoin Core node and integrating it with a multisig wallet using Specter. This interactive session aims to blend theoretical concepts with live demonstrations, offering participants the opportunity to engage directly with the material.

We invite you to follow carefully the video of our lecturer to successfully complete the installation.

content overview

This lecture is structured to provide a complete walkthrough of setting up a Bitcoin Core node and utilizing it with a multisig wallet configuration, and it is divided into several key components:

- Bitcoin Core Node Setup: this section covers the installation and configuration of a Bitcoin Core node from scratch, emphasizing manual setup to ensure a thorough understanding.

- Integration with Specter Wallet: after establishing the node, the focus shifts to installing and configuring Specter, a desktop wallet that supports multisig options. This process includes best practices for security measures like signature verification and hash validation, crucial for maintaining network integrity.

practical setup of a Bitcoin core node

To ensure participants gain real world experience, the practical segment simulates a Bitcoin node setup in a Linux environment, using a virtual machine that mimics setups like Raspberry Pi or dedicated Linux hardware. Here's a breakdown of the process:

linux command essentials

Understanding basic Linux commands is foundational for managing a Bitcoin node. This section introduces participants to:

- File and Directory Management: using commands like

cd(change directory),ls(list files),mkdir(make directory),cp(copy files), andmv(move files) to navigate and organize the Linux environment. - Administrative Tasks: commands such as

sudo(superuser do) for executing administrative tasks, essential for managing permissions and system configurations. - Advanced Operations: in depth commands for user creation,

ownership adjustments, and file handling, including

useradd(add user),chown(change ownership),tar(archive files),wget(download files),GPG(GNU Privacy Guard for cryptographic verification), andSHA-256 SUM(checksum verification).

node configuration and setup

Participants will manually configure their Bitcoin Core node, walking through these critical steps:

- User and Directory Setup: create a dedicated user for running the Bitcoin node, isolating it from other system processes for added security.

- Data Directory Preparation: set up the Bitcoin Core’s data directory, organizing it for optimal performance and future expansion.

- Downloading and Verification: securely download Bitcoin Core from the official website and verify its authenticity using cryptographic tools like GPG and SHA-256, ensuring the integrity of the installation package.

- Configuration Adjustments: modify the Bitcoin Core configuration file to set up RPC (Remote Procedure Call) authentication, adjust network settings, and define node behavior. These configurations ensure the node operates securely and aligns with best practices.

- System Service Setup: configure Bitcoin Core to run as a system service, enabling it to start automatically on boot and ensuring continuous uptime.

integrating wallets and multisig configuration with specter

Once the Bitcoin Core node is operational, participants will proceed to connect it with a secure wallet setup using Specter, focusing on multisig configurations:

wallet setup and security measures

- Specter Installation: download and install Specter Desktop, ensuring it connects seamlessly with the Bitcoin Core node. This software acts as an interface for managing keys, addresses, and transactions.

- Hardware Wallet Integration: participants will learn to link hardware wallets (e.g., Jade) with Specter, creating a secure environment for managing private keys. This integration adds an essential layer of security, ensuring sensitive data remains protected.

- Public Key Management: properly manage and export public keys to facilitate multisig operations, understanding how they contribute to overall wallet security.

creating and managing multisig wallets

The multisig setup is a critical part of the session, emphasizing the importance of multiple signatures for transaction authorization. Here below is what participants will do:

- Generate Multisig Addresses: learn how to create multisig addresses, setting up wallets that require multiple private keys for transaction approval.

- Security Best Practices: back up configuration data, store keys securely, and implement procedures for data recovery in the case of loss. This segment highlights the importance of redundancy and secure backup in Bitcoin operations.

- Transaction Creation and Verification: explore how to create, sign, and verify multisig transactions using Specter, ensuring accuracy and compliance with Bitcoin’s decentralized principles.

advanced practical activities

To reinforce the session's concepts, participants will engage in advanced group exercises that simulate real world scenarios. These activities will test their understanding of node management, multisig wallet configurations, and transaction security.

Collaborative exercises

- Group Work with “Elephant” Tool: in teams, participants will use the web based "Elephant" tool to create and manage complex multisig setups. This exercise aims to enhance their grasp of Bitcoin scripting capabilities and how advanced spending policies can be enforced.

- Multisig Transactions and Recovery: each group will simulate a scenario involving the creation of multisig wallets, validation of transactions, and the recovery process if a key is lost. These activities emphasize teamwork and effective communication, mirroring professional Bitcoin operations.

troubleshooting and optimization

Participants will face common challenges encountered during node setup and multisig configuration. This troubleshooting segment focuses on practical solutions, teaching participants to resolve connectivity issues, transaction errors, and data synchronization problems efficiently.

conclusion

By the end of the lecture, participants will have a comprehensive understanding of Bitcoin's infrastructure, from setting up a node to managing multisig wallets. They will leave with practical experience, capable of operating within Bitcoin’s ecosystem securely and confidently. This hands on knowledge not only demystifies Bitcoin technology but also empowers students to participate actively in the world of decentralized finance.

This session is designed to be both instructional and interactive, with ample opportunities for hands on practice, group collaboration, and in depth exploration of Bitcoin's capabilities. Participants are encouraged to continue experimenting with the tools and techniques covered in the session, both independently and in collaborative environments, to solidify their skills and contribute to the broader Bitcoin community.

Bitcoin Myths Debunked

Bitcoin "Maximalism"

Lugano, Switzerland dac3b166-31ef-41f3-bfef-6e9d3855c12c

Introduction to Bitcoin maximalism

Bitcoin Maximalism is more than a simple preference for Bitcoin over other cryptocurrencies — it is an ideology grounded in the belief that Bitcoin is the only cryptocurrency that truly matters. Maximalists see Bitcoin as superior due to its decentralized structure, its fixed supply of 21 million coins, and its unique ability to act as a hedge against inflation. This chapter delves into the historical, cultural, and economic factors that have shaped Bitcoin Maximalism, and explores why its proponents believe that Bitcoin is the best, and perhaps the only, viable long term cryptocurrency.

The origins and growth of Bitcoin maximalism

The term Bitcoin Maximalism originated outside the Bitcoin community as a way to describe what outsiders perceived as an overly zealous focus on Bitcoin. However, over time, the term was embraced by the Bitcoin community itself. Central to this ideology is the belief that Bitcoin's decentralization, immutability, and scarcity make it fundamentally different from — and superior to — all other cryptocurrencies.

Bitcoin's mathematical scarcity (with a cap of 21 million coins) makes it a unique digital asset, setting it apart from fiat currencies, which can be printed at will, and from altcoins, which can be created infinitely. This scarcity makes Bitcoin the only truly sound money in the cryptocurrency space}.

Cultural and social significance

Bitcoin Maximalism is rooted in more than just technology. It is tied to a broader cultural skepticism of centralized authority and a belief in the importance of individual sovereignty. Many Bitcoin maximalists are staunch advocates of financial privacy, decentralization, and self-sovereignty. They see Bitcoin as the ultimate tool for empowering individuals by giving them control over their own wealth, free from the influence of governments and banks.

Criticism of altcoins

A key aspect of Bitcoin Maximalism is its rejection of altcoins, which are often referred to derisively as shitcoins. This derogatory term stems from the belief that altcoins are either unnecessary clones of Bitcoin or outright scams designed to enrich their creators at the expense of users. Maximalists argue that any innovation purportedly brought by altcoins can be better implemented on Bitcoin’s existing infrastructure without the need for a separate token.

Historical parallels: the protocol wars

The Protocol Wars of the 1970s to 1990s — debates over the best communication protocol for the Internet — offer a striking parallel to the current competition between Bitcoin and altcoins. Just as the TCP/IP protocol eventually emerged as the dominant standard for the Internet, Bitcoin maximalists believe that Bitcoin will be the dominant protocol for decentralized money.

During the Protocol Wars, competing models like the OSI (Open Systems Interconnection) were bureaucratic and inefficient, while TCP/IP was simpler, more adaptable, and decentralized. In the same way, maximalists argue that Bitcoin's simplicity and decentralization will make it the ultimate standard, while altcoins will fade into obscurity as inefficient, over engineered alternatives.

Bitcoin as the dominant protocol

Bitcoin is seen as not just another cryptocurrency but as the base layer for a new global financial system. Maximalists believe that Bitcoin's first mover advantage, network effects, and hard cap of 21 million coins give it a near insurmountable lead over other cryptocurrencies. Altcoins, in contrast, are seen as redundant at best and fraudulent at worst, with most serving no real purpose other than speculative profit for their creators.

Network effects and the future of money

The power of network effects is crucial to understand Bitcoin's dominance. In fact, as more people use Bitcoin, its utility increases, making it more valuable and reinforcing its position as the dominant cryptocurrency. This trend mirrors the adoption of TCP/IP during the early days of the Internet. Once a network achieves critical mass, it becomes nearly impossible for competitors to displace it without offering a dramatically better alternative. Bitcoin maximalists argue that no altcoin has offered improvements significant enough to challenge Bitcoin’s dominance:contentReference[oaicite:6]{index=6}:contentReference[oaicite:7]{index=7}.

Philosophical underpinnings

Maximalists also emphasize the philosophical purity of Bitcoin’s creation. Bitcoin was launched without any pre-mined tokens or initial coin offerings (ICOs), meaning that its creator, Satoshi Nakamoto, had no financial incentive other than building a decentralized monetary system. In contrast, many altcoins usually are launched with pre-mines or ICOs, enriching their founders and early investors, which corrupts the purpose of a decentralized currency, as maximalists argue.:contentReference[oaicite:8]{index=8}:contentReference[oaicite:9]{index=9}.

Conclusion: why Bitcoin alone matters

Bitcoin Maximalism is based on the belief that Bitcoin, with its decentralized, immutable, and scarce nature, is the only cryptocurrency capable of truly revolutionizing the global financial system. Other cryptocurrencies, according to maximalists, distract from the Bitcoin mission by creating confusion and diluting the principles of sound, decentralized money. For maximalists, Bitcoin is not just the best cryptocurrency — it is the only one that matters:contentReference[oaicite:10]{index=10}.

Bitcoin Criticisms

Introduction to the criticism of Bitcoin

Bitcoin has faced a wide range of criticism over the years, ranging from its environmental impact to its use in criminal activities. In this chapter, we delve into the most common critiques leveled against Bitcoin, addressing their validity and exploring the counterarguments often made by Bitcoin proponents. These types of criticism are important to understand, as they reveal the external challenges and misconceptions Bitcoin faces on its journey to widespread adoption.

Environmental criticism: pollution and energy usage

One of the most common criticism of Bitcoin is its energy consumption. Bitcoin mining, the process by which new coins are created and transactions are validated, uses substantial computational power, which in turn consumes large amounts of electricity. Critics argue that this contributes to global pollution, especially when the energy used comes from non-renewable sources.

Energy consumption in perspective

To fully assess the environmental impact of Bitcoin, it is crucial to understand that energy consumption is not inherently bad. Bitcoin actually uses less than 1% of the world's energy extraction, and much of the energy consumed is renewable or otherwise wasted energy. In fact, Bitcoin miners often utilize energy sources that would otherwise go unused, such as stranded or flared natural gas. This feature makes Bitcoin's energy consumption more efficient than critics suggest:contentReference[oaicite:0]{index=0}:contentReference[oaicite:1]{index=1}.

Bitcoin's consumption must also be compared to the energy use of traditional financial systems. The banking sector, with its extensive infrastructure, ATMs, branches, and data centers, uses far more energy. Furthermore, the U.S. military, which underpins the global financial system, is one of the largest consumers of fossil fuels on the planet. In comparison, Bitcoin offers a far more efficient alternative for securing and transferring wealth:contentReference[oaicite:2]{index=2}:contentReference[oaicite:3]{index=3}.

Crime and illicit activity

Another major criticism of Bitcoin is its association with criminal activities. Since Bitcoin transactions offer a degree of pseudonymity, critics claim that it is used for money laundering, drug trade, and even terrorism financing.

The reality of Bitcoin and crime

While it is true that Bitcoin has been used in illegal transactions, its traceability actually makes it less ideal for criminal enterprises. In fact, every Bitcoin transaction is recorded on the blockchain, a public ledger that allows for the tracking of funds, and law enforcement agencies have successfully traced and seized illicit Bitcoin in numerous cases, debunking the myth that Bitcoin is untraceable:contentReference[oaicite:4]{index=4}.

In contrast, traditional fiat currencies like the U.S. dollar remain the most widely used for large scale crime. Cash transactions, in particular, are anonymous and nearly impossible to trace. Bitcoin, by comparison, can reduce crime through smart contracts and multi-signature transactions, which require multiple parties to approve a transaction, thus offering more security:contentReference[oaicite:5]{index=5}.

Technical shortcomings and scalability

Bitcoin also faces technical challenges, particularly around scalability and transaction throughput. The Bitcoin network can only process a limited number of transactions per second, which some critics claim is insufficient for a global currency. Moreover, transaction fees can increase during times of high network usage, further limiting Bitcoin’s scalability as a medium of exchange.

Layered solutions to scalability

To address these issues, Bitcoin developers have proposed and implemented second layer solutions such as the Lightning Network. Lightning Network allows transactions to be conducted off chain, reducing the load on the main Bitcoin blockchain while enabling faster and cheaper transactions. By utilizing these second layers, Bitcoin can maintain its security while vastly improving scalability:contentReference[oaicite:6]{index=6}:contentReference[oaicite:7]{index=7}.

Cultural criticism: toxicity and exclusivity

Bitcoin’s culture has also been a target of criticism. Some describe the Bitcoin community as toxic due to its often harsh and direct communication style. This stems from Bitcoin’s roots in the cypherpunk movement, which prioritized privacy, security, and ideological purity over widespread adoption. The term "toxic maximalism" is often used to describe Bitcoiners who reject all other cryptocurrencies and aggressively defend Bitcoin's principles.

Embracing criticism for progress

While the toxicity criticism is valid in some respects, the blunt nature of Bitcoin debates stems from the desire to protect Bitcoin’s fundamental principles. In the Open Source community, rigorous scrutiny and direct communication are seen as essential for ensuring the integrity of the project. Many in the Bitcoin community believe that this cultural characteristic is what keeps Bitcoin free from dilution by corporate or governmental interests:contentReference[oaicite:8]{index=8}:contentReference[oaicite:9]{index=9}.

Conclusion: understanding Bitcoin's criticism

Bitcoin faces a broad range of criticism, but many of them are based on misunderstandings or misinterpretations of the technology. Whether it's energy consumption, criminal activity, or scalability, Bitcoin’s critics often overlook the solutions being developed to address these concerns. By acknowledging and addressing these criticisms, the Bitcoin community can continue to improve and evolve the technology, ensuring its place in the future of global finance:contentReference[oaicite:10]{index=10}:contentReference[oaicite:11]{index=11}.

Business Projects

Bitcoin Business Models

The course began with a focus on the foundational concepts of Bitcoin through the modules "Why Bitcoin," "How Bitcoin," and "Bitcoin Myth Debunked." These modules provided a strong theoretical and practical understanding of Bitcoin, exploring the key mechanisms that make it function and debunking common misconceptions about the technology.

Transition to business applications

Now, as we move into the next phase of the course, our focus shifts from understanding Bitcoin’s mechanics to applying it in real world business contexts. This transition marks a critical point in the course where students begin to explore how Bitcoin can be integrated into business models. The goal is to equip students with the skills to use Bitcoin as a tool for solving business challenges and fostering innovation.

Introduction to advanced topics

To complement the business focused modules, students will have the opportunity to participate in the PlanB Tech School, which will delve deeper into technical topics such as coding, cryptography, and Bitcoin development. As a consequence, by combining both business and technical knowledge, students will have a well rounded understanding that prepares them for a range of career opportunities within the Bitcoin ecosystem.

Group formation and project assignments with industry participation

Formation of student groups

A key component of this phase is the formation of student groups. Each group will consist of three members, a size that encourages collaboration and ensures active participation from all members. This structure also allows for dynamic decision making, as smaller groups tend to function more efficiently in problem solving and project execution.

Project assignments from leading Bitcoin companies

The projects assigned to each group are sourced from leading companies in the Bitcoin ecosystem, including Full Group Ventures, Tether, Bitfinex, Satsbeq, Lipa, and Breeze. Each company has provided real world business challenges, giving students the opportunity to apply their knowledge to current industry needs. These assignments vary in complexity and scope, allowing students to choose projects that align with their strengths and interests.

Timeline and submission requirements

The projects come with a tight timeline, as students will have approximately two months to complete their assignments. Each group will submit their project to the mentors for review, with a maximum of seven submissions accepted per assignment. This competitive element ensures that students put forth their best efforts, knowing that their work will be evaluated by industry professionals who are actively involved in the Bitcoin space.

Bitcoin and the evolution of decentralized systems

Evolution of the blockchain use cases

Blockchain has undergone a significant evolution from being a mere buzzword to becoming a core technology in decentralized systems. In the early stages, the term "blockchain" was often misused as an “excuse” to gain legitimacy for projects that didn’t require it. However, as the industry matures, the blockchain is now being applied in more meaningful ways, particularly in decentralized finance, identity management, and secure transactions.

The role of consensus mechanisms

An important part of understanding Bitcoin’s and blockchain’s role in decentralized systems is the distinction between consensus mechanisms, specifically proof-of-work (PoW) and proof-of-stake (PoS). While many assume that PoS is inherently cheaper than PoW, both mechanisms come with their own energy costs, which are essential for maintaining network security. Understanding the role of energy consumption in these systems is crucial for evaluating their long term viability.

Open source and Bitcoin’s influence

Blockchain’s rise can be attributed in large part to Bitcoin’s Open Source roots. Licensed under MIT, Bitcoin’s Open Source nature has allowed it to influence numerous industries, particularly banking and finance. However, many businesses have rushed to adopt the blockchain technology without fully understanding its limitations. As a result, some have applied the blockchain where simpler, centralized systems would suffice, missing the true value that decentralization can bring.

Smart contracts and digital identity systems

One of the most promising areas of blockchain application lies in the use of smart contracts and digital identity systems. Smart contracts allow for automated, transparent transactions without the need for intermediaries, while digital identity systems offer individuals greater control over their personal information. These decentralized systems empower users by reducing reliance on centralized authorities, although challenges remain in ensuring true decentralization in practice.

Conclusion: business models

As we move forward, it’s important for students to critically assess the use of blockchain and Bitcoin in various industries. By understanding both the potential and the limitations of these technologies, students will be better equipped to contribute meaningfully to the next generation of decentralized applications. This course aims to provide the tools and knowledge necessary to harness these innovations for business growth and societal impact.

Business Projects Assignment

Welcome, to this comprehensive lecture for Business Projects Module. Today, we will delve into three primary themes: assignment Guidelines and Group Formation, Case Studies and Company Involvement, and Sustainable Energy and Bitcoin Mining. These sections are designed to provide essential insights to guide you through your assignments and projects.

These themes were part of the nominations for Biz School 2024, and while we encourage you to watch the video for additional learning and insights, please note that the assignments and group formations discussed have already been finalized. They should not be considered as a template or basis for future editions of Biz School, as each year’s structure and requirements are tailored to reflect evolving educational goals and industry trends. We hope this content serves as a valuable resource to enhance your understanding, but always refer to the latest guidelines provided for your specific cohort.

Company specific assignments

Fulgur Ventures: groups will perform market research on one of Fulgur's portfolio companies, focusing on target markets, revenue streams, and long term exit strategies. Lipa: groups will investigate how banks have adapted to Bitcoin over the last five years, assessing their services and attitudes towards Bitcoin integration Breeze: known for its non custodial mobile wallets and Lightning Network integration, Breeze’s assignment focuses on conducting market research to identify how P2P technologies could benefit from their software development kit (SDK). Bitfinex: bitfinex is seeking help in marketing and community building strategies for their RGB protocol, which allows Bitcoin based tokenization.

Bitcoin Business Cases

Mining And Energy

The Bitcoin ecosystem operates at the intersection of mining, energy consumption, and economic models, creating a dynamic and evolving landscape. As Bitcoin has grown in prominence, so too has the scrutiny on the environmental and economic implications of its mining process. The following discussion delves into the key aspects of Bitcoin mining, from the energy demands and technological advancements, to the business models that sustain it, offering a comprehensive look at the factors that shape its role in the global economy.

Mining and energy in the Bitcoin ecosystem

The Bitcoin ecosystem represents a complex interplay between mining activity and energy consumption. As Bitcoin popularity has grown, the balance between mining operations and energy sources has become a central topic of discussion and innovation. This lecture explores the mining process, its energy implications, and its critical role within the Bitcoin ecosystem, drawing on insights from experts involved in energy utilities and ventures.

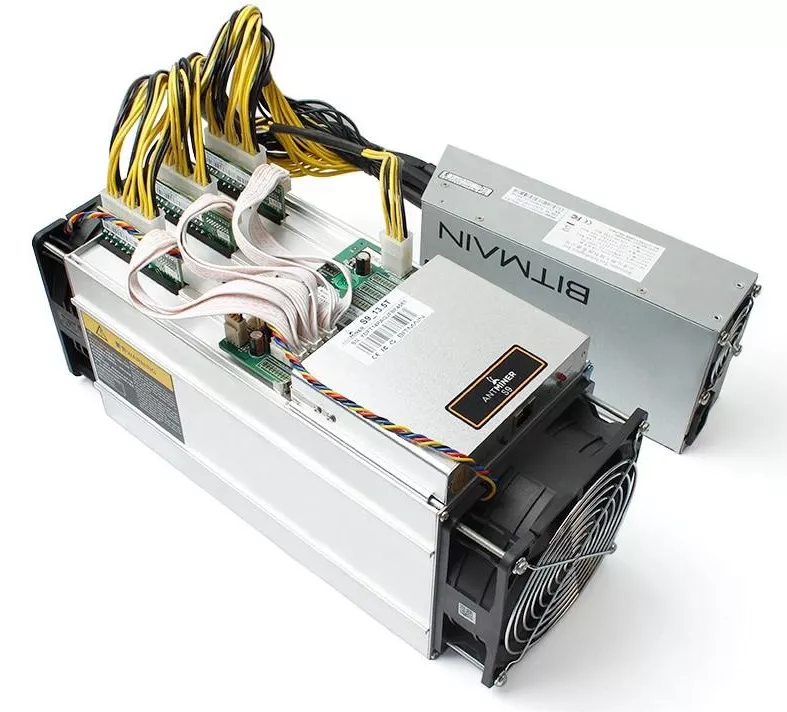

The Mining Process is the backbone of Bitcoin, as it enables the addition of transactions to the blockchain. The process involves solving complex computational problems using SHA-256 hash functions, typically performed by ASICs (Application Specific Integrated Circuits). Like other energy intensive industries, such as data centers or steel production factories, Bitcoin mining requires significant energy resources.

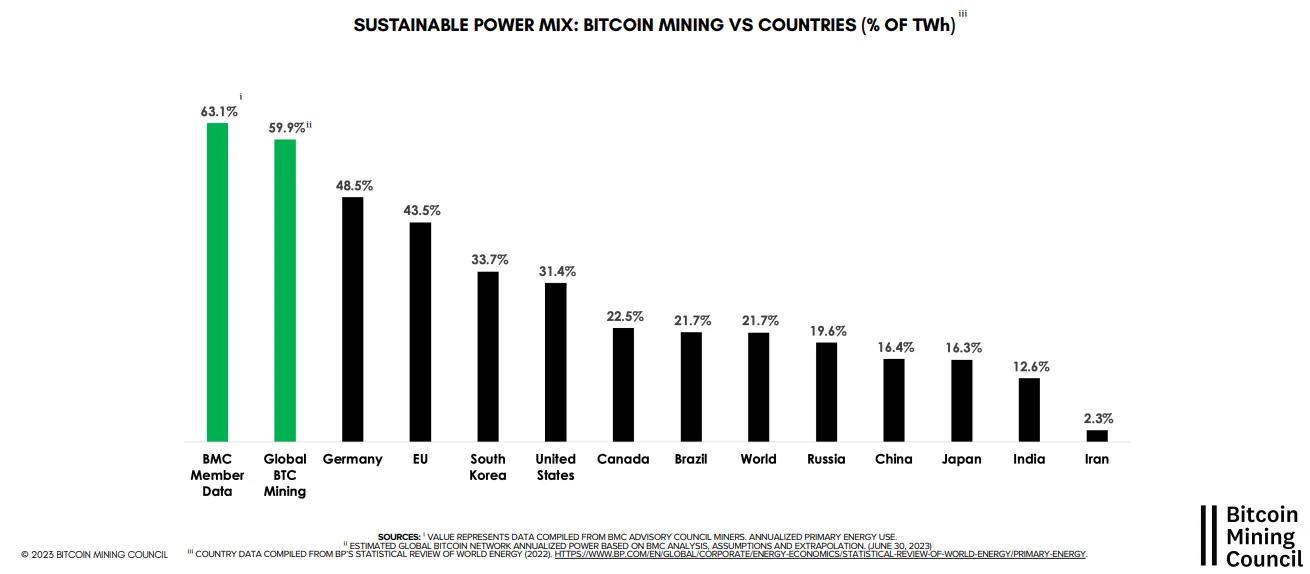

Energy Considerations: Bitcoin mining’s energy demand has sparked global debate, particularly concerning its environmental impact. Critics point to the high electricity consumption, especially when powered by non renewable sources such as coal. However, approximately 60% of Bitcoin mining is now powered by sustainable energy sources, including hydroelectric and geothermal energy, as evidenced by Iceland's distinct energy mix (watch the video at around 1:00:00 to know more).

- Graph: Comparison of sustainable energy usage in Bitcoin mining vs. countries, showing Bitcoin Mining Council members leading with 63.1%

Understanding the energy dynamics of Bitcoin mining is vital for recognizing its future role in the global economy. While its energy use is substantial, the industry is progressively incorporating more renewable energy sources, which offer many environmental advantages.

The economics and business models of Bitcoin mining

The economics of Bitcoin mining encompass diverse business models and market strategies, reflecting the multifaceted nature of the technology. This section explores these economic dimensions, providing insights into how mining operations are structured and sustained financially.

Economic Models: Bitcoin mining involves significant capital expenditure (CAPEX) and operating expenses (OPEX). Mining profitability is driven by factors such as electricity costs, equipment efficiency, and market conditions. The cyclical nature of the industry—marked by periods of bull and bear markets—requires strategic investment and operational readiness to maintain profitability over time.

Business Models: several business models have emerged within the Bitcoin mining sector. Self-miners own and manage their hardware and obtain the rewards directly, while hosting services provide infrastructure management for a fee. Mining pools play a central role, pooling computational power to increase the likelihood of earning rewards and providing more stable income streams for participants.

As the industry evolves, these business models adapt to market trends and technological advancements, shaping the landscape of Bitcoin mining and its economic impact.

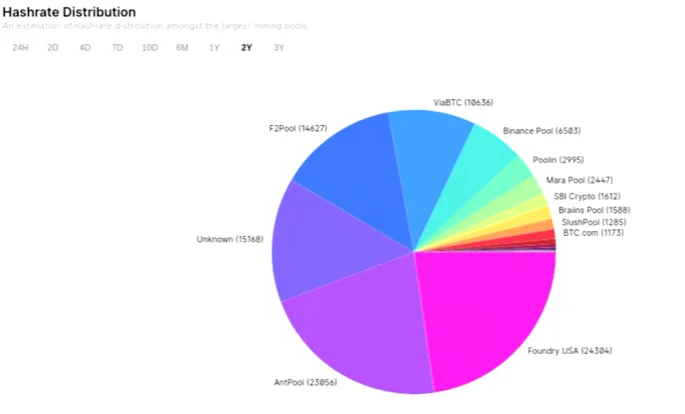

- Graph: Pie chart showing the hash rate distribution among major Bitcoin mining pools over a 2 year period, with Foundry USA and AntPool leading.

Environmental and technological impacts of mining

Mining has both environmental and technological impacts that influence the ecosystem and broader environmental policies. This section examines these effects and highlights potential solutions and innovations within the mining industry.

- Environmental Impacts: concerns surrounding Bitcoin mining are often tied to its energy consumption and associated carbon footprint, particularly in regions that rely heavily on coal powered electricity. However, growing efforts to integrate renewable energy sources, such as flared gas and hydroelectric power are positioning Bitcoin mining as a forward thinking energy consumer, offering innovative solutions to traditional energy use.

- Technological Impacts: technological advances in mining equipment have significantly increased efficiency over time. The shift from early CPU-based mining to the use of highly specialized ASICs has industrialized the process, making it both capital and energy intensive. Additionally, the development of supporting infrastructure, such as data centers and energy grids, has had a significant impact on the technological landscape surrounding mining operations.

Cryptocurrency mining continues to present both challenges and opportunities in the environmental and technological arenas. By adopting sustainable practices and leveraging technological innovations, the industry can reduce its environmental footprint while pushing the boundaries of mining efficiency and scalability.

Conclusion

The Bitcoin ecosystem is deeply intertwined with mining, energy, and economics: each one is playing a critical role in its overall growth and sustainability. Understanding these aspects is essential for those engaging with or contributing to this transformative technology.

Lightning And Open Source

The Lightning network: enhancing Bitcoin's scalability

One of the primary challenges of Bitcoin is its scalability. With a transaction capacity of only about seven transactions per second, compared to traditional payment systems like Visa or MasterCard, Bitcoin's utility as a medium of exchange has been limited. The Lightning Network, a layer two solution, addresses this limitation by enabling fast, low-cost payments between nodes. By creating off chain transaction channels, Lightning Network facilitates numerous transactions with minimal fees before final settlement on the Bitcoin blockchain. This solution not only enhances transaction speed but also significantly reduces costs, making microtransactions feasible.

Entrepreneurial opportunities

The interplay between AI and Lightning Network presents new entrepreneurial opportunities. With AI's capabilities in data analysis and automation, innovative services can be developed to optimize Lightning Network efficiency and user experience. These emergent business models can revolutionize the way transactions and related services are executed, offering unique value propositions in the financial technology landscape.

The Open Source movement and its impact on technology

Historical context and evolution

The Open Source movement, deeply rooted in the principles of transparency and community collaboration, has significantly shaped modern technology. It began as a counter movement to proprietary software, championed by figures like Richard Stallman, who founded the Free Software Foundation (FSF) in the 1980s. The FSF advocated for software freedom, encapsulated in the concept of "free software," which emphasized the freedom to study, modify, and distribute code.

Impact of free and Open Source Software (FOSS)

The impact of free and Open Source software (FOSS) on technology is profound and multifaceted. Major projects like Linux, Apache, and Bitcoin itself exemplify the transformative power of Open Source development. These projects illustrate how open collaboration can lead to robust, secure, and innovative solutions. The Open Source model fosters an environment where developers can freely contribute, leading to a diverse range of perspectives and solutions.

Licensing and business models

Open Source software employs various licenses, such as the GPL, MIT, and newer models like BSL, which balance openness with commercial strategy. Business models in the Open Source realm are diverse, ranging from the OpenCore model to SaaS and marketplace platforms. Companies like Red Hat have demonstrated profitability through service based models, proving that Open Source can be both sustainable and lucrative.

Technological and market impact

Open Source software has become integral to the tech industry, prevailing in DevOps, IT operations, and data analytics. It promotes healthy market competition and transparency, enabling developers to build on existing solutions and to innovate freely. The Open Source ethos supports technological advancements by facilitating integration and interoperability through open APIs and collaborative development.

Bitcoin's scalability and the role of the Lightning Network

Scalability challenges and solutions

Bitcoin's scalability has been a persistent challenge due to its limited block size and transactional throughput. Two primary approaches have emerged: increasing the block size, as seen with Bitcoin Cash, or optimizing transactions through solutions like SegWit and the Lightning Network. The latter has been more widely adopted, focusing on layer two solutions to enhance scalability without altering the core Bitcoin protocol.

The Lightning Network's role

The Lightning Network stands out as a pivotal solution to address Bitcoin's scalability issues. By facilitating off chain transactions, it significantly boosts the network's capacity, enabling high speed, low cost payments that are settled on the main blockchain only when necessary. This feature not only alleviates network congestion, but also expands Bitcoin's usability for everyday transactions.

Challenges and future developments

While Lightning Network offers substantial improvements, it comes with its own challenges. Issues like the requirement for nodes to be online for receiving payments and the complexity of channel management need addressing. Future developments, such as integrating client side validation and exploring additional layers like RGB and Taproot Assets, all aim to further enhance Bitcoin's scalability, privacy, and functionality.

Conclusion

Bitcoin, as both a protocol and an asset, continues to evolve within the framework of Open Source collaboration and innovation. Lightning Network exemplifies how layered solutions can address inherent limitations, paving the way for Bitcoin's broader adoption and integration into global financial systems. As the Open Source movement continues to influence technological development, Bitcoin's role in shaping the future of digital transactions remains significant, offering a glimpse into a decentralized and transparent monetary future.

Bitcoin Business Context

Bitcoin Market Cycles

Introduction to Bitcoin's investment dynamics

This lecture is about Bitcoin's investment dynamics and it is led by Gael Sánchez, a seasoned expert with a unique career from engineering to finance. Gael's fascination with Bitcoin volatile market behavior has been bolstered by his hedge fund experience and his academic role at IE University, where he explores Bitcoin and blockchain intricacies. As the co-founder of AlphaBitcoin and the author of "Bitcoin Lo Cambia Todo," Gael provides an unparalleled perspective on Bitcoin as an investment asset.

Bitcoin's characteristics as an investment asset

Bitcoin is often viewed through technical or philosophical lenses, but its attributes as an investment asset warrant separate consideration. Its fixed supply of 21 million coins creates unique dynamics, distinguishing it from other assets like equities or real estate. As a store of value, Bitcoin's scarcity mirrors the one of precious metals, yet its digital nature allows for unprecedented accessibility and divisibility. The network effects generated by its decentralized architecture further enhance its appeal as an investment, allowing Bitcoin to serve as a hedge against fiat currency devaluation.

Integration into investment portfolios

Integrating Bitcoin into investment portfolios involves evaluating its risk return profile. Despite its volatility, Bitcoin offers diversification benefits due to its low correlation with traditional assets such as bonds and equities. Institutional interest, evidenced by SPOT ETF approvals and increasing allocations by pension funds, underscores its growing credibility. The key is balanced allocation, typically between 0.5% to 3%, which can enhance portfolio performance by optimizing the Sharpe ratio, ultimately contributing to a sophisticated investment strategy.

Bitcoin's market influences and price analysis

Exploring Bitcoin's market dynamics involves understanding the micro and macroeconomic factors that influence its price. Bitcoin's halving cycle, occurring every four years, significantly impacts its supply-demand equilibrium, often leading to price appreciation. This cyclical pattern aligns with historical returns, where post-halving periods witness notable gains, despite skepticism from traditional financial institutions.

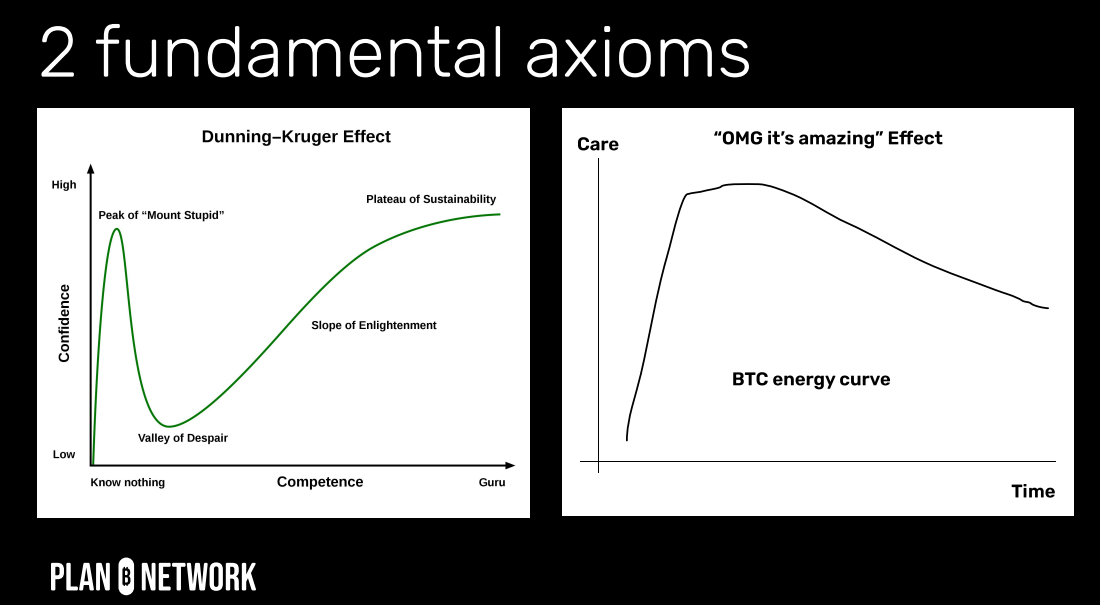

Price analysis and predictive models

Price forecasting in Bitcoin markets necessitates sophisticated modeling techniques. While models like the stock-to-flow are popular, their predictive power is limited by market inefficiencies and collective behavior. The recursive nature of these models means that as they become widely adopted, they may alter market dynamics, challenging their accuracy. Thus, alternative models focusing on Bitcoin adoption metrics, such as user count and transaction volume, are crucial for nuanced analysis.

- Chart illustrating Bitcoin's price history compared to the stock-to-flow model.

External influences and institutional dynamics